Significant Stablecoin Inflows to Binance Observed

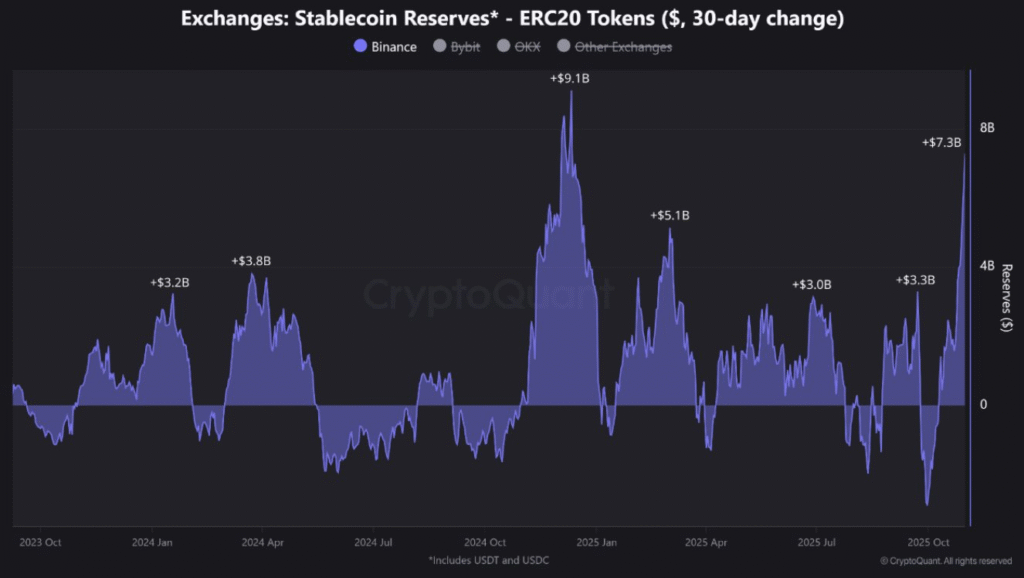

Stablecoin inflows to Binance have reached $7.3 billion in the past 30 days, marking the highest level since December 2024. This period of substantial inflow activity historically preceded a significant rally in Bitcoin's price, moving from $67,000 to $108,000.

According to data compiled by CryptoQuant, the $7.3 billion influx of stablecoins into Binance over the last 30 days represents the largest such increase in reserves on the exchange since December 2024. During that earlier period, Bitcoin was trading around the $67,000 mark before embarking on a climb to $108,000.

The data specifically tracks ERC-20 stablecoins, including USDT and USDC, held across centralized exchanges. Binance has emerged as the primary driver of this recent surge, with other exchanges like Bybit and OKX showing comparatively smaller movements. This recent activity has elevated Binance's stablecoin reserve growth to levels not witnessed in nearly a year.

JA Maartun, an analyst at CryptoQuant, shared insights on X: “The last time inflows reached similar levels was in December 2024, shortly before Bitcoin broke its $67K all-time high and rallied to $108K.”

Historical Context and Market Implications

The current $7.3 billion inflow is being closely examined in comparison to the $9.1 billion inflow recorded in December 2024. That preceding surge coincided with a notable upward trend in Bitcoin's price action.

While stablecoin inflows are not direct predictors of price movements, they are widely monitored as an indicator of potential buying capital entering cryptocurrency exchanges. Historically, periods of high stablecoin reserves on exchanges have often been followed by increased trading volumes and market activity.

This data may suggest heightened user interest in the crypto markets or a strategic preparation for asset accumulation. However, the precise origins of these substantial stablecoin inflows have not been detailed in the publicly available data. CryptoQuant's historical charts show significant inflow spikes in early 2024 and mid-2025, but none have reached the magnitude of the current influx.

Market participants will continue to closely observe the trajectory of this trend and whether it aligns with historical patterns that preceded the late 2024 Bitcoin rally.