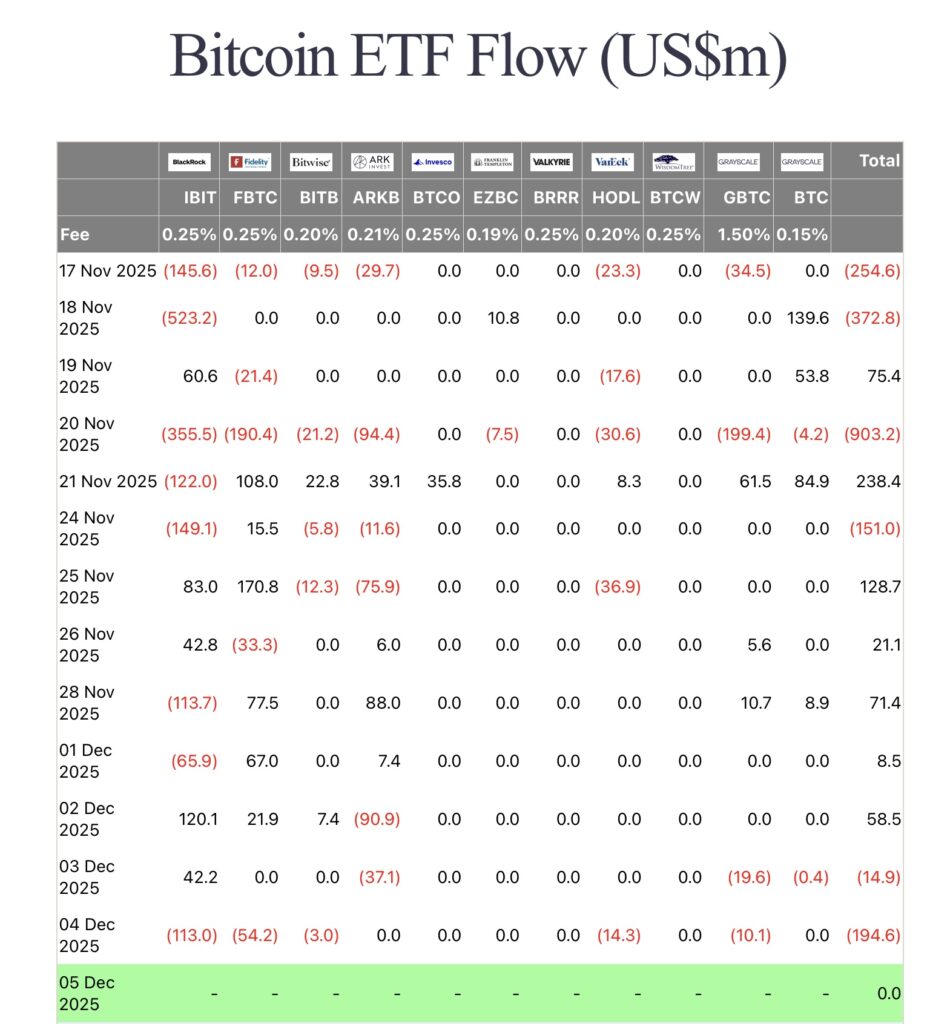

On December 4, 2025, Bitcoin ETFs experienced record outflows of $194.6 million, an unprecedented level in two weeks. This abrupt movement raises questions: is it a simple adjustment or a harbinger of a deeper downward trend in December?

Bitcoin ETF: Massive $194 Million Outflow — What Is Happening?

On December 4, 2025, Bitcoin ETFs recorded net outflows of $194.6 million, according to Farside Investors. BlackRock’s IBIT fund alone accounted for $113 million in outflows, followed by Fidelity’s FBTC with $54.2 million. These figures contrast with five consecutive days of inflows before this hemorrhage.

The causes are multiple. First, institutional investors closed ’basis trades’, a strategy that consists of buying Bitcoin ETFs while selling futures contracts to lock in low-risk profits. Second, macroeconomic fears, notably anticipation of a rate hike by the Bank of Japan on December 19, weigh on the markets. These combined factors explain this massive outflow, the highest in two weeks.

Why Are Institutional Investors Reducing Their Holdings?

Some analysts believe these massive $194 million outflows of Bitcoin ETFs reflect a repositioning out of leveraged positions, often used by institutional investors. In addition to risks linked to the ’yen carry trade’, a practice where investors borrow yen to invest in higher-yielding assets like BTC. A rise in Japanese rates could make this strategy less attractive.

Others believe the current selling pressure comes from institutions closing their ’basis trades’! This, along with progressive market consolidation in 2026, after this retracement phase. Arthur Hayes already pointed to these strategies as responsible for the massive Bitcoin ETF outflows in recent months.

Bitcoin: A Challenging December Ahead?

Despite the record outflows, the BTC price remained relatively stable, with a limited drop of 1.7% over 24 hours and 0.5% over seven days. However, the monthly trend remains negative, with a 10.5% drop in November. Does this apparent stability mask a deeper vulnerability?

The outlook for December is mixed. On one hand, macroeconomic risks, such as rate hikes in Japan, could increase pressure on Bitcoin. On the other hand, the closing of ’basis trades’ could mark the end of a selling cycle, opening the way for stabilization. For investors, caution is key: monitoring ETF flows and central bank announcements will be crucial to anticipate market movements.

The massive outflows from Bitcoin ETFs raise questions about market resilience. While analysts agree on institutional disengagement, the outlook for December remains uncertain. One thing is clear: investors will need to stay alert to macroeconomic signals and capital flows. Should this be seen as a buying opportunity or a sign to exercise increased caution?