Market Overview and Investor Sentiment

Bitcoin's value dropped sharply from $115,000 to $104,000 over four days last week, according to Glassnode, reflecting market volatility and investor caution. The decline highlights fragile market sentiment, leading to decreased trading volumes and a shift toward risk-averse strategies, impacting broader cryptocurrency dynamics.

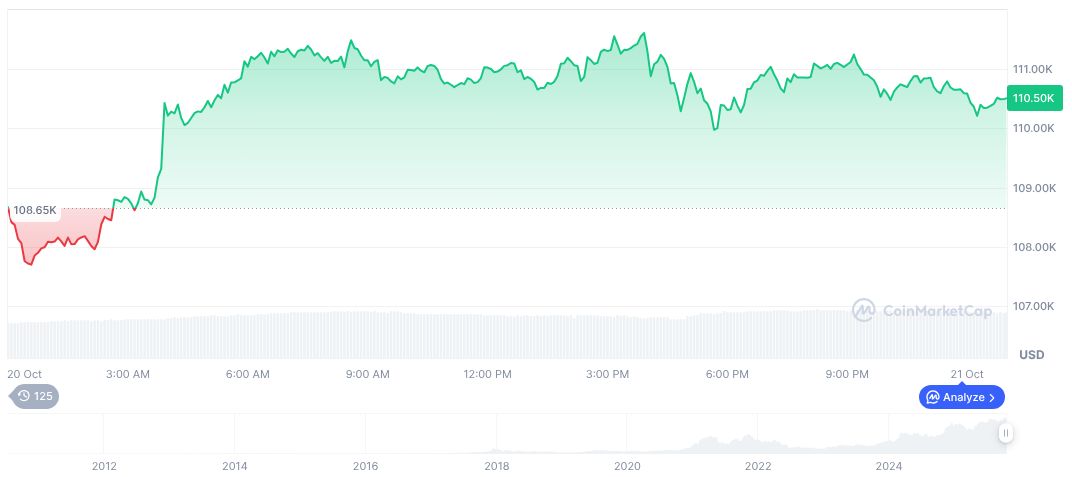

Current Market Data and Dominance

Bitcoin is actively trading at $108,262.34, accounting for a 59.00% dominance in the cryptocurrency market. Recent data shows a 1.61% price drop in 24 hours and a consistent decline over 90 days at 8.92%. The current market cap stands at $2,158,489,429,245.91.

Analysis of Trading Strategies and Regulatory Implications

The Coincu research team highlights that Bitcoin's instability could steer regulatory conversations toward heightened scrutiny of leveraged positions. They note ongoing shifts towards de-risked asset allocations as traders prefer regulatory safe havens, hinting at future market adaptations.

Historical Context and Future Outlook

Did you know? Bitcoin's current volatility reflects patterns seen in past market corrections, where defensive trading took precedence, leading to significant liquidity reductions and increased risk aversion across the asset class.

Bitcoin's current market dynamics suggest a potential shift in trading strategies as traders adapt to the changing landscape.

Market analysts continue to emphasize the importance of monitoring Bitcoin's price movements closely, as they could indicate broader trends in the cryptocurrency market.