Key Market Insights

- •Bitcoin is retesting the $93.5K level while facing resistance at crucial bull market moving averages.

- •Bitfinex whales are maintaining strong long positions, with no significant rise in shorts, indicating continued market confidence.

- •The current technical pattern suggests a bullish outlook, with a potential for a 30% move towards $126K if the established structure holds.

Bitcoin Approaches Critical Weekly Level

Bitcoin was trading at $96,647.06. Over the past 24 hours, the price has experienced a slight decrease of 0.98%. However, over the last seven days, it has shown a positive movement of 6.5%. The daily trading volume stands at $62.7 billion. This recent bounce follows a consistent climb of more than 21% from its last local low.

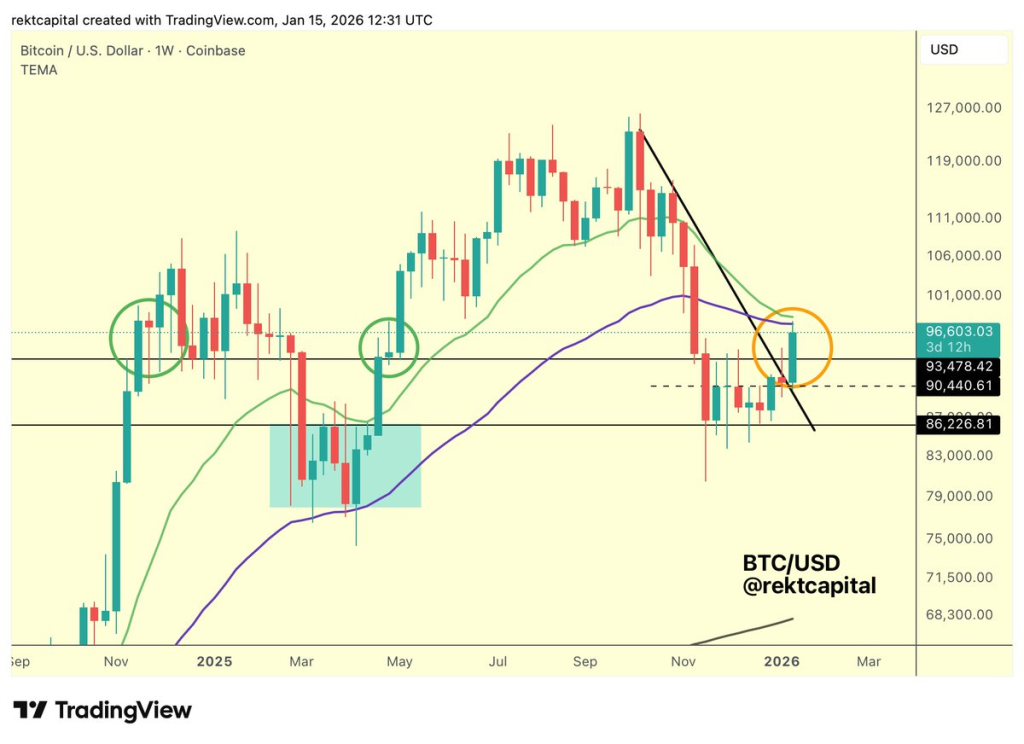

The current price is nearing a level that is closely monitored by traders – the 21-week and 50-week Exponential Moving Averages (EMAs). These moving averages have historically served as resistance during the initial stages of recovery phases. Bitcoin is currently trading just above the $93,500 mark, a level that could be pivotal in determining whether the upward trend will continue or experience a pause.

Analysis indicates that Bitcoin has successfully broken above a recent downward trendline. This breakout was subsequently followed by a rally towards the cluster of EMAs. A horizontal resistance level situated near $93,500 is now a focal point. Achieving a weekly close above this level could serve as confirmation of sustained strength in the market.

As noted by Rektcapital:

“Bitcoin is well-positioned for a Weekly Close above $93,500 but it is finding resistance at the Bull Market EMAs,”

Furthermore, historical data from previous market cycles suggests that Bitcoin sometimes experiences a pullback after initially encountering these critical levels. However, once these EMAs are successfully breached, the price often continues its upward trajectory.

Trend Structure Remains Intact

An alternative analysis, presented by JavonTM1, illustrates Bitcoin's market structure through wave formations. This observed pattern displays a consistent series of higher lows and steady recoveries, a trend that has remained unbroken thus far. The significant rise of over 21% from the recent local low suggests that buyer interest remains robust.

The analysis projects that "$BTC can climb another ~30% to and above the $126,230.09." This forecast aligns with previous market movements that have followed similar chart patterns. The coming weeks will be crucial in determining whether Bitcoin can sustain its current levels and advance towards this projected target zone.

Bitfinex Whale Positions Show No Shift Yet

Data sourced from Bitfinex provides additional context regarding market sentiment. The long positions held by large investors remain elevated, hovering around the 70 million mark. While these levels have been associated with profit-taking in the past, there has been no significant decrease observed to date, indicating that major traders have not exited their positions.

Conversely, short positions continue to stay at low levels. This observation suggests that whales are not currently positioning themselves for a potential market downturn. As CW observed:

“They are also not currently interested in short positions,”

Historically, an increase in short exposure often precedes the end of a bull cycle. For the present moment, the prevailing trend appears to be maintained.