Bitcoin has officially broken below the $90,000 threshold for the first time in nearly seven months, falling to around $89,570 and marking a decisive end to the multi-month support zone that has held since late April.

The move comes amid a combination of ETF outflows, weakening market structure, and renewed macro pressure, creating a sharp sentiment shift across the crypto market.

The drop also carries major symbolic weight.

According to new data shared by Glassnode’s Sean Rose, the flow-weighted average cost basis of all spot Bitcoin ETF inflows since launch is now approximately $89,600. With Bitcoin trading below that level, the entire spot ETF investor cohort, retail and institutional, is now sitting on unrealized losses for the first time ever.

ETF Outflows Intensify as Price Breaks Support

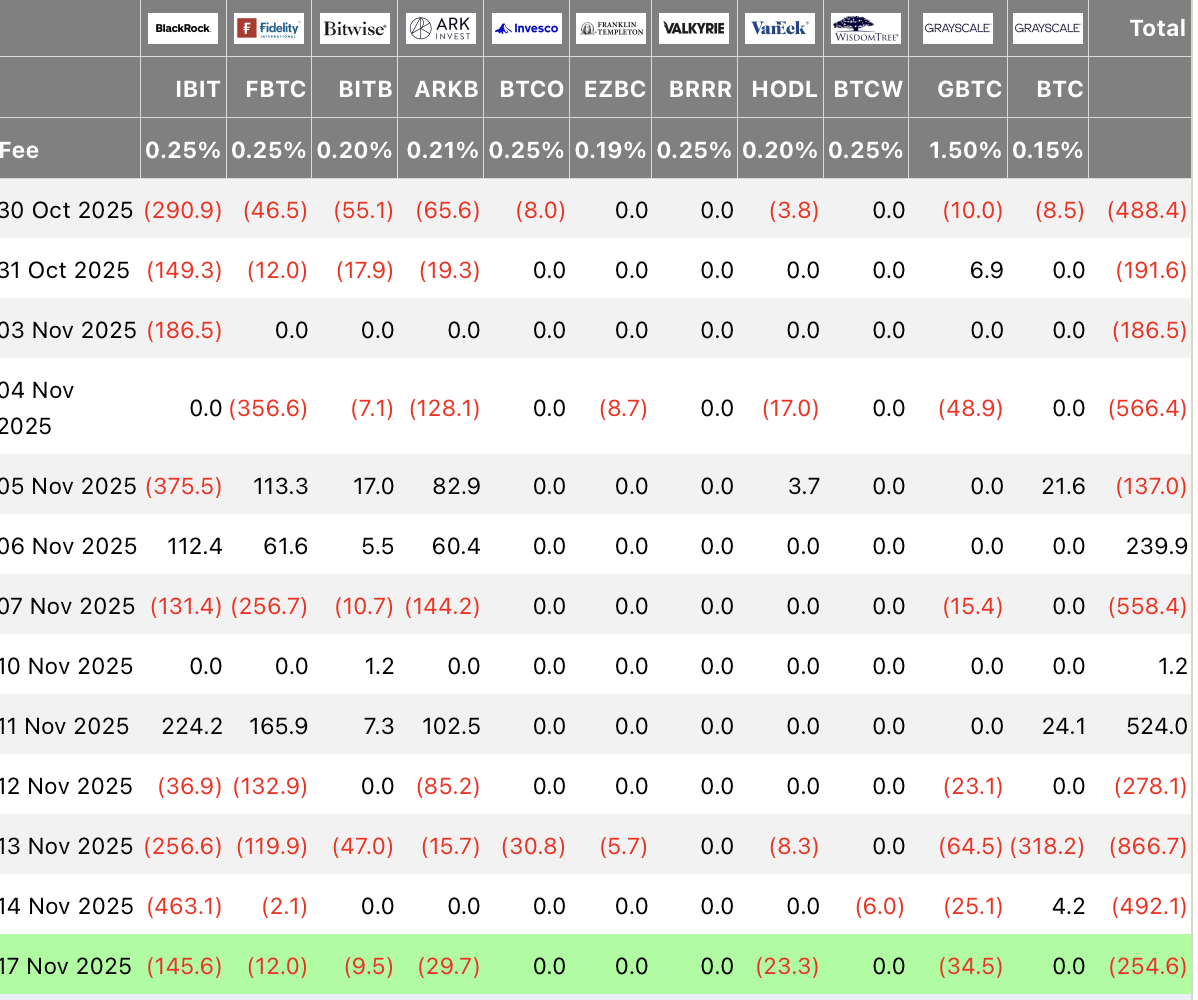

Data from November 17 shows several spot Bitcoin ETFs experiencing clear redemptions:

- •BlackRock (IBIT): –$145 million

- •Fidelity (FBTC): –$12 million

- •Bitwise (BITB): –$9.5 million

- •ARK 21Shares (ARKB): –$29.7 million

- •VanEck (HODL): –$23.3 million

- •Grayscale GBTC: –$34.5 million

In total, the group saw –$254.6 million in net outflows.

This is the most notable coordinated red day for U.S. Bitcoin ETFs since the summer, and it reflects growing investor caution. Many buyers entered during the August–October period, when Bitcoin traded comfortably above $100,000, and are now facing meaningful drawdowns.

Chart Signals Breakdown: First Test of April Support

The daily chart shows Bitcoin decisively losing the $92K–$94K support band, which acted as a holding zone from May through October. Price is now retesting levels not seen since late April.

Key chart takeaways:

- •The breakdown has accelerated, with multiple long-bodied red candles signaling strong sell pressure.

- •Trading volume picked up sharply during the drop, a sign that the move is driven by real liquidation, not thin markets.

- •The next high-liquidity region sits around $86K–$88K, a zone that previously acted as both resistance (in April) and support (in May).

If Bitcoin regains $90K quickly, the breakdown may be short-lived. But continued ETF selling increases the probability of a deeper retest.

What Happens Next?

The critical levels to watch:

- •Reclaim of $90.5K–$92K → would signal recovery and stop ETF bleed

- •Failure to hold $88K → opens door to deeper pullback toward $84K–$86K

Historically, Bitcoin corrections that push all new ETF capital into the red often produce sharp reversals once weak hands exit and long-term buyers step in.

For now, Bitcoin’s first move below $90,000 since April marks a pivotal moment, one that will test conviction across the entire ETF investor ecosystem and determine whether the bull cycle’s momentum can recover heading into December.