Bit Digital's Strategic Ethereum Accumulation

Bit Digital, recognized as one of the largest holders of Ethereum, further solidified its position by acquiring an additional 31,057.3 ETH during October. As of October 31, 2025, these holdings are valued at approximately $590.5 million.

This strategic acquisition underscores Bit Digital's ongoing commitment to Ethereum, reinforcing its role as a central component of the company's digital infrastructure strategy.

Significant Investment in Ethereum Staking

Bit Digital, under the leadership of CEO Sam Tabar, has substantially increased its Ethereum treasury through the acquisition of over 31,000 ETH in October. Sam Tabar stated, "This purchase demonstrates our commitment to building shareholder value by financing ETH accumulation on terms that are accretive to NAV per share." The acquisition was facilitated by a $150 million convertible notes offering, highlighting Bit Digital's dedication to Ethereum-focused strategic investments. This move aligns with the company's strategic pivot from Bitcoin mining to Ethereum staking, which began in 2022.

The company's market strategy reflects this immediate impact. With no current plans for diversification into other assets, Bit Digital's substantial Ethereum holdings emphasize its institutional focus on digital financial infrastructure. The company's total Ethereum holdings now stand at 153,547 ETH, with 132,480 ETH actively staked and generating rewards, indicating a preference for yield optimization and stability.

Industry observers are closely monitoring Bit Digital's approach, characterized by its transparency and direct integration of staking activities. While prominent crypto influencers have yet to offer extensive commentary, this acquisition aligns with Bit Digital's publicly declared objectives of expanding its Ethereum treasury within public-market frameworks, as consistently stated by CEO Sam Tabar.

Ethereum Market Dynamics and Bit Digital's Strategic Realignment

Did you know? Bit Digital's strategic transition from Bitcoin mining to establishing a robust Ethereum presence mirrors broader trends in the cryptocurrency market, signaling growing institutional interest in Ethereum as a foundational asset for digital financial ecosystems.

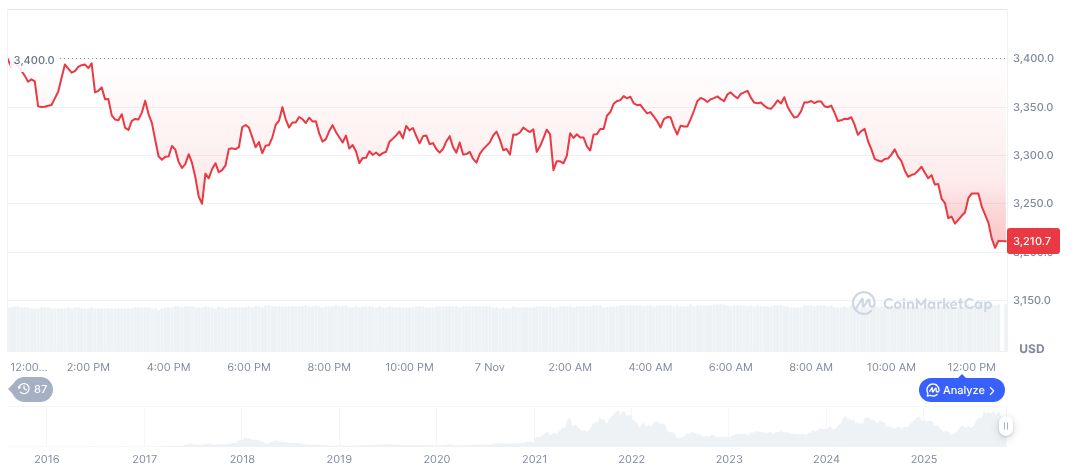

Ethereum (ETH) is currently trading at $3,459.36, with a market capitalization of $417.53 billion and a market dominance of 12.04%. Recent data shows a 3.86% increase in ETH over the past 24 hours, though it has experienced a 10.29% decline over the last seven days.

Coincu's research team suggests that Bit Digital's acquisition further solidifies Ethereum's standing as an institutional asset, potentially impacting long-term market trends and underscoring technological advancements in staking and blockchain infrastructure. This strategic concentration could lead to increased utilization of staking yields and reinforce Ethereum's importance in digital asset portfolios.