Key Insights

- •IREN announces a $9.7 billion deal with Microsoft for AI cloud services, a significant development in Bitcoin mining news.

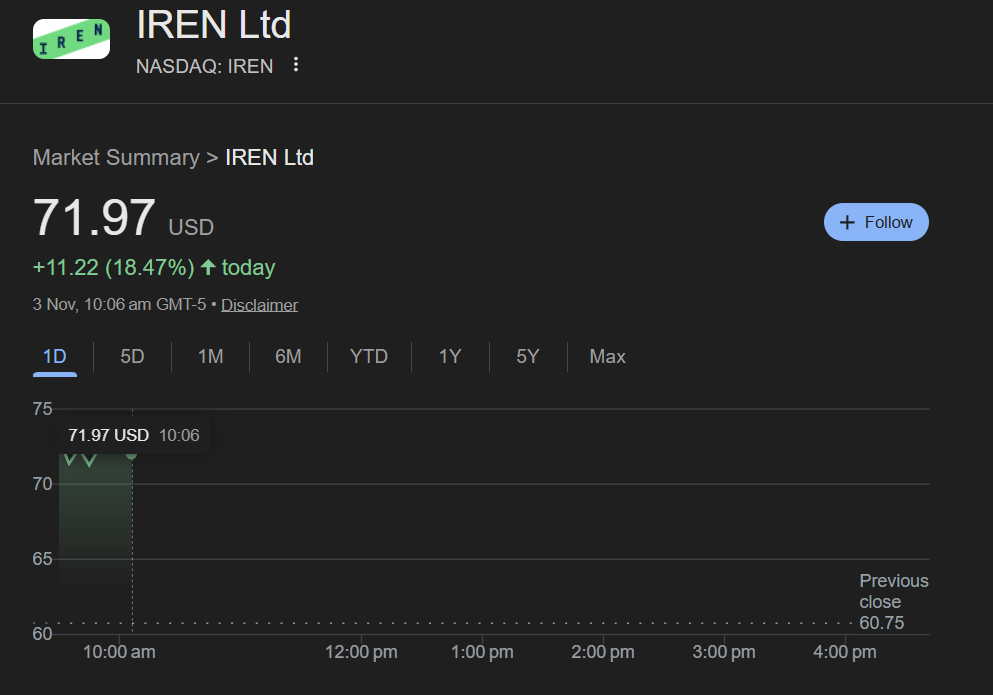

- •IREN's stock price experienced a substantial jump of over 20% on Monday.

- •Bitcoin price has shown slight upward momentum, though traders remain cautious about sustained bullish trends.

IREN Inks Major AI Cloud Deal with Microsoft

In significant Bitcoin mining news today, IREN announced on Monday that it has entered into a substantial AI cloud services deal with technology giant Microsoft. This agreement has led to a remarkable surge of over 20% in IREN's stock price within a single trading day.

Bitcoin mining firm IREN has officially signed a $9.7 billion deal with Microsoft, announced on November 3. Under the terms of this agreement, IREN will grant Microsoft access to NVIDIA GB300 GPUs over a five-year period.

Additionally, IREN has entered into a separate agreement with Dell Technologies to procure the necessary GPUs and associated equipment, valued at $5.8 billion. The deployment of these advanced NVIDIA GPUs is slated to occur in stages through 2026 at IREN's 750MW campus located in Childress, Texas.

This expansion includes the delivery of new liquid-cooled data centers designed to support a significant IT load of 200MW. IREN has outlined its funding strategy for these expenditures, which will involve a combination of cash reserves, customer prepayments, ongoing operating cashflows, and strategic financing initiatives.

Daniel Roberts, co-founder of IREN, commented on the significance of the deal, stating that it underscores the company's robust capabilities and the scalability of its integrated AI Cloud platform.

The agreement also serves as a validation of IREN's standing as a reliable provider of AI Cloud services. This development occurs at a time when Bitcoin miners are increasingly diversifying into AI services, driven by substantial market buzz and demand.

IREN Stock Price Surges 20%

IREN's stock price experienced a dramatic increase, skyrocketing by 20% in pre-market trading hours on Monday. This surge indicated a strong opening for the stock, capturing the attention of investors amidst the widespread Bitcoin mining news.

At the time of reporting, the stock was trading approximately 18% higher at $70.99. The 24-hour trading range recorded a low of $70.09 and a high of $75.73.

Despite the positive Bitcoin mining news, the trading volume observed was lower than the typical average volumes of 35 million. Nevertheless, the stock has achieved an impressive 637% return year-to-date.

Recently, Bitcoin mining stocks have been a focal point in the market. Companies such as MARA Holdings (MARA), Riot Platforms (RIOT), CleanSpark (CLSK), and Core Scientific (CORZ) have all witnessed substantial increases in their share prices.

Technology companies, including Meta, Oracle, Google, and Microsoft, are increasingly investing in artificial intelligence. This strategic shift has resulted in a significant rise in their operational expenses over the past quarter, as indicated by recent earnings reports.

Mirroring the strategic pivot of competitors like CoreWeave, IREN has expanded its operations beyond traditional Bitcoin mining to encompass AI services. This shift allows for the more effective utilization of GPUs for AI workloads, which are often more profitable than Bitcoin mining.

The company has greatly benefited from this change in focus. Its ongoing partnership with Nvidia has been a crucial advantage, providing access to cutting-edge hardware essential for AI development and deployment.

Last week, Microsoft CFO Amy Hood stated that the company anticipates its demand for AI capacity to extend into mid-2026. This revised projection indicates a longer-term need for these resources, compared to earlier predictions that suggested requirements would be met later this year.

BTC Price Rebounds Slightly Amidst Bitcoin Mining News

The price of Bitcoin experienced a slight rebound above $108K in the past hour, influenced by a series of positive developments, including IREN's significant deal within the Bitcoin mining sector.

At the time of this report, BTC was trading at $107,987. The cryptocurrency saw a 24-hour low of $107,010 and a high of $110,764.

Trading volume has seen an uptick following Michael Saylor’s MicroStrategy's continued Bitcoin accumulation, even amidst concerns about market crashes and doubts surrounding the company's treasury strategy.

Data from CoinGlass also indicates a growing buying sentiment in the derivatives market. Currently, the total BTC futures open interest has increased by 1% to $71.21 billion over the last 24 hours.

However, a closer look at futures open interest reveals a mixed picture. BTC futures open interest on CME has decreased by more than 2%, and on Binance, it is down by 1.30%. This divergence suggests that traders are exercising caution, with whales continuing to liquidate some of their holdings.