Bitcoin’s recent price stabilization is masking a quieter but persistent issue beneath the surface: ETF-driven liquidity has not returned in any meaningful way.

Data shared by CryptoQuant points to weakening demand from the exchange-traded funds that historically exert the most direct influence on spot price action.

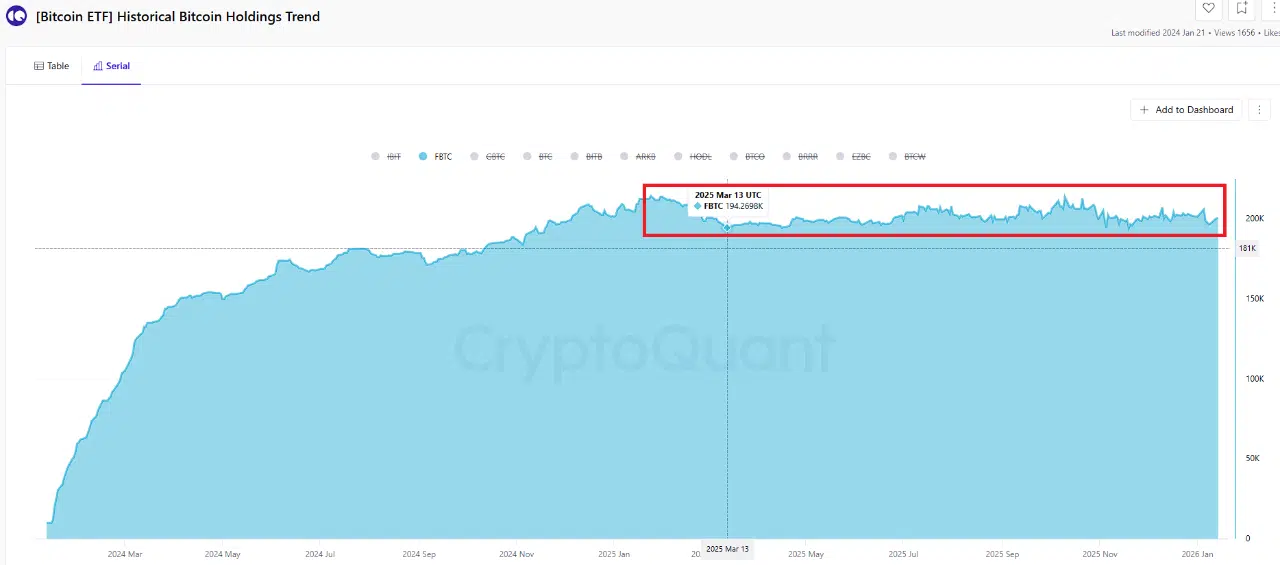

FBTC and ARKB Are No Longer Setting New Highs

Among U.S. spot Bitcoin ETFs, Fidelity’s FBTC and ARK’s ARKB have shown the strongest historical correlation with Bitcoin’s price. The first chart highlights FBTC’s cumulative holdings trend, which rose steadily through 2024 before stalling. Since March 2025, FBTC has failed to surpass its previous peak, moving sideways despite periods of higher Bitcoin prices.

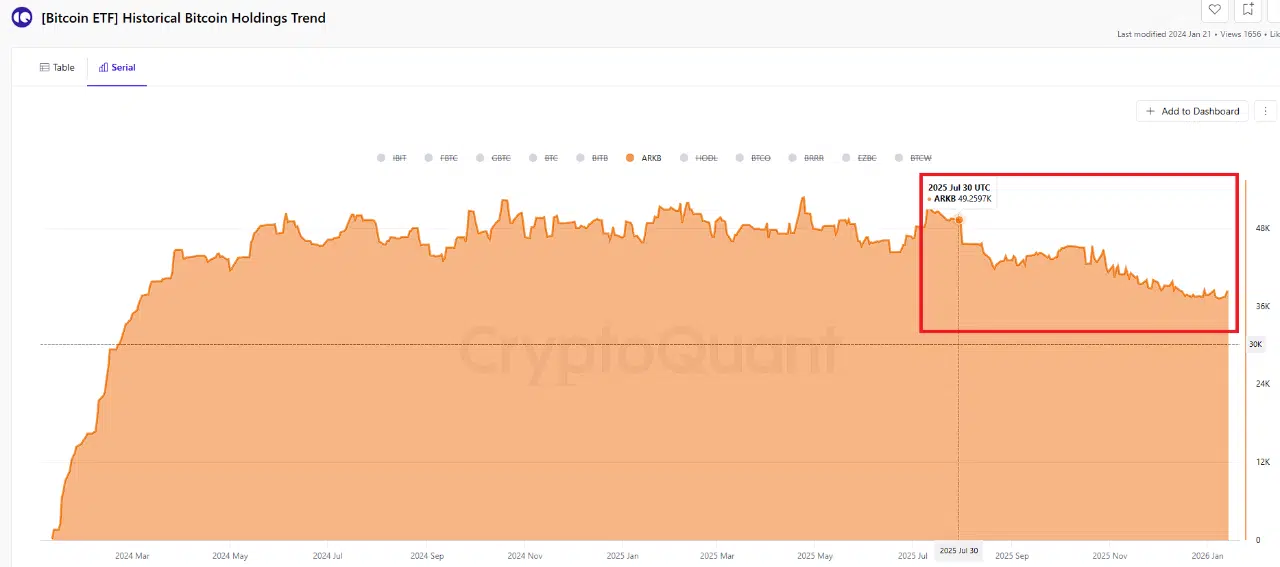

ARKB shows an even clearer deterioration. The next chart indicates that ARKB’s holdings peaked around July 2025 and have been trending lower since. This sustained decline suggests net outflows rather than accumulation, weakening a key source of incremental demand. Without these two funds expanding their exposure, the liquidity impulse that previously supported upside moves is notably absent.

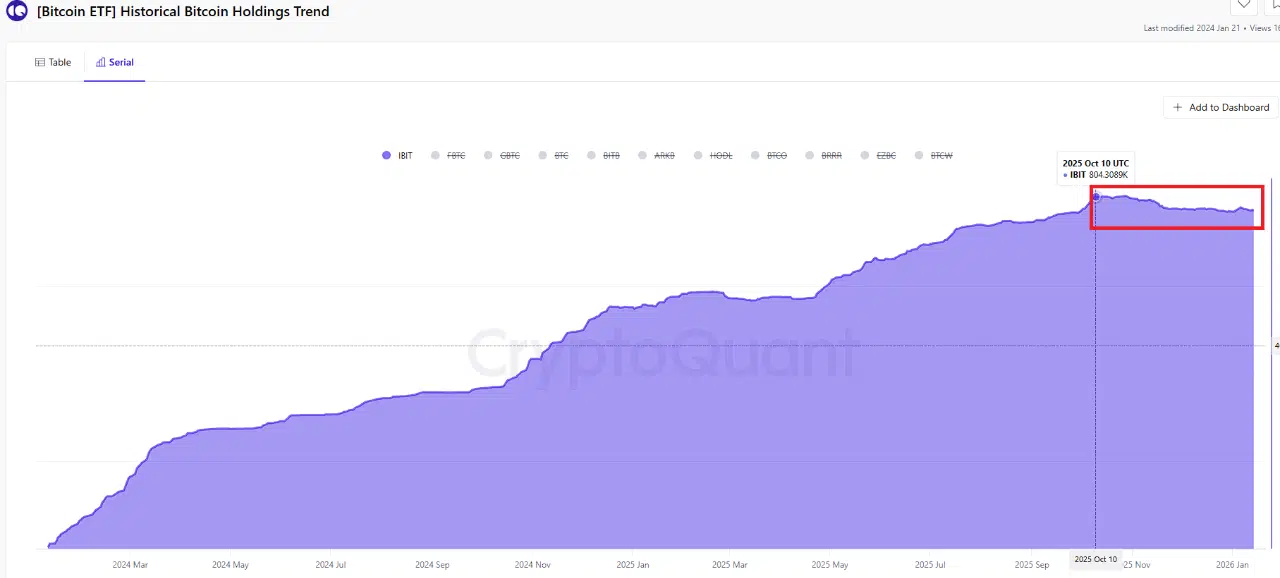

IBIT’s Support Comes Off-Market

BlackRock’s IBIT remains the largest and most important ETF by total holdings, as shown in the fourth chart. Its accumulation trend is still intact, but the structure matters. According to the analysis, most of IBIT’s buying occurs via over-the-counter transactions rather than open-market purchases. That means the inflows do not directly lift exchange prices in the same way as visible spot buying.

IBIT’s activity appears to be acting as a stabilizer rather than a driver. The assessment notes that without IBIT’s current pace of OTC absorption, Bitcoin would likely have experienced a significantly deeper drawdown. Still, even this backstop is weakening compared to earlier phases of the cycle.

A Familiar Pattern Seen Before

The third chart, comparing Bitcoin with MicroStrategy (MSTR), reinforces the broader point. Both peaked around November 2024 and have since struggled to register meaningful new highs. The similarity underscores a common theme: liquidity strength is fading across multiple Bitcoin-linked vehicles, not just ETFs.

Why This Matters for Price

CryptoQuant’s conclusion is blunt. The type of liquidity many market participants expect has not returned yet. Short-term inflows may appear, but from a trend perspective, demand remains insufficient. If OTC buyers like IBIT can no longer absorb supply at current levels, those coins are likely to spill into the open market, increasing visible sell-side pressure.

For now, the ETF data argues against a renewed liquidity-driven breakout. The underlying demand structure is still losing strength, not rebuilding.