Key Insights

- •The US Spot Bitcoin ETF recorded an outflow of $137 million on Wednesday.

- •BTC price has shown some recovery today after falling to a low of $99,000.

- •Top experts are suggesting a potential crash in Bitcoin USD, with some indicating the start of a bear market.

The US Spot Bitcoin ETF has once again experienced a significant outflow on Wednesday, prompting discussions within the market. Despite this trend, the BTC price has managed to erase some of its recent losses and is trading in positive territory today. Notably, the substantial outflow from this investment instrument suggests a declining interest from institutions. Investors, meanwhile, are adopting a cautious approach, evaluating the potential future trajectory of the flagship cryptocurrency. The current recovery in Bitcoin USD may have positively influenced broader crypto market sentiment, with altcoins like Ethereum and XRP quickly rebounding from their recent lows.

This recent dip may have presented an opportunity for many traders to enter the market at discounted prices. However, in light of the US Spot Bitcoin ETF outflows, analysts have issued warnings about a potential Bitcoin price crash, with some predicting a drop as low as $40,000.

US Spot Bitcoin ETF Continues to See Outflows

On Wednesday, November 5, the US Spot Bitcoin ETF recorded an outflow totaling $137 million. This marks the sixth consecutive day of outflows from the investment instrument, which has continued to negatively impact trader sentiment. The outflow on Wednesday was primarily driven by withdrawals from the BlackRock Bitcoin ETF (IBIT). According to data from Farside Investors, IBIT reported an outflow of $375.5 million, which was partially offset by inflows of $113.3 million into Fidelity’s FBTC and $82.9 million into Ark Invest’s ARKB.

Over the past six sessions, from October 29, the total outflow has reached $2.04 billion. The significant outflows from BlackRock’s IBIT have further concerned market participants regarding a potential waning appetite for risk among traders.

Analysts Hint at Bitcoin (BTC USD) Price Crash Amid ETF Outflows

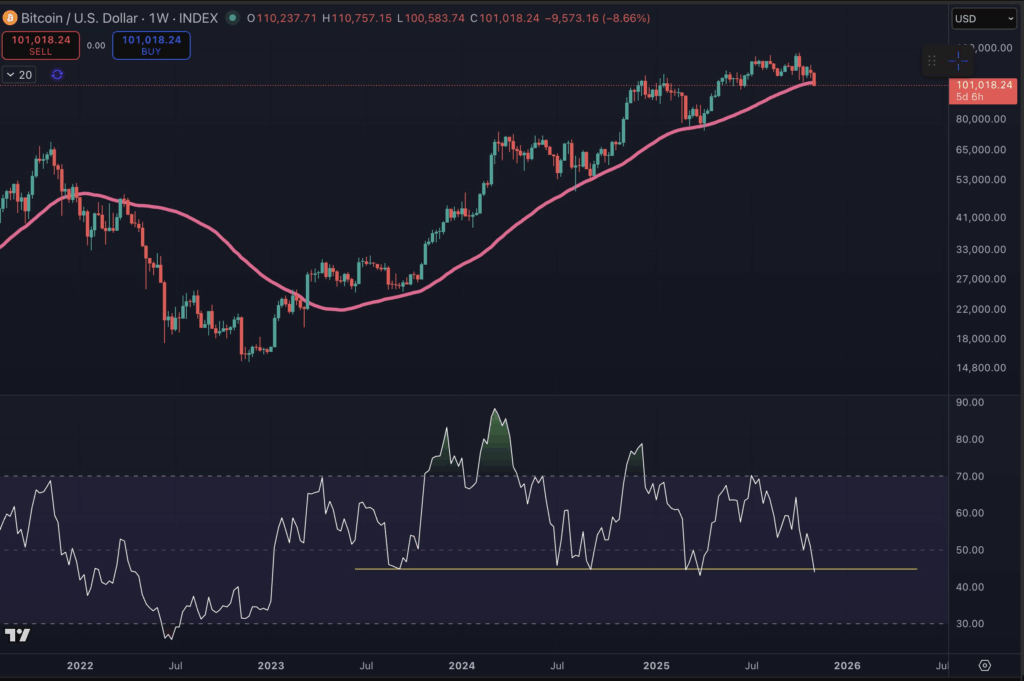

Amid the ongoing outflows from the US Spot Bitcoin ETF, analysts have cautioned about a potential crash in BTC price. However, they also noted that if the Bitcoin price manages to remain above a critical support level, it could potentially avoid further selling pressure. In a recent X post, analyst Benjamin Cowen stated that the Bitcoin USD price is currently at a critical juncture. He indicated that multiple closes below the 50-week moving average would signify a confirmed top, similar to patterns observed in previous market cycles.

Cowen anticipates that 2026 will likely be a bear market, irrespective of whether the current cycle's peak has been reached or if there is a minor price increase. Similarly, analyst Doctor Profit suggests that the current market conditions may not just represent a correction but could be the beginning of a bear market. This expert forecasts that the Bitcoin price could fall to levels between $54,000 and $60,000 by September or October 2026. Another analyst, Ali Martinez, has highlighted the importance of the 50-week moving average (50W SMA) as a crucial long-term support level for Bitcoin.

Historically, a break below this level has often led to significant corrective phases, with average corrections around 60%. If the BTC price closes below the current 50W SMA level, which is approximately $102,000, Martinez warns of a potential 60% correction, projecting a downside target near $40,000.

Can Bitcoin Price Avoid This Crash?

Despite the ongoing outflows from the US Spot Bitcoin ETF and the warnings from some experts, a segment of analysts remains optimistic. In a recent X post, analyst Ted pointed out that the recent dip in Bitcoin price below the EMA-50 level was anticipated. However, he emphasized that the upcoming weekly close will be crucial in determining the next market move. Ted suggested that a close above the EMA-50 with strong buying volume could indicate that Bitcoin has found its bottom. Conversely, a close below the EMA-50 might signal further declines.

Concurrently, analyst Rekt Capital has advised investors to monitor a breakout above $108,000 as confirmation of a bullish trend. According to Rekt, if Bitcoin USD can achieve a close above $108,000, it could trigger a substantial surge for BTC price towards $123,000.

However, if the US Spot Bitcoin ETF begins to see renewed inflows, it could contribute to a strong recovery in Bitcoin USD. Furthermore, the recent price dip might also provide an opportunity for retail traders to enter the market at a more favorable price point.