Key Takeaways

- •Despite a significant 36% correction, Bitcoin inflows to Binance have remained notably low.

- •On-chain capital flows continue to be positive, suggesting a lack of widespread investor panic.

- •Bitcoin is approaching crucial support levels between $88,000 and $89,000, which bulls are defending.

Low Exchange Inflows Diverge from Past Cycles

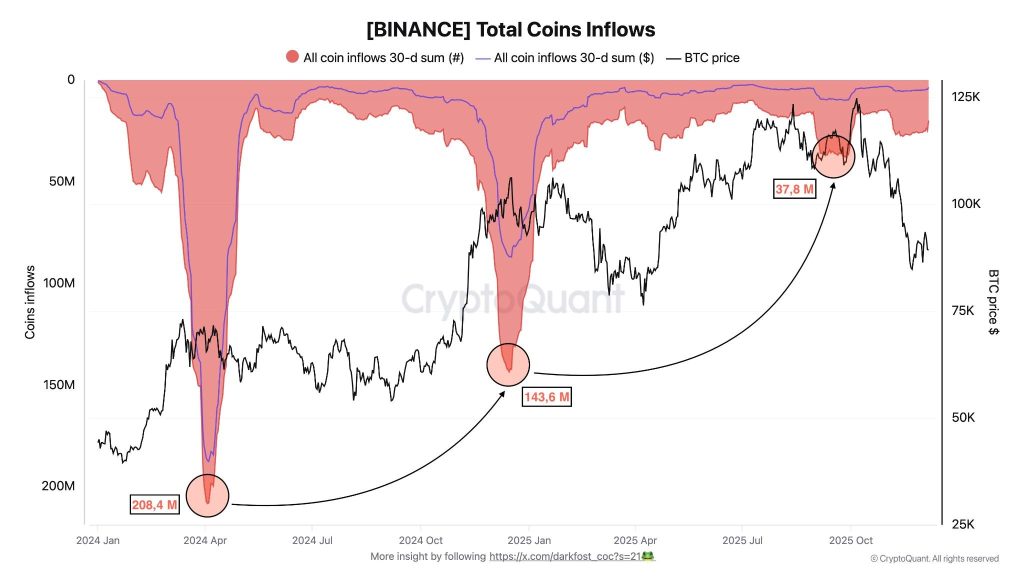

Bitcoin has experienced a nearly 36% decline over the past two months. However, inflows to the cryptocurrency exchange Binance have been unexpectedly low, a departure from patterns observed in previous market cycles. Historically, sharp price pullbacks have often coincided with increased exchange activity as investors moved to sell. In contrast, the current inflows to Binance are approximately five times lower than those seen during the peaks in April and December of 2024. Despite this reduction, the inflows have remained unusually stable, which indicates a reduced intent among investors to liquidate their holdings.

During April 2024, following Bitcoin's surge to $73,800, over 200 million coins flowed into Binance. A similar trend was observed in December 2024 when Bitcoin traded above $100,000. The current data, however, shows a marked difference, suggesting a calmer market sentiment among investors.

This behavior suggests strong conviction and a patient approach from Bitcoin holders during price depreciations. Consequently, market participants may be positioning themselves for a potential upward price movement.

On-Chain Metrics Support Market Stability

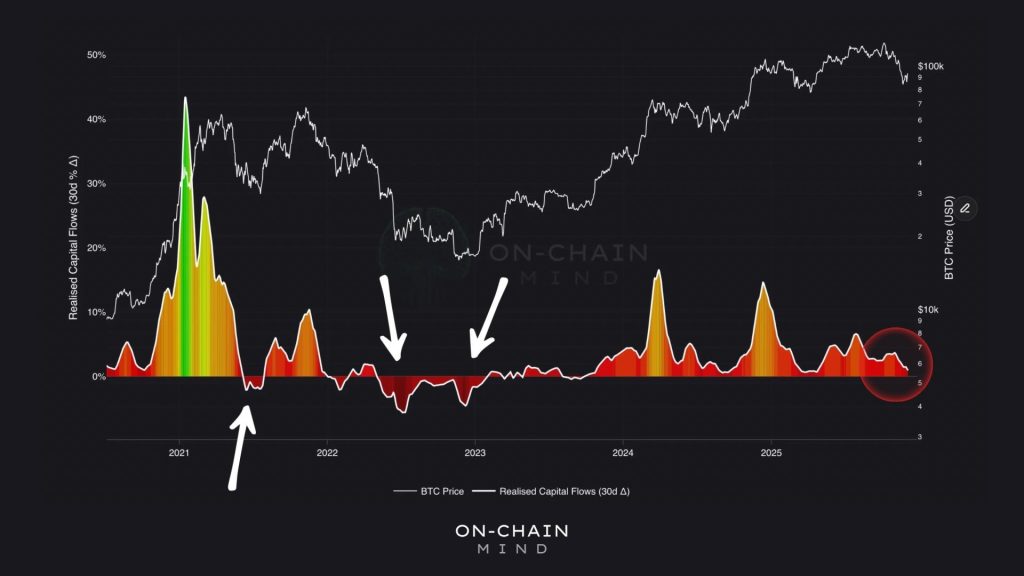

On-chain metrics further reinforce the notion of market stability. Realized Capital Flows, measured over a 30-day period, have consistently remained positive. This indicates that capital is still entering the Bitcoin network, a trend that contrasts with prior bear markets where these flows typically dipped below zero. The current positive trajectory is a significant indicator of ongoing investor interest and accumulation.

In previous downturns, such as those experienced in mid-2022 and late 2022, realized capital flows consistently fell below -20%. The current readings, however, remain above zero, signaling the absence of major capitulation events. This sustained positive flow suggests that investors are not exiting the market in large numbers despite the price correction.

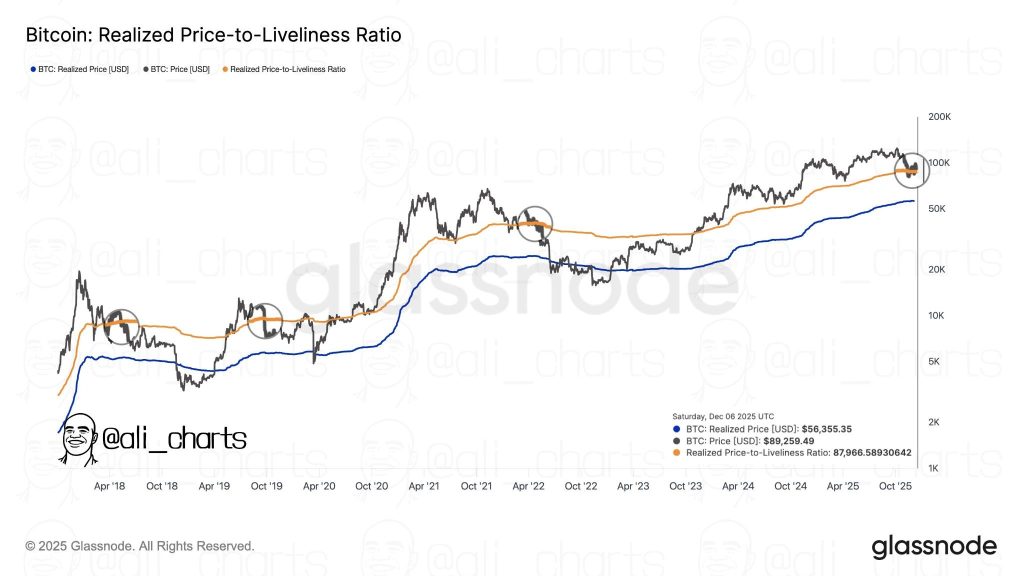

Bitcoin is currently trading near significant support levels identified by on-chain data. Its Realized Price, a metric representing the average price at which each Bitcoin was last moved, stands at $56,355. The current market price is $89,259.

The Realized Price-to-Liveliness Ratio, another key indicator, is currently at $87,966. This level has historically acted as a support area during previous market downturns, suggesting it could attract buyers if the price experiences further weakness.

Bitcoin faces immediate resistance between $92,000 and $94,000, levels that bulls have struggled to breach in recent attempts. However, the support zone between $88,000 and $89,000 remains critical for maintaining bullish momentum.

A nearby CME futures gap at $89,500 is also likely to be filled in the near future, which could potentially lead to increased price volatility. Following the potential filling of this gap, the future price direction will likely depend on how effectively bulls defend the key support levels.

The combination of investor behavior, low exchange inflows, and strong on-chain metrics paints a constructive picture for the market. If selling pressure continues to subside, Bitcoin may be well-positioned to embark on its next upward trend.