Market Shakeout and Mass Liquidations

Bitcoin stumbled into the new month after a sharp weekend drop erased days of calm trading and reignited market-wide fear. Prices plunged without warning on Sunday, triggering heavy liquidations and closing out the asset’s weakest November in years. Traders now question whether the fall signals deeper trouble or a reset that clears the way for a rebound.

Bitcoin spent most of the weekend holding near $91,500, trading in a tight range that suggested steady month-end consolidation. Momentum shifted late Sunday when a wave of selling hit the market, sending the asset down almost 5% in just three hours. Prices slid to $86,950 on Coinbase, according to market data, ending Bitcoin’s attempt to push past key resistance levels.

Kobeissi Letter noted the pattern of abrupt weekend moves, commenting that Friday and Sunday sessions have repeatedly brought outsized volatility this year. No major news event sparked the slide, suggesting instead that internal market pressure was to blame.

Analysts attributed the drop to a sudden burst of sell orders that cascaded through heavily margined positions. Kobeissi described it as a domino-style move driven by a buildup of fragile leverage rather than a shift in fundamentals.

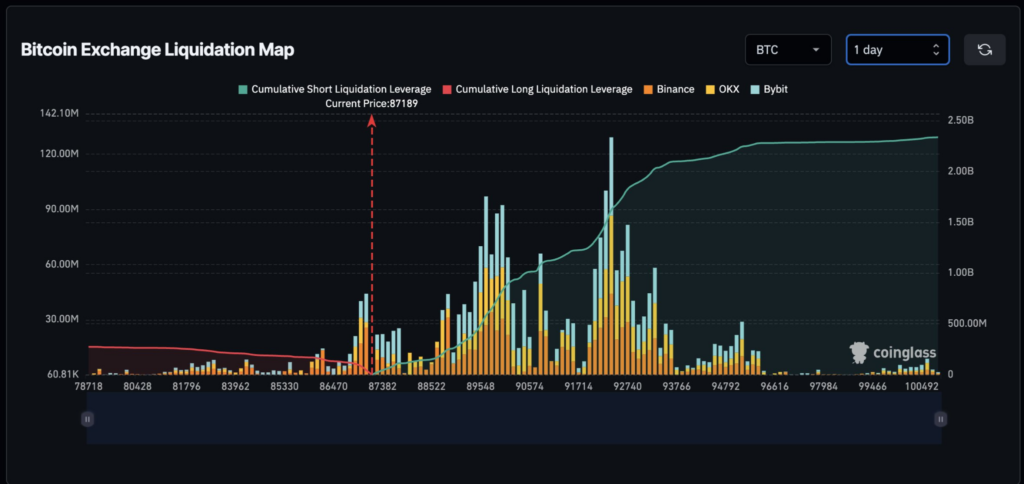

Liquidations surged across crypto markets, wiping out the positions of more than 180,000 traders in 24 hours. Total liquidations reached $539 million, largely concentrated in Bitcoin and Ether longs, according to CoinGlass.

The flush followed an earlier wipeout that erased $8 billion in open interest within days, a sign of an overheated market resetting aggressively.

Several on-chain and market metrics pointed to growing trader exhaustion:

- •Nearly 90% of liquidations came from long positions.

- •Open interest dropped sharply after weeks of elevated leverage.

- •Short-term holder activity showed signs of capitulation.

- •Market sentiment fell to 24 on the Fear & Greed Index chart.

- •Bitcoin slipped below the 200-day simple moving average.

November closed with Bitcoin down 17.49%, marking its weakest monthly performance of 2025. Interestingly, it also marks the coin’s worst November performance since 2018, when it fell more than 36% during a deep bear market.

Potential for Rebound After CME Gap Closure

At the time of writing, Bitcoin is exchanging hands at $86,565, after posting only 12 green trading days in the past month. The OG crypto now trails 86% of the top 100 crypto assets in year-to-date performance.

Even though Bitcoin’s performance remains weak, some in the crypto community still hold a positive outlook on the asset. Analyst “Sykodelic” maintained an optimistic stance, calling the early-month pullback a healthy reset.

He noted that the CME gap has already closed and nearly $400 million in longs were cleared, removing excess leverage. Clearing downside liquidity first, he maintained, sets conditions for a stronger recovery.

Mister Crypto added that Bitcoin may have reached a local bottom, citing a weekly RSI near 30 and growing speculation around potential rate cuts. While broader on-chain data still points to a downward trend, several analysts view the recent washout as a step toward stabilizing the market.