Bipartisan Collaboration on Crypto Market Structure Act

Senators Kirsten Gillibrand and Cynthia Lummis announced progress on the bipartisan Crypto Market Structure Act at the Blockchain Association Policy Summit in Washington, D.C., on Tuesday. The bill aims to enhance regulatory clarity in cryptocurrencies, potentially increasing market stability and encouraging institutional investment while addressing decentralized finance oversight.

This legislative effort represents a significant step for the U.S. crypto industry. Discussions at the Blockchain Association Policy Summit focused on overcoming bipartisan hurdles to establish comprehensive regulatory guidelines. Senator Gillibrand confirmed the smooth progress of ongoing bipartisan negotiations, stating, "The first bipartisan meeting last week went smoothly without obstacles."

In parallel, Senator Lummis has been coordinating with Democratic Senator Ruben Gallego on ethical clauses, further enhancing the framework's robustness.

"The first bipartisan meeting last week went smoothly without obstacles."

Industry reactions reflect cautious optimism, with stakeholders anticipating clearer operational guidelines. The crypto market's response remains tempered, yet stakeholders keenly await further developments. Comments from Senate members emphasize potential shifts in trust and stability across digital financial platforms as regulatory measures advance.

Impact of Crypto Regulations on Industry Confidence

The Lummis-Gillibrand Responsible Financial Innovation Act, introduced in 2023, set a precedent by establishing standards predominantly for financial consumer protection amidst cryptocurrency expansion.

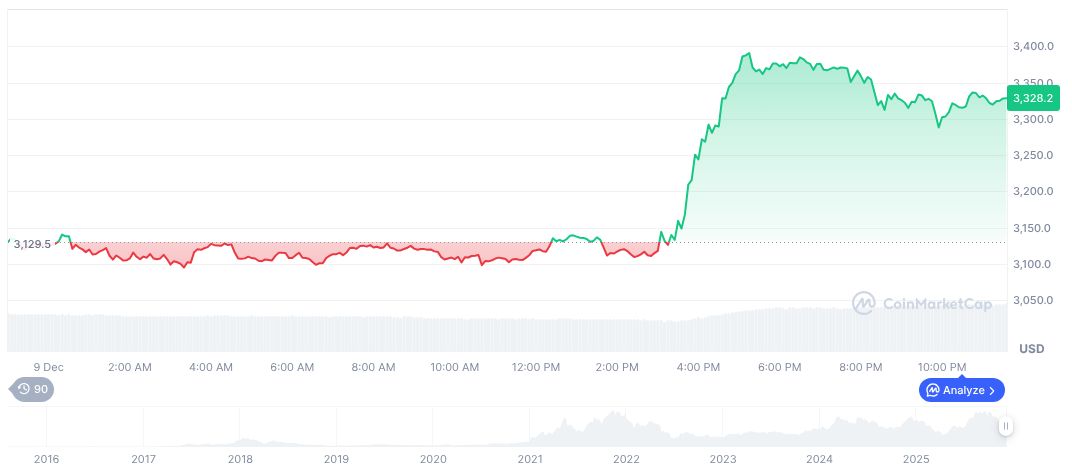

Ethereum shows notable price shifts, currently valued at $3,308.91 with a market cap of $399.37 billion. Market data reveals Ethereum's 6.07% rise over 24 hours despite a 24.07% decline observed over 90 days. Trading activity increased by 28.46% recently, highlighting investor interest.

Analysts foresee regulatory advancements fostering heightened institutional confidence in crypto markets, thus potentially bolstering investment flows. The emphasis on comprehensive decentralized finance guidelines may catalyze transformative impacts across platform operations, further endorsing structured digital asset growth.