Bitcoin experienced a significant price surge on Wednesday, breaking out of a two-month consolidation period to reach a high of approximately $97,704. The world's largest cryptocurrency was trading up 1.7% on the day, settling at $96,442 as of 1:13 a.m. EST, marking its strongest level since mid-November.

This price advance resulted in an estimated $455.07 million in liquidations of crypto short positions, with approximately $187.1 million specifically tied to Bitcoin, according to data from Coinglass. The broader cryptocurrency market also saw a slight increase, with the total market capitalization inching up a fraction of a percentage to $3.26 trillion. The CMC Crypto Fear and Greed Index climbed to 54, indicating a neutral sentiment in the market as investors position themselves.

CZ Predicts Bitcoin Price Could Rally To $200K

Changpeng Zhao, co-founder of Binance, has expressed a strong conviction that Bitcoin will reach $200,000. He believes this outcome is more a matter of timing than probability and represents the most obvious investment opportunity.

That's the most obvious thing in the world to me.

(not financial advice) https://t.co/iy7qg4PpJN

— CZ 🔶 BNB (@cz_binance) January 14, 2026

During a recent AMA session, Zhao noted that there are currently no signs of Bitcoin's value peaking and emphasized its substantial growth potential. He also suggested that the U.S. Securities and Exchange Commission (SEC) is unlikely to prioritize digital assets in its 2026 examination efforts. This anticipated shift could reduce enforcement risks and cultivate a more favorable environment for Bitcoin.

This prediction comes even as the Senate Banking Committee has delayed the markup of a bipartisan market structure bill, known as the CLARITY ACT, which extends uncertainty regarding the legislation's timeline. The bill was intended to define the regulatory jurisdiction for cryptocurrencies between the SEC and the Commodity Futures Trading Commission (CFTC).

Zhao's optimistic Bitcoin forecasts are not unique. Tom Lee of Fundstrat also shares a bullish short-term outlook for the leading cryptocurrency, suggesting that BTC could potentially reach approximately $200,000 to $250,000, driven by supportive policies and increased institutional investment.

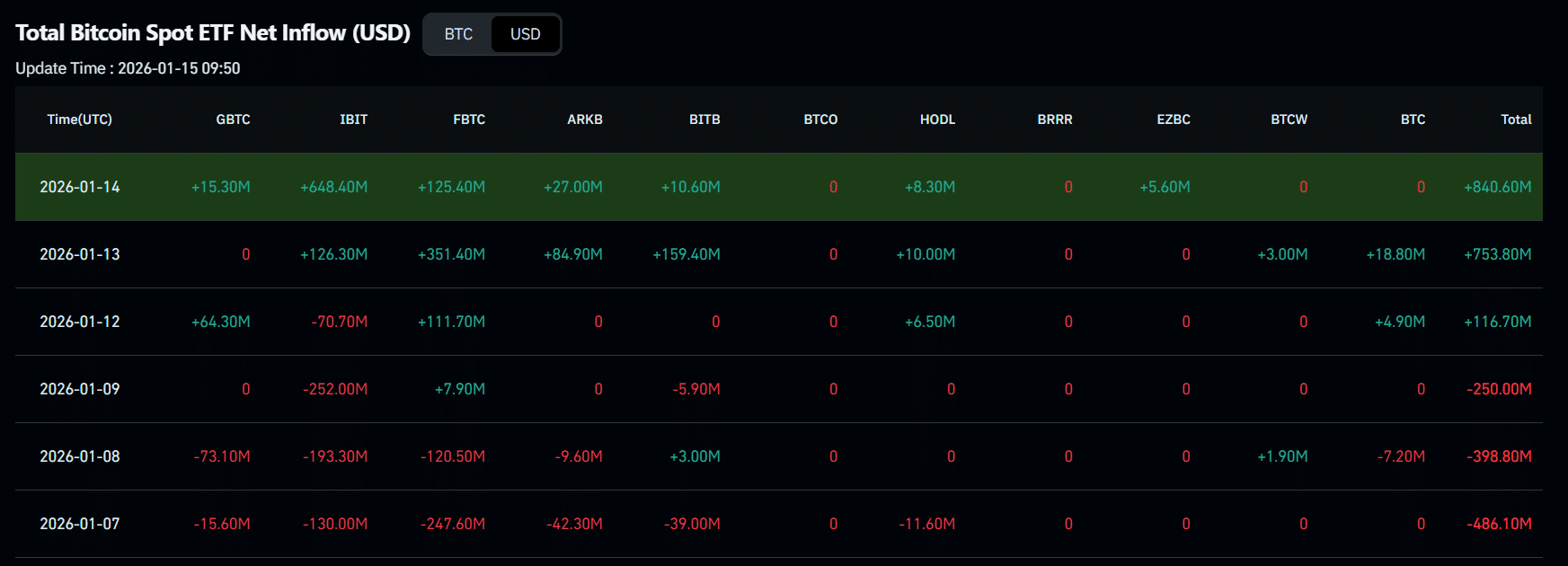

Bitcoin ETFs Draw in Over $840 Million As BTC Surges

The recent surge in Bitcoin's price, surpassing $96,000, has led to the strongest single-day inflows for U.S. spot exchange-traded funds (ETFs) in three months. These products collectively added $840.6 million on January 14, according to Coinglass data. This marks the third consecutive day of net inflows for the week.

BlackRock's IBIT ETF led the inflows with a netflow of $648.4 million. Fidelity's FBTC followed closely, reporting a netflow of $125.4 million.

This buying pressure has increased the total net assets across all U.S. spot BTC ETFs to approximately $122.9 billion, representing roughly 6.5% of Bitcoin's current market capitalization of $1.89 trillion.

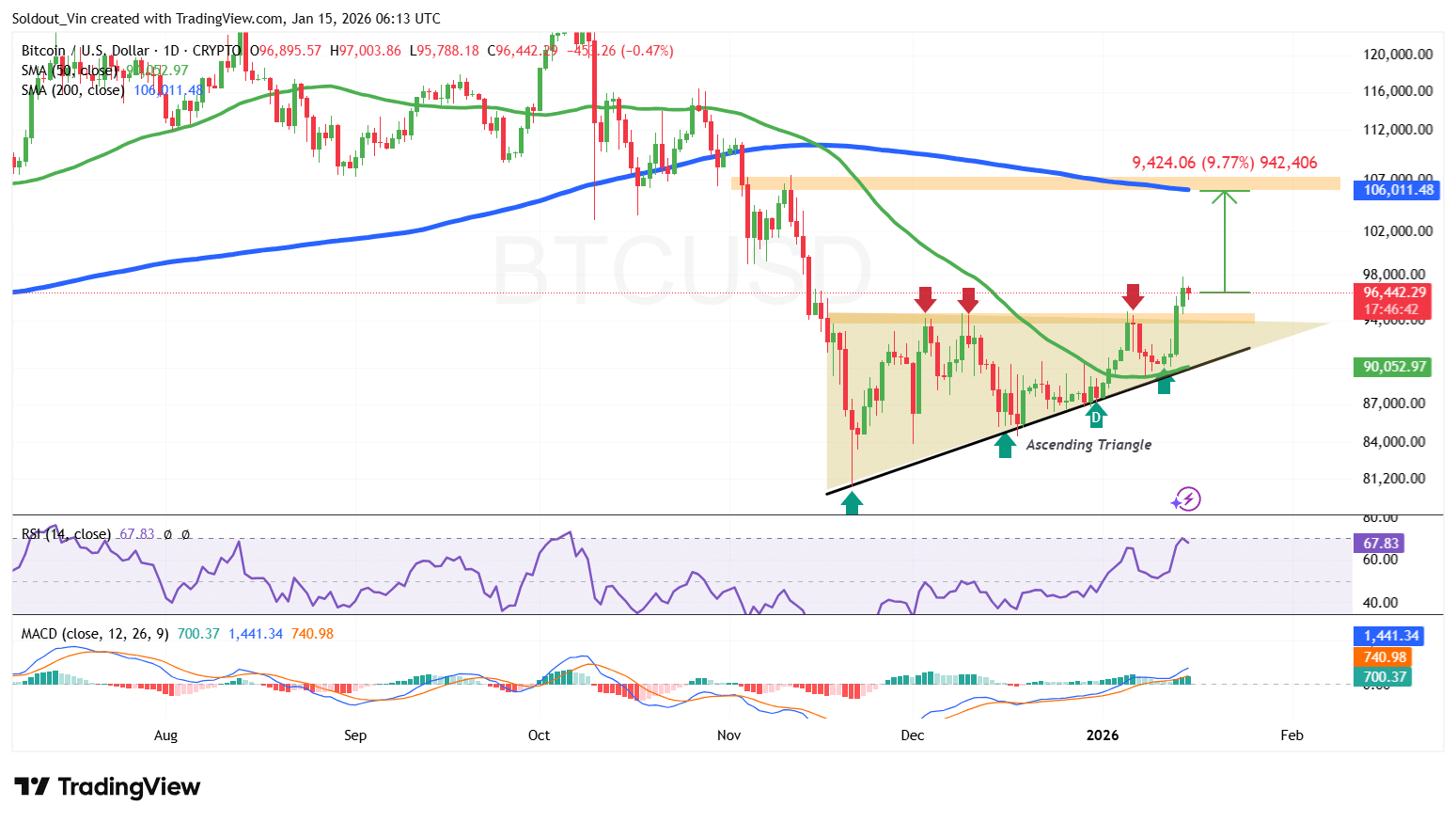

BTC Breaks Out Of An Ascending Triangle

After consolidating for two months within an ascending triangle pattern, the BTC price has recently broken above the $94,000 resistance level within the last three candles on the daily chart. This technical breakout is significant, as a move above such a pattern often signals the start of a sustained bullish rally.

By crossing the resistance area around $94,000, the Bitcoin price has indicated that the sideways price action previously observed within the pattern may be concluding.

The ascent above the $90,000 mark has pushed Bitcoin's price back above its 50-day Simple Moving Average, suggesting a positive short-term outlook.

Bitcoin's Relative Strength Index (RSI) is also approaching overbought territory, currently standing at 67.83. This level indicates that buyers are in control, but the price has not yet become excessively overbought, suggesting there is still room for further price appreciation.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator has also turned positive, with the blue MACD line crossing above the orange signal line, further reinforcing the bullish sentiment.

Can the Momentum Be Sustained?

The 1-day BTC/USD chart analysis suggests that the breakout above the ascending triangle pattern has the potential to be sustained. If this momentum continues, buyers could see a surge of 9.77%, pushing the price towards the $106,011 level, which aligns with the 200-day Simple Moving Average.

Conversely, given the 7% price increase observed over the past week, short-term investors might consider taking profits. This could potentially lead to a price pullback, with support expected around the $89,000 level.