BingX has experienced rapid growth over the past few years, establishing itself as a popular and widely-used global cryptocurrency exchange, though it often feels like it operates under the radar compared to major players like Binance or Bybit.

After thoroughly testing its spot markets, futures engine, and various additional features, the overall user experience has proven to be surprisingly capable. BingX offers a feature-rich set of products that cater effectively to both beginners and advanced traders.

This review for 2025 aims to provide a comprehensive overview of my findings regarding BingX's strengths, weaknesses, costs, safety profile, and its competitive standing against industry leaders.

Key Takeaways

- •BingX offers a broad suite of trading products, including spot, futures, copy trading, grid bots, and earning tools.

- •Copy trading is a standout feature, making the platform particularly appealing to passive investors and beginners.

- •Futures fees are highly competitive, with strong liquidity on major pairs and reliable execution.

- •The platform lacks major-market regulatory oversight, and its availability varies significantly by region.

Company Background and Reputation

Founded in 2018 by Josh Lu, BingX has evolved into a globally recognized cryptocurrency exchange that provides a comprehensive suite of trading and Web3-oriented tools. The platform serves a substantial user base, exceeding 20 million users worldwide, according to its official website.

Over the years, BingX has expanded its offerings beyond traditional spot cryptocurrency trading. It now includes derivatives (futures), social trading through copy trading products, and a variety of tools designed for different trader profiles, from novices to advanced users.

In 2024, BingX gained significant visibility through a major sponsorship deal with the prominent football club Chelsea FC. Earlier in 2025, the exchange committed to investing $300 million in the development of AI-powered trading and product tools, signaling its dedication to technological advancement.

In summary, BingX has rapidly emerged as a major, ambitious exchange with a global presence and a diverse portfolio of services. It is frequently listed among CoinMarketCap's top 10 exchanges by trading volume in both derivatives and spot markets.

Supported Markets, Products, and Access

BingX has strategically positioned itself as a multi-market trading platform, offering a wide array of cryptocurrency products. My testing revealed the following details:

Spot Trading Markets

BingX supports hundreds of cryptocurrencies, including major assets like BTC, ETH, SOL, XRP, ADA, and a wide selection of popular altcoins. The spot market selection is extensive and well-suited for both beginners and general investors. BingX also consistently expands this selection.

In terms of liquidity, as is common with most exchanges, it is strongest on major trading pairs. While long-tail assets may have thinner order books compared to some of the largest exchanges, this is standard industry practice and was not unexpected.

Futures & Derivatives

The futures trading environment is recognized as one of BingX's core strengths, and it largely lived up to expectations. BingX offers USDT-M perpetual contracts, coin-margined futures, and a continuously growing roster of derivatives pairs.

Notably, the exchange provides standard futures on multiple cryptocurrencies, which is a refreshing offering not commonly found outside of major exchanges. Leverage options are competitive, as are the spreads. During testing, the derivatives engine demonstrated stability and responsiveness, even during periods of heightened market volatility.

Other Supported Products

BingX also offers several other notable products, which are explored in further detail below:

- •Copy Trading & Social Trading

- •Grid Trading Bots

- •Dual Investment Products

- •Standard Staking & Earning Tools

Core Features and Platform Functionality

BingX has developed into a feature-rich platform that strives to balance advanced trading capabilities with accessible tools. While some areas show room for improvement, others are exceptionally well-executed. Let's examine these aspects:

Copy Trading & Social Trading

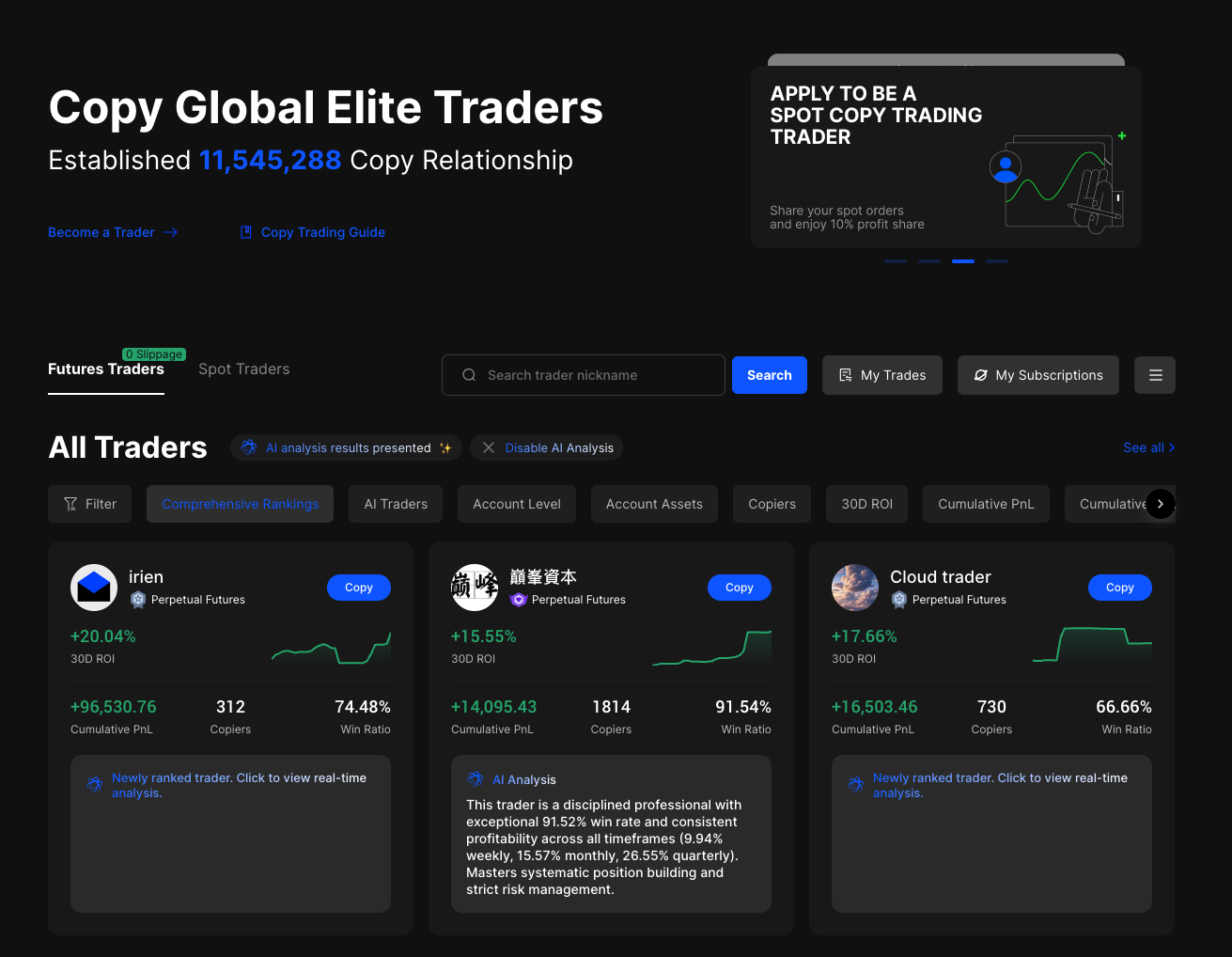

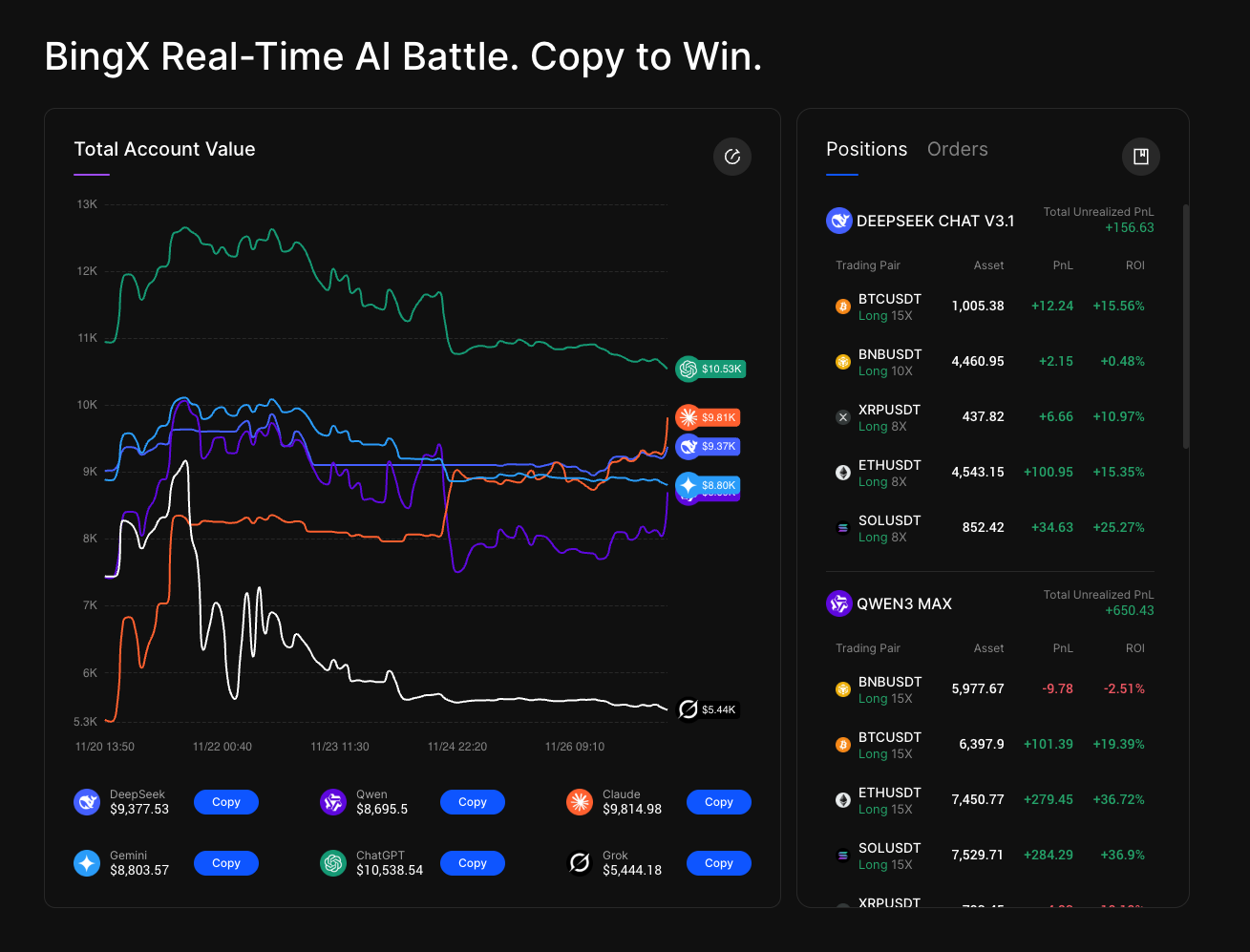

While copy trading has always presented mixed feelings and is not universally recommended, BingX offers extensive options for social trading enthusiasts. Users can choose to copy popular and successful traders, as well as certain AI models, a concept gaining significant traction recently.

The copy trading interface is user-friendly. BingX provides helpful explainer guides and adjacent products. Their AI-oriented copy-trading solution is particularly noteworthy. While detailed disclaimers regarding the risks associated with AI trading are available, they were not prominently displayed on the page, which could be an area for enhancement.

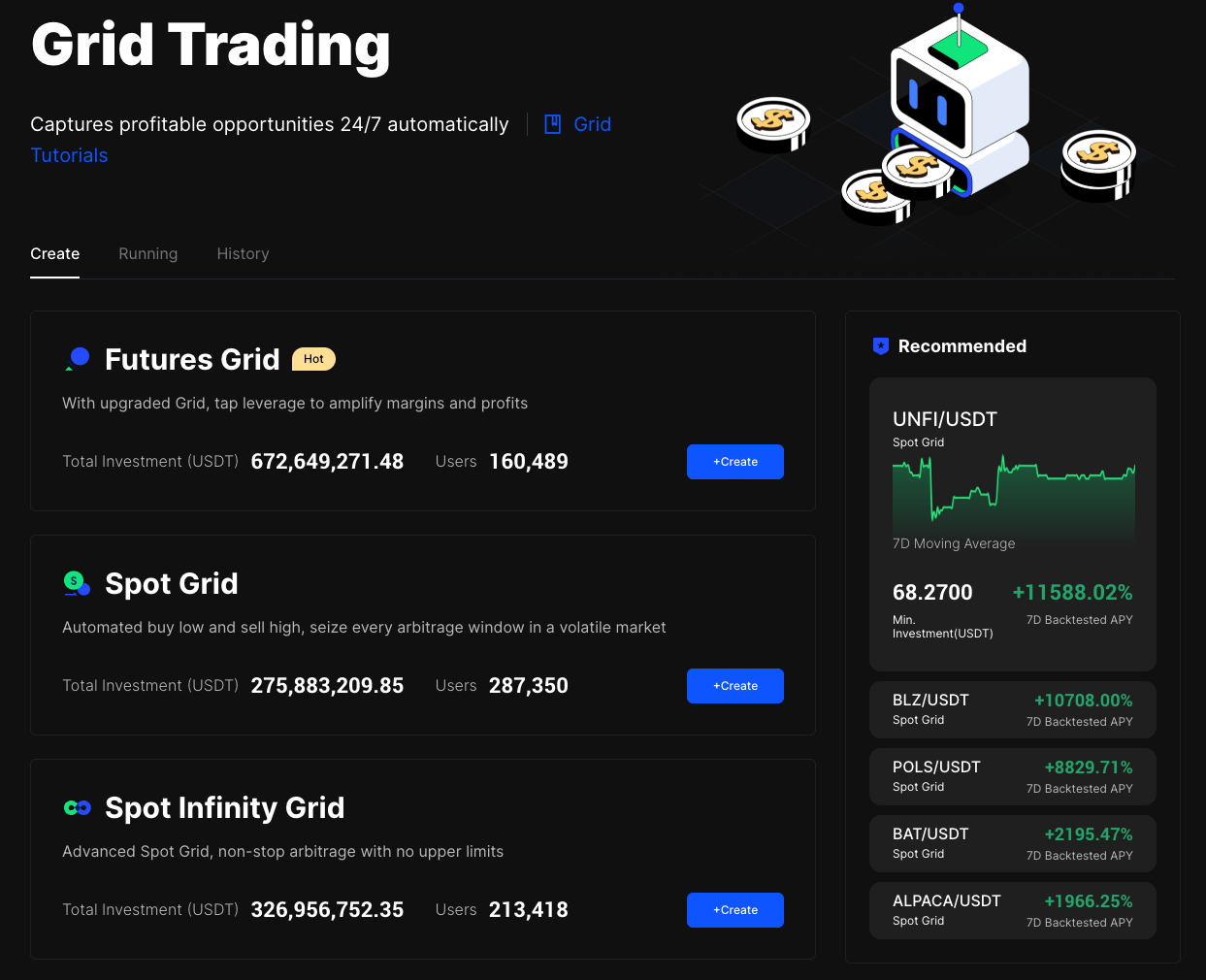

Grid Trading Bots and Automation

For users interested in automation, a growing trend in 2025, BingX provides robust solutions. It offers grid trading bots for both spot and derivatives markets. Additionally, AI-enhanced bots and pre-configured strategy templates are available.

These tools are designed for ease of use and deployment, even for individuals with no prior experience. However, it is strongly advised to conduct practice trading before committing real capital. The platform does not require users to write code.

Dual Investment Products

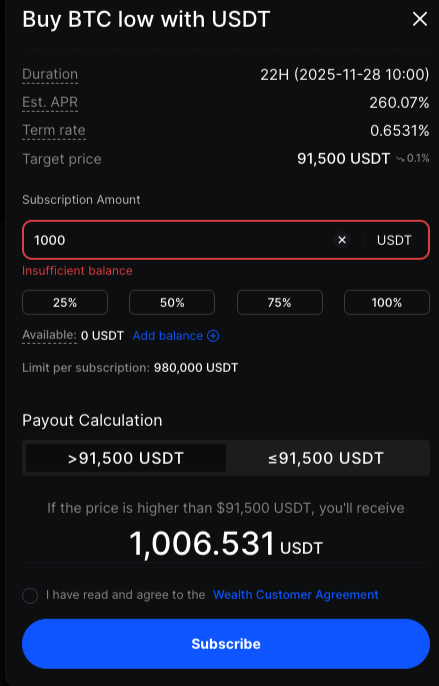

Dual investment products, while potentially complex for beginners, offer a way to earn a premium on investments regardless of price movements, albeit with inherent risks. Essentially, it functions as an options trading tool.

The interface for dual investment products is presented clearly. For example, a user might set an order to buy BTC at a price lower than its current market value. If the order is filled, the user earns a premium at a specified Annual Percentage Rate (APR) for a set duration. Upon contract expiration, the user receives their investment back plus the premium, either in USDT or the equivalent in BTC, depending on the price at settlement. The risks involve potential opportunity cost if the price moves favorably beyond the premium, or acquiring an asset at a higher effective cost if the price moves unfavorably.

This product is ideal for users looking to earn a premium on their unused stablecoins and who are comfortable buying a cryptocurrency at a predetermined price, even if the market price might fluctuate. It provides an entry point plus a premium on the investment.

Standard Earn and Staking

Standard earn and staking opportunities are also available on BingX. These offerings are typical within the industry and provide accessible methods for users to generate yield on their assets. Returns naturally vary based on the specific asset and the lock-up period.

Fees, Costs, and Incentives

BingX has positioned itself as an exchange with competitive trading fees, particularly in the futures market. The fee structure is transparent and comparable to major exchanges.

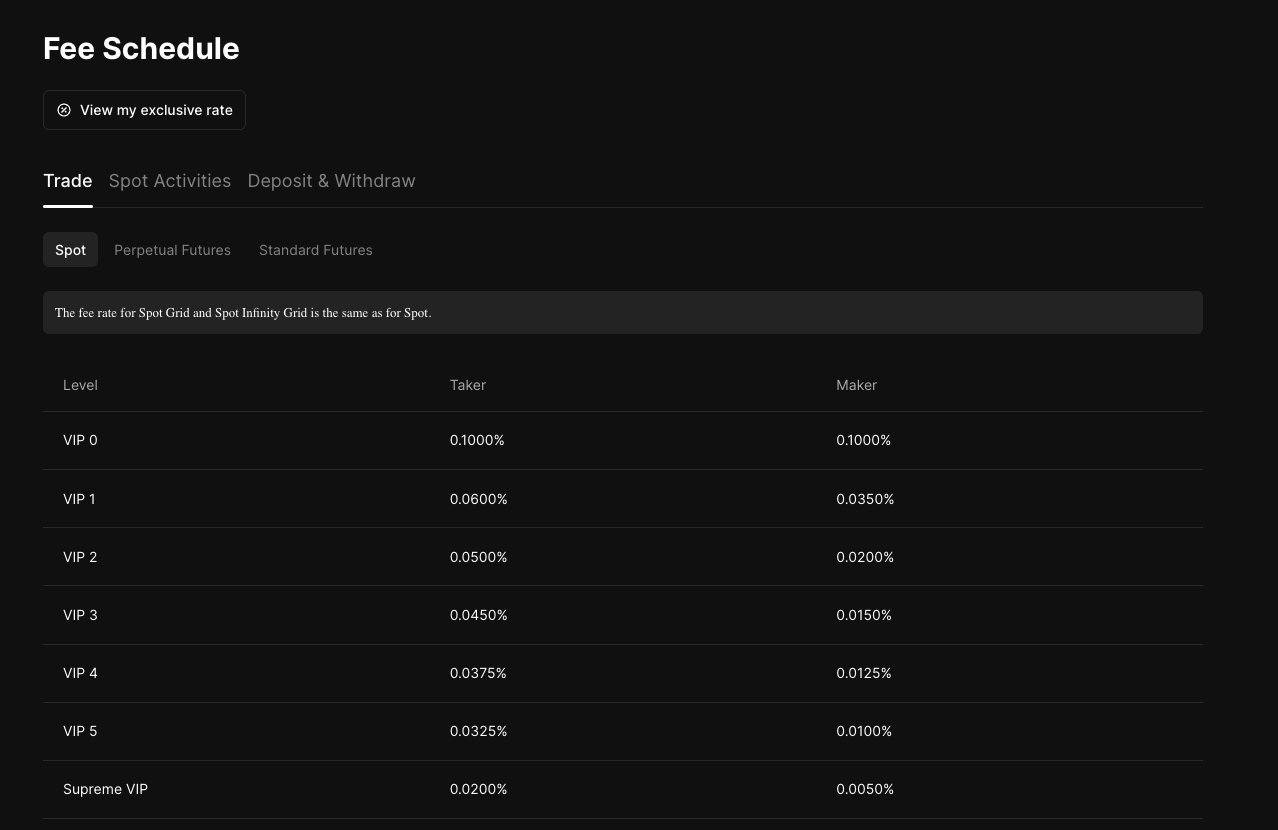

Spot Trading Fees

Spot trading fees begin at 0.1% for VIP level 0, which is on par with Binance. Fees decrease with higher VIP levels.

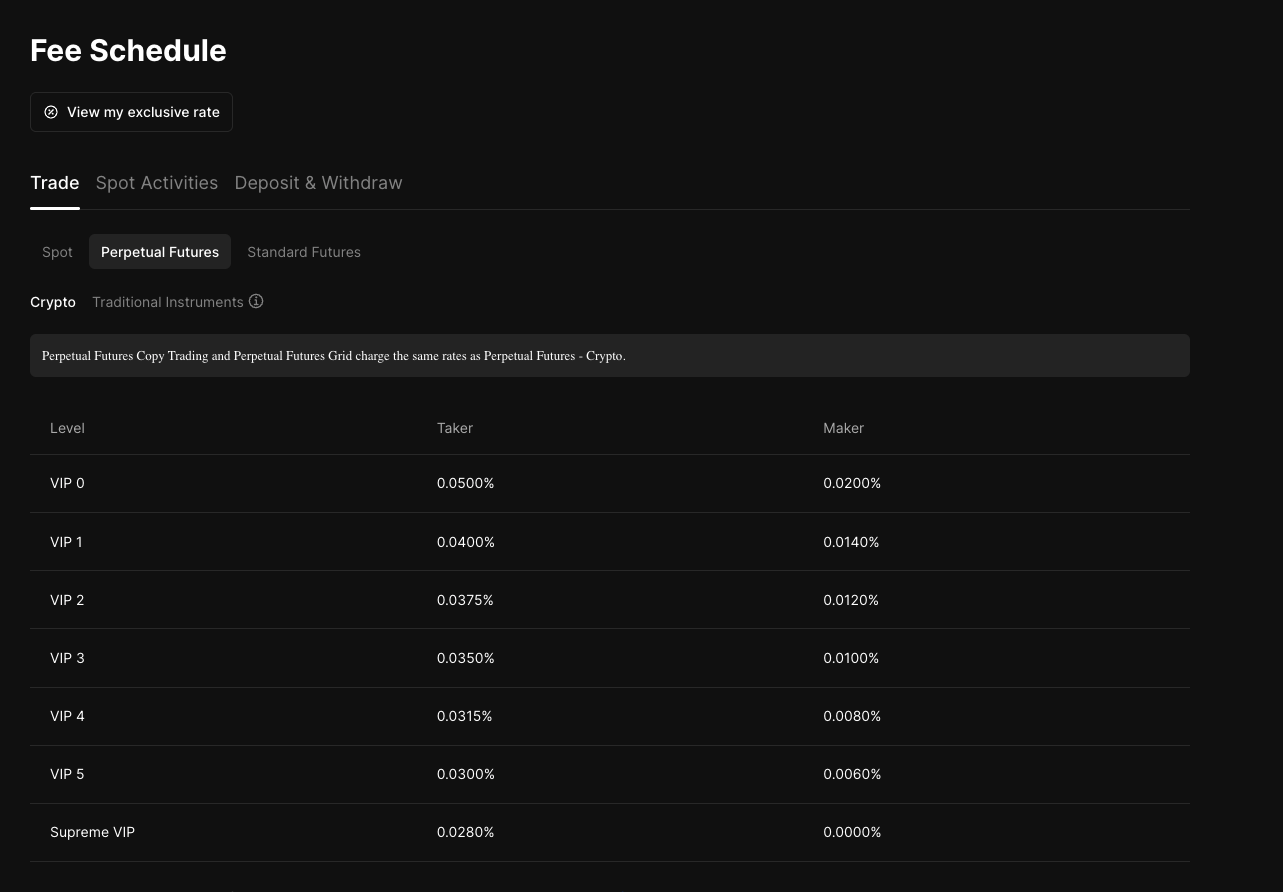

Futures Trading Fees

The futures trading fee structure is also competitive and comparable to Binance. However, Binance offers more competitive fees at its highest VIP levels, which would only be relevant for users with extremely high trading volumes (over $1 billion).

Costs

A critical cost to consider is the spread, which is the difference between the order price and the execution price. For instance, if a limit order to buy BTC at $100,000 cannot be filled at that exact price due to a rapid price drop and lack of liquidity, the order might be executed at a lower rate. This can be problematic, especially when using such orders as stop-losses.

BingX demonstrates solid liquidity for major markets, resulting in competitive spreads. However, for less common altcoins with thinner markets, spreads tend to be wider. This is a common characteristic across most cryptocurrency exchanges and is an aspect often overlooked in educational resources.

Incentives

BingX actively engages users with incentives and promotions. For example, at the time of this review, a promotion offered 0% maker and taker fees on several spot markets, which can significantly reduce trading costs.

Security, Compliance, and Risk Management

Security is a paramount consideration when evaluating any cryptocurrency exchange. BingX has a strong track record, having never experienced a hack. It supports standard account-level security features, including end-to-end encrypted connections, two-factor authentication, and separate trading accounts for different products. The platform also offers Proof of Reserves, a notable feature for any exchange claiming reliability.

Regulatory Status and Licensing

While BingX operates as an international exchange, it does not offer services in the United Kingdom, the United States, or Canada, among other restricted countries. This is a common practice for many exchanges facing significant regulatory hurdles in these major jurisdictions.

BingX is considered reasonably secure, employing industry-standard protection methods. It is important to note that some exchanges prioritize obtaining extensive licensing more than BingX does.

User Experience and Customer Support

The overall user experience on BingX is excellent. The platform's tools are easy to locate and operate, and its extensive features and product set are intuitive to navigate. The interface feels familiar to users of other centralized exchanges.

Despite the positive user experience with the platform's functionality, BingX has received mixed reviews for its customer service, with a Trustpilot score of 1.8 out of 5. However, it is worth noting that many other major exchanges, such as Binance (scoring 1.4), also receive a high volume of negative reviews. Users are often more motivated to leave negative feedback when experiencing dissatisfaction, rather than positive feedback for satisfactory service.

BingX Pros and Cons

Pros

- •Wide selection of spot, futures, and automated trading tools.

- •Industry-leading copy trading with robust social features.

- •Competitive futures fees and reliable execution.

- •Beginner-friendly mobile app and intuitive user interface.

- •Demo trading mode for risk-free practice.

Cons

- •Limited regulatory oversight in major jurisdictions.

- •Not available to users in the United States.

Final Verdict and Recommendations

After an extensive period using BingX, I am satisfied with the majority of its features, particularly its spot and futures trading capabilities, which are crucial for most users.

The platform's most significant strength lies in its wide array of retail-oriented features, such as its copy-trading ecosystem, which remains one of the most accessible and feature-rich in the industry.

BingX does come with certain trade-offs. The limited regulatory coverage in jurisdictions like the US and the UK may deter some users, though this is not uncommon in the crypto space.

Overall, BingX presents a very strong option for traders seeking an easy-to-use and feature-rich platform.

Frequently Asked Questions (FAQs)

Is BingX a regulated exchange?

BingX holds registrations and licenses in specific jurisdictions but lacks comprehensive regulation in major markets such as the US or UK.

Can US residents use BingX?

No, BingX is not accessible to residents of the United States.

Is BingX safe to use?

BingX implements standard security measures, including 2FA, cold storage, anti-phishing tools, and proof-of-reserves, contributing to its safety profile.

Does BingX support copy trading?

Yes, copy trading is one of the platform's most prominent and well-developed features.