Bitcoin's slide into a crucial trading band intensified market attention as the asset retraced roughly 32% from its $126,000 peak and settled between $86,000 and $80,600. This movement developed while the Bitcoin ETF market delivered a rare positive session, with several products posting net inflows even though BlackRock’s IBIT still ended the day in the red.

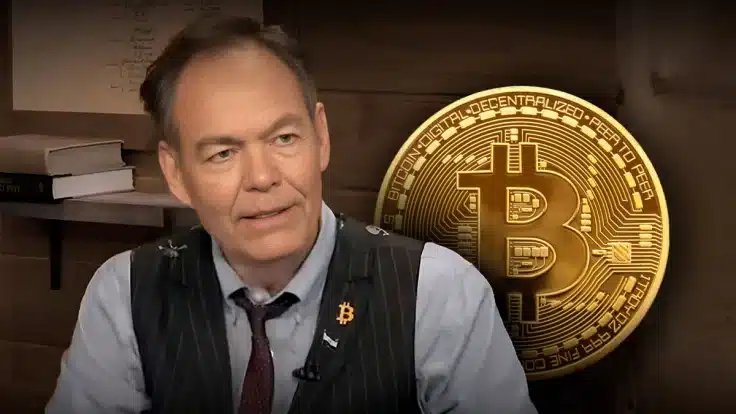

Momentum shifted further when Max Keiser voiced his stance on the downturn. According to him, the latest decline represents the end of a long distribution phase and the start of fresh accumulation. ETF data added weight to that view because crypto investment products recorded $238 million in net inflows despite losing more than $4.3 billion this month. Larger investors appear to be buying the dip instead of waiting for cheaper entries.

Distribution ends.

Accumulation begins.

New BTC high in 2025. https://t.co/f0FJgTzonO— Max Keiser (@maxkeiser) November 23, 2025

Critical Structural Levels Draw Trader Attention

Bitcoin now edges toward the final major structural support at $74,110, which is also the average entry price for Michael Saylor’s Strategy. The Company currently holds 649,870 BTC valued at about $55.96 billion. Staying above the $80,600 zone through the next weekly candles keeps the path open toward the former resistance region near $112,000. A break through the $120,000–$125,000 pocket remains essential before any renewed push toward a potential 2025 high gains momentum.

Additional movement surfaced on chain as 20,000 BTC returned to exchanges within seven days, hinting that some whales may be locking in profits. However, steady ETF inflows signal that institutional appetite has not faded and continue to align with Max Keiser’s accumulation narrative.

Bitcoin now trades inside a zone that traders have monitored since early Q1. Its reaction around these support levels will influence whether buyers can build strength from this range as ETF demand continues to counter broader market pressure.