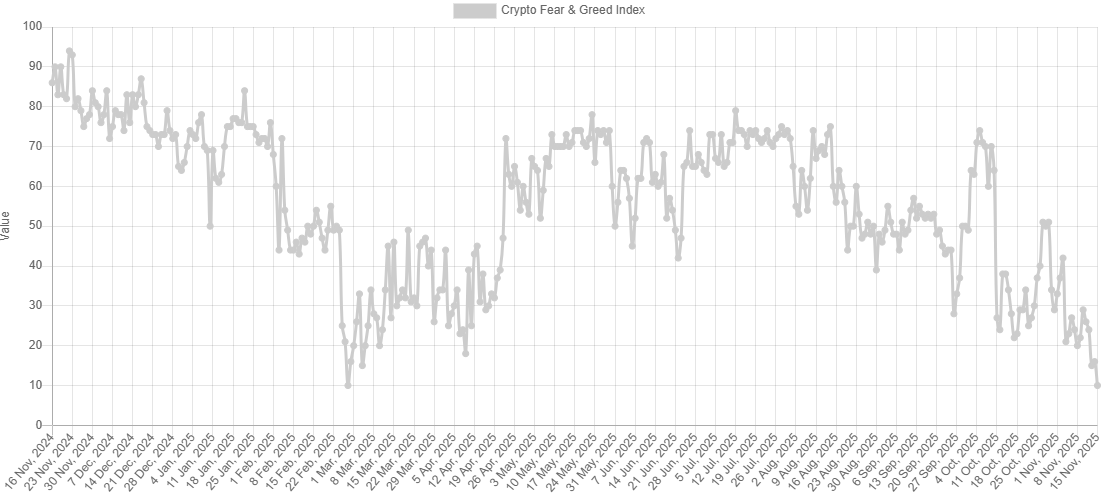

The narrative surrounding cryptocurrency markets has undergone a significant shift in just over a month, a change clearly reflected in the popular Fear and Greed Index. This has led several analysts to question whether this presents an opportune moment for individuals to build generational wealth through strategic action.

Deep in Fear Territory

It was just over a month ago that the period known as ‘Uptober’ began, and Bitcoin’s price was on an upward trajectory, reaching a fresh all-time high exceeding $126,000. At that time, the cryptocurrency market appeared to be performing exceptionally well.

However, this rally proved to be short-lived. The cryptocurrency entered a prolonged correction phase, which culminated in early November with Bitcoin dipping below $100,000 for the first time since July. The situation deteriorated further on November 14 when the asset dropped below this level again, falling as low as $94,000, its lowest price point in six months.

Examining the Fear and Greed Index retrospectively reveals an interesting pattern. In early October, the Index surged into ‘extreme greed’ territory, a condition that is typically followed by a market correction. This aligns with the often-quoted advice: "be fearful when others are greedy, and greedy when others are fearful."

The subsequent downward price movement altered market sentiment, causing the Index to plummet to a level of 10. This represents the lowest point, indicating the deepest ‘extreme fear’ state, since late February. The question now arises: will a rebound occur, if historical patterns are any indication?

Generational Wealth in the Making?

Considering Bitcoin's historical performance following sharp shifts in the Fear and Greed Index, many are now speculating whether this significant decline from 50 to 10 within a few weeks presents a viable buying opportunity.

For instance, Bitcoin dropped below $80,000 in late February and early March when the metric reached similar low levels. Within a few weeks, it briefly rebounded to $88,000, and within a couple of months, Bitcoin had re-entered the six-digit price range.

Satoshi Flipper, a market commentator, has shared insights on the matter, suggesting that investors have the potential to build "generational wealth" by setting aside emotions and capitalizing on this current market momentum.

If you have capital remaining, longing the F out of $BTC & crypto after a 26-30% $BTC correction and a F/G index of 10 is where you make generational wealth 💰💸

— Satoshi Flipper (@SatoshiFlipper) November 15, 2025