The price action reflects a fragile recovery after several sharp intraday sell-offs, with traders showing caution across spot and derivatives markets.

Market Structure Shows Waning Demand

Despite the small 24-hour bounce, the broader trend remains weak. Analysts note that rallies have begun stalling due to diminishing demand, confirmed by lighter spot volume and fading momentum on the 4-day and weekly charts. Market depth has thinned, reducing the strength of buy-side liquidity needed for a sustained rebound.

Short-term holders, typically the most reactive segment – continue to realize losses aggressively, a classic sign of capitulation within the early stages of a downtrend.

What the Chart Is Signaling Right Now

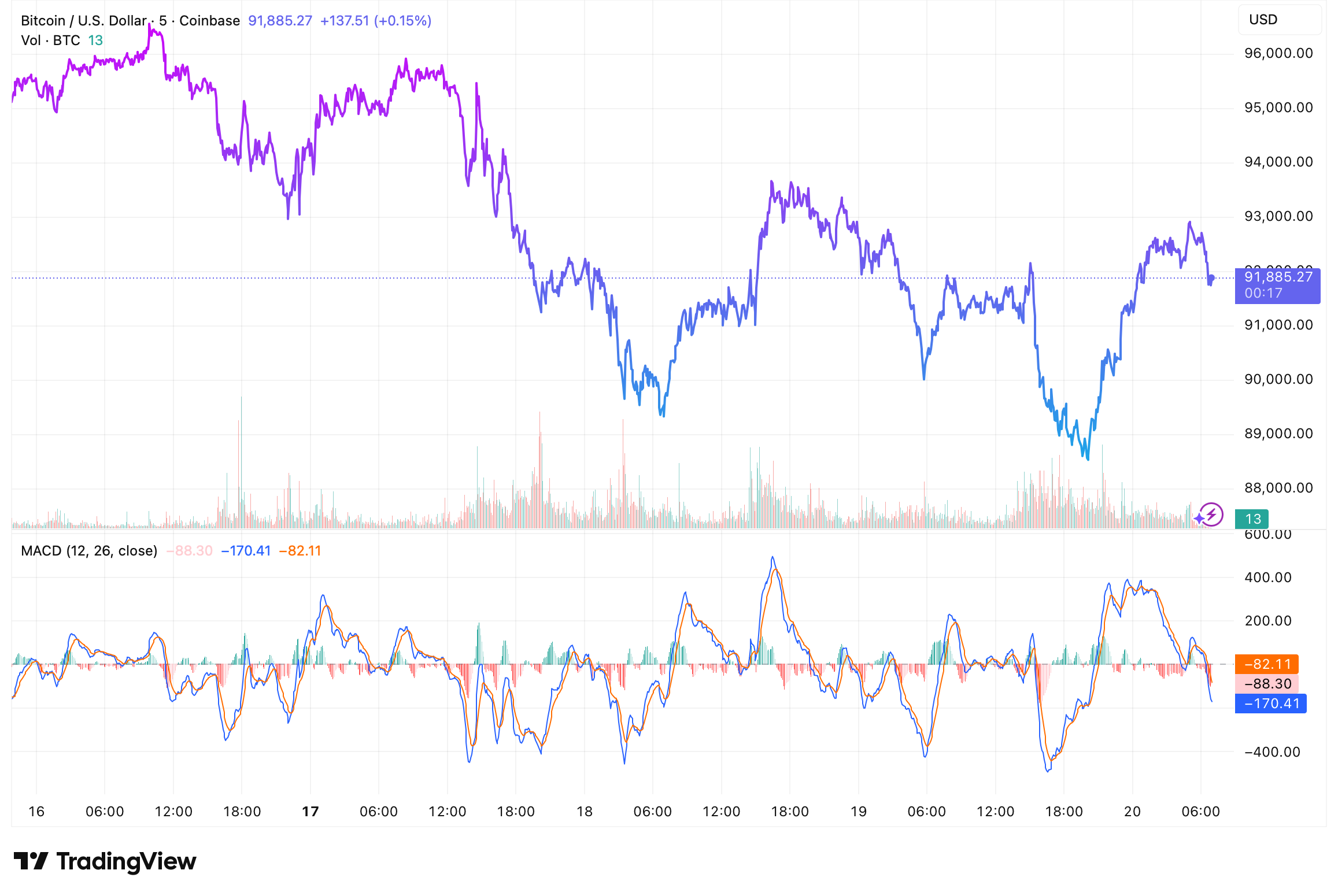

TradingView chart shows:

- •A failed attempt to reclaim $93K–$94K, followed by a drop into the $89K range before a modest recovery.

- •The MACD remains below the zero line, with the signal and MACD lines both pointing downward — a confirmation of weakening momentum.

- •Volume spikes coincide with downward candles, highlighting sell pressure dominating bounce attempts.

On the daily timeframe, Bitcoin remains below the short-term moving averages, suggesting the trend bias is still bearish unless BTC reclaims the $94K level with strong volume.

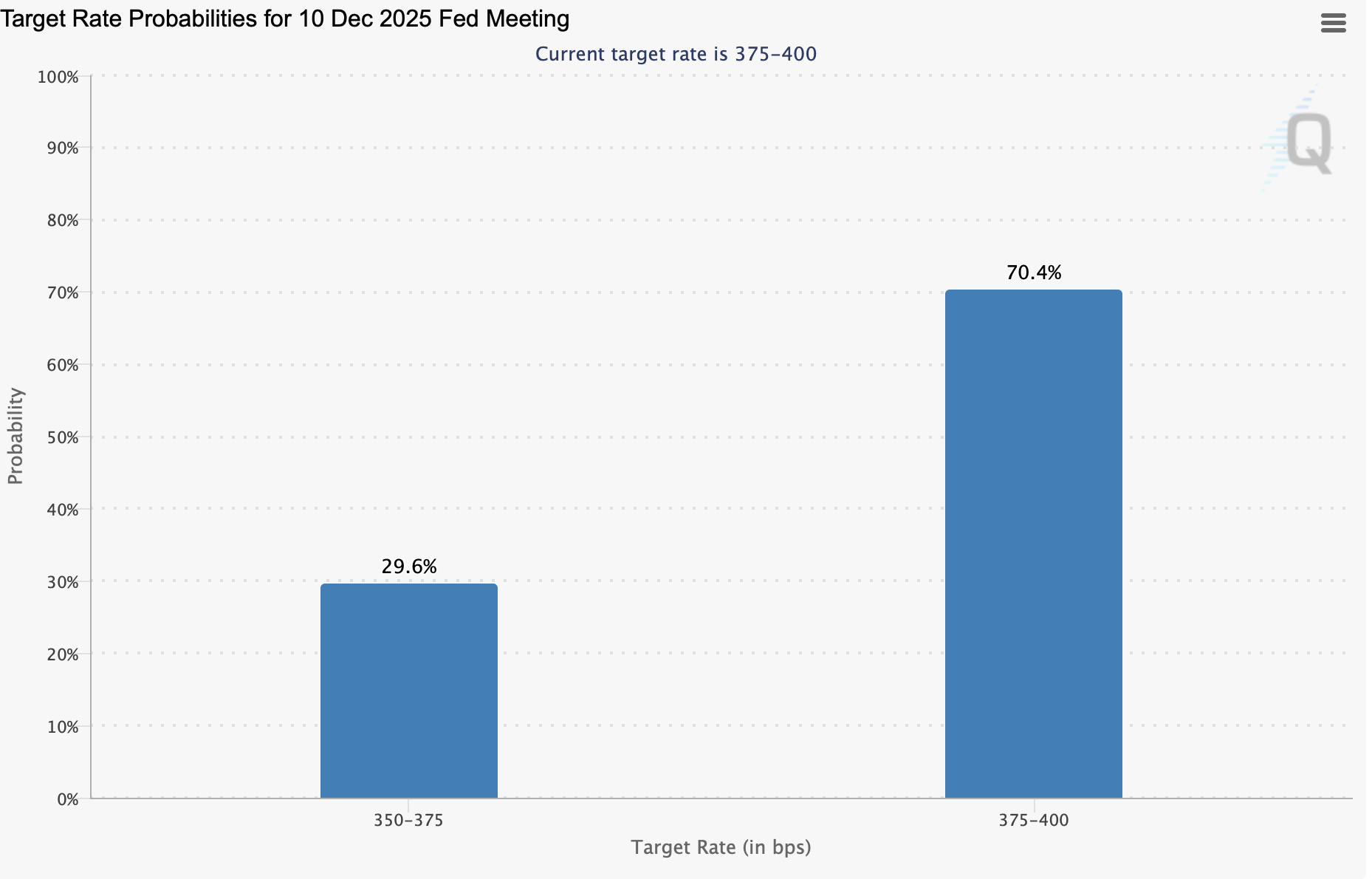

Macro Pressure: Fed Uncertainty Hits Risk Assets

The weakening structure aligns with broader macro stress. The probability of a December Federal Reserve rate cut has fallen sharply — from 94% a month ago to 29% now. This shift reduces appetite for risk assets, particularly crypto, which historically performs best in declining-rate environments.

Institutional Outflows Add to the Pressure

BlackRock’s IBIT ETF recorded one of its largest outflows since launching in January 2024, signaling notable institutional selling. These outflows have added additional weight to an already fragile market.

Sentiment Turns Bearish, But Long-Term Buyers Step In

Retail sentiment is firmly in “bearish” territory. Social and trading activity reflect high levels of fear and defensive positioning among smaller investors.

Yet long-term conviction remains strong in some corners. Strategy’s Michael Saylor has continued purchasing Bitcoin, treating the pullback as a strategic accumulation opportunity — consistent with his historical behavior during market stress.

Conclusion

Bitcoin’s current price at $91.8K represents a technical pause inside a broader weakening trend. Waning demand, institutional outflows, and macro uncertainty continue to weigh on sentiment. While near-term price action looks fragile, long-term buyers continue accumulating — suggesting the market may be in the middle of a deeper reset rather than a structural breakdown.