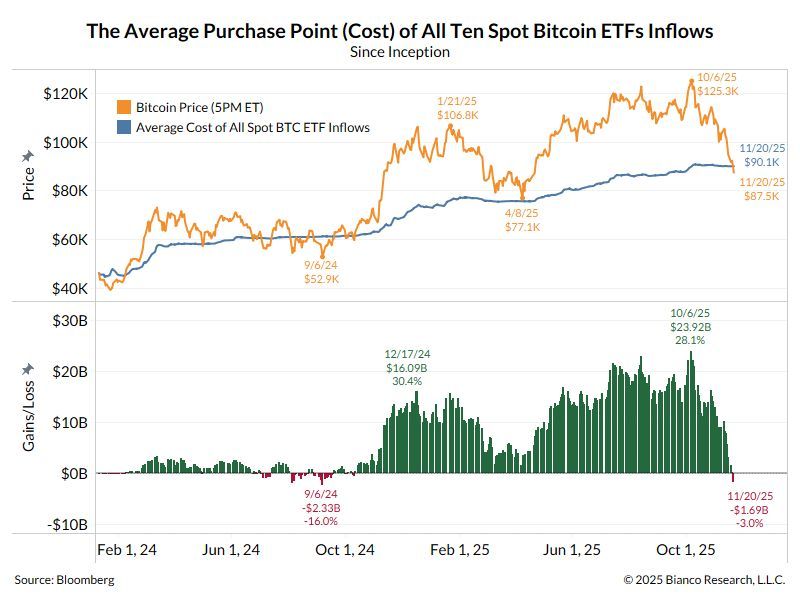

A new analysis from CryptosRUs and fresh data from Bianco Research shows that spot Bitcoin ETF investors are experiencing their first genuine moment of pressure, with the average ETF holder now in the red. After nearly a year of smooth inflows, steady price appreciation and persistent optimism, the market is finally testing the conviction of millions of new Bitcoin investors who entered through ETFs.

ETF Investors See Red for the First Time

According to Bianco Research’s chart, the average spot Bitcoin ETF cost basis now sits near $87.5K, while Bitcoin has slipped below $85K and is trading around $85,000 at the time of writing, pushing most ETF buyers into unrealized losses.

This is the first significant drawdown since spot ETFs launched, and many newcomers have never experienced a Bitcoin correction of this scale. For almost a year, ETF buyers encountered only the pleasant side of Bitcoin, consistent inflows, strong candles and positive media momentum. Now they are confronted with what long-term holders already know: Bitcoin’s path is never linear.

Veteran Holders Are Buying, Not Panicking

Despite the sharp decline, activity beneath the surface suggests a very different picture. Whales are steadily accumulating, long-term investors remain calm, and institutional buyers appear unaffected by short-term volatility. These experienced players are buying weakness rather than retreating from it. Market structure shows no signs of widespread panic among veteran participants, reinforcing the view that this drop is a typical retracement rather than a cycle-ending event.

This Is the Moment That Defines ETF Conviction

The core question now isn’t why ETF buyers are down, it’s whether they can withstand the volatility that has always defined Bitcoin. Many ETF investors now see their cost basis sitting above the current price, forcing them to confront their beliefs about Bitcoin’s long-term value.

CryptosRUs notes that cycle after cycle, Bitcoin presents this moment where newcomers must decide whether they believe in what they bought or whether they were simply riding momentum. Historically, those who hold through these uncomfortable phases often become the next wave of committed long-term holders, while those who exit early hand their coins to whales and institutions eager to accumulate at discounted prices.

A Crucial Cycle Moment

Bitcoin’s retracement has erased much of the outsized gains seen at the October peak, when spot prices briefly climbed above $120K. Even so, the broader trend still shows Bitcoin in a multi-year uptrend, and long-term participants appear to be treating this downturn as a normal corrective move. For ETF investors, however, this marks the first true emotional and psychological test. According to CryptosRUs, this is one of those defining cycle moments, the kind that separates temporary excitement from lasting conviction.