Innovative ETF Structure Targets Overnight Trading Opportunities

A new exchange-traded fund (ETF) is being proposed with the specific goal of tracking Bitcoin's price action during periods when the U.S. financial markets are closed. This innovative product, named the Nicholas Bitcoin and Treasuries AfterDark ETF, was detailed in a filing submitted to the Securities and Exchange Commission on December 9.

The fund is designed to initiate Bitcoin-linked trades exclusively after the U.S. financial markets conclude their trading day and to close those positions shortly after the next day's market opens. This strategy confines trading activity to the overnight window, and importantly, the fund will not hold Bitcoin directly.

At least 80% of the fund's assets are allocated to Bitcoin futures, exchange-traded products (ETPs), other Bitcoin ETFs, and options associated with these ETPs and ETFs. The remaining assets can be held in U.S. Treasuries. The filing explicitly states the objective is to leverage price movements that occur when the equity market is not operational. Exposure is maintained solely through listed products, avoiding direct ownership of spot tokens or on-chain custody, with all positions being reset each morning after the market opens.

Data Suggests Significant Potential in After-Hours Trading

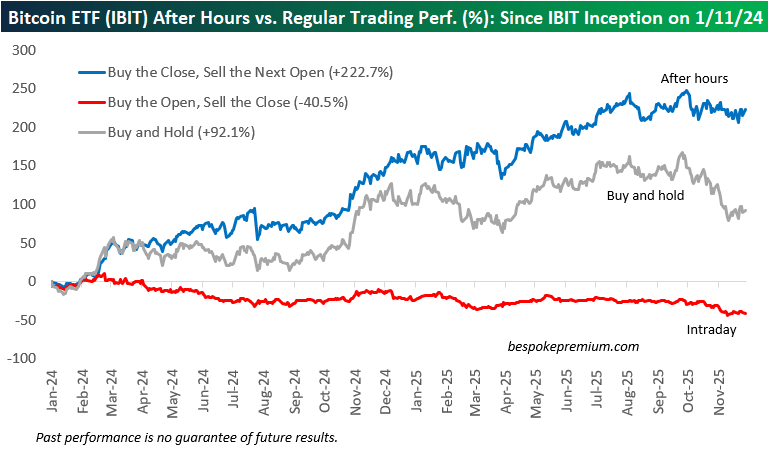

Research conducted by Bespoke Investment Group has provided compelling evidence for the viability of this strategy. A test case using the iShares Bitcoin Trust ETF (IBIT) revealed that purchasing at the U.S. market close and selling at the subsequent open, from January 2024 onwards, resulted in a substantial 222% gain. In contrast, the same test strategy focused solely on daytime trading, buying at the open and selling at the close, showed a significant loss of 40.5%.

This considerable difference in returns highlights the specific market inefficiency that the AfterDark ETF aims to capture.

Expanding ETF Landscape and Regulatory Environment

The current market for Bitcoin ETFs continues to grow, with filings for products linked to Aptos, Sui, Bonk, and Dogecoin also in the pipeline. This expansion follows a period where former President Donald Trump advocated for more relaxed regulations at the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). During this time, Donald Trump also engaged with both agencies regarding token issuers and digital asset exchanges.

Since the initial approvals began in January 2024 under the previous administration, over 30 Bitcoin ETFs have commenced trading in the U.S., according to data from ETF.com. U.S. spot ETFs are currently experiencing renewed inflows as prices exhibit a choppy upward trend following weeks of declines.

On Tuesday, SoSoValue reported that spot Ethereum ETFs attracted $177.64 million, marking the highest inflow in six weeks. This figure surpassed the $151.74 million invested in spot Bitcoin ETFs on the same day. Solana ETFs saw inflows of $16.54 million, while XRP ETFs garnered $8.73 million. Funds tracking Dogecoin and Chainlink experienced flat flows. Across all crypto-related ETF products to date, a total of $21.40 billion in Ethereum has been absorbed, which represents approximately 5% of its $400 billion market value.