Hashprice Compression Pushes Public Miners Toward Losses

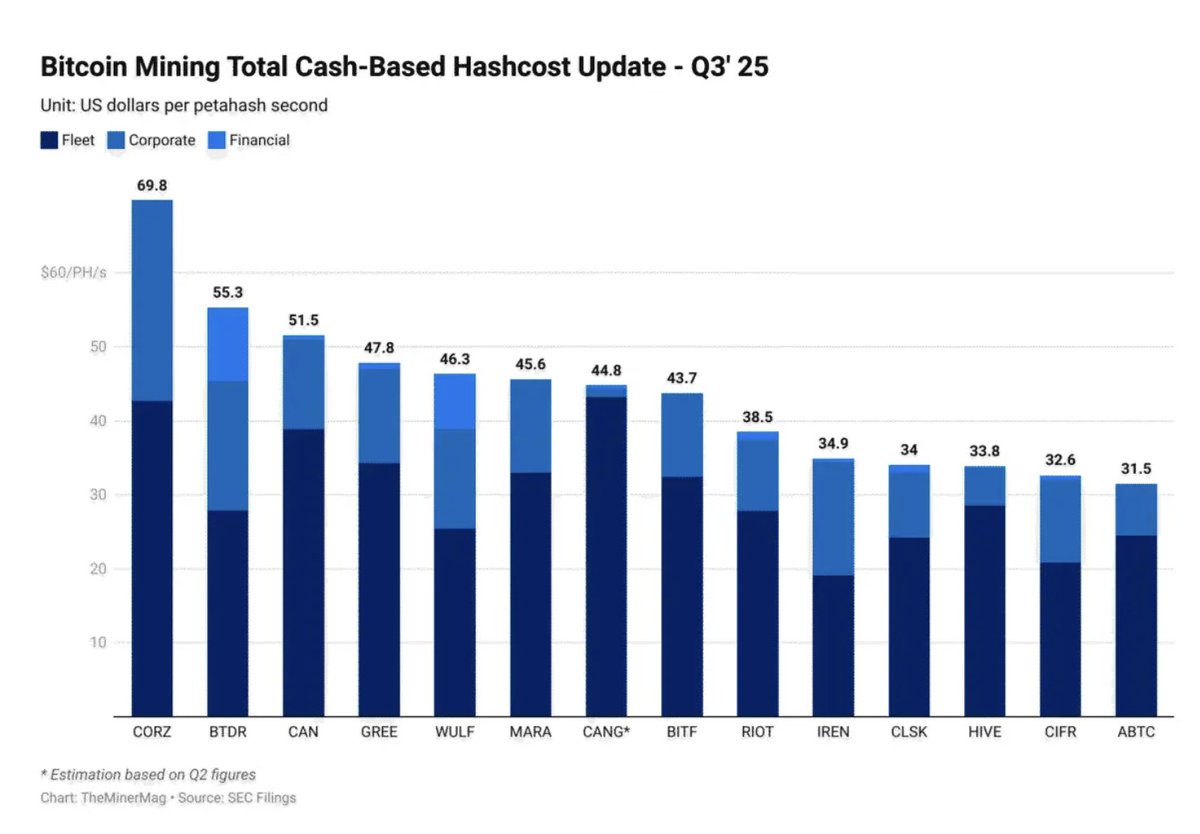

Bitcoin mining profitability has dropped to one of its weakest points in years, as hashprice, the revenue miners earn per petahash per second, has fallen to roughly $35/PH/s. With median cash-based hashcosts near $44, a large portion of the industry is now operating at, or below, break-even.

The chart shared by Cointelegraph shows clear cost pressure across nearly every major publicly listed miner. Operators with the highest all-in hashcosts, such as CORZ at nearly $70/PH/s, are now significantly underwater. Mid-tier miners, including BTDR, CAN, GREE, WULF, MARA, and CANG, report costs in the $44–55 range, meaning their revenue no longer covers their full operational burden. Only a handful of firms with unusually efficient fleets come close to breakeven, including ABTC, CIFR, HIVE, and CLSK.

The data breaks down spending across fleet operations, corporate overhead, and financial obligations, showing how quickly total cost stacks up when hashprice declines. Even efficient players face pressure once hashprice dips below $40, making the current environment one of the toughest since the post-halving reset.

Financial Pressure Builds Across the Mining Sector

With revenue now below the all-in cost of production for many operators, miners must adapt rapidly. The declining margin environment encourages fleet optimization, energy renegotiations, and operational consolidation. Firms with older hardware or heavier debt loads face the most immediate challenges, while those with more modern ASICs and lower electricity pricing still have room to maneuver.

The broader implication is a potential reshaping of the mining landscape. Historically, extended periods of low hashprice have triggered shakeouts in which weaker or overleveraged operators exit, while the strongest accumulate more hashrate. The chart suggests this pattern may already be forming, as miners sit in one of the most compressed profitability zones of the cycle.

If hashprice does not recover, the sector may experience accelerated consolidation, with efficiency becoming the defining competitive advantage for survival.