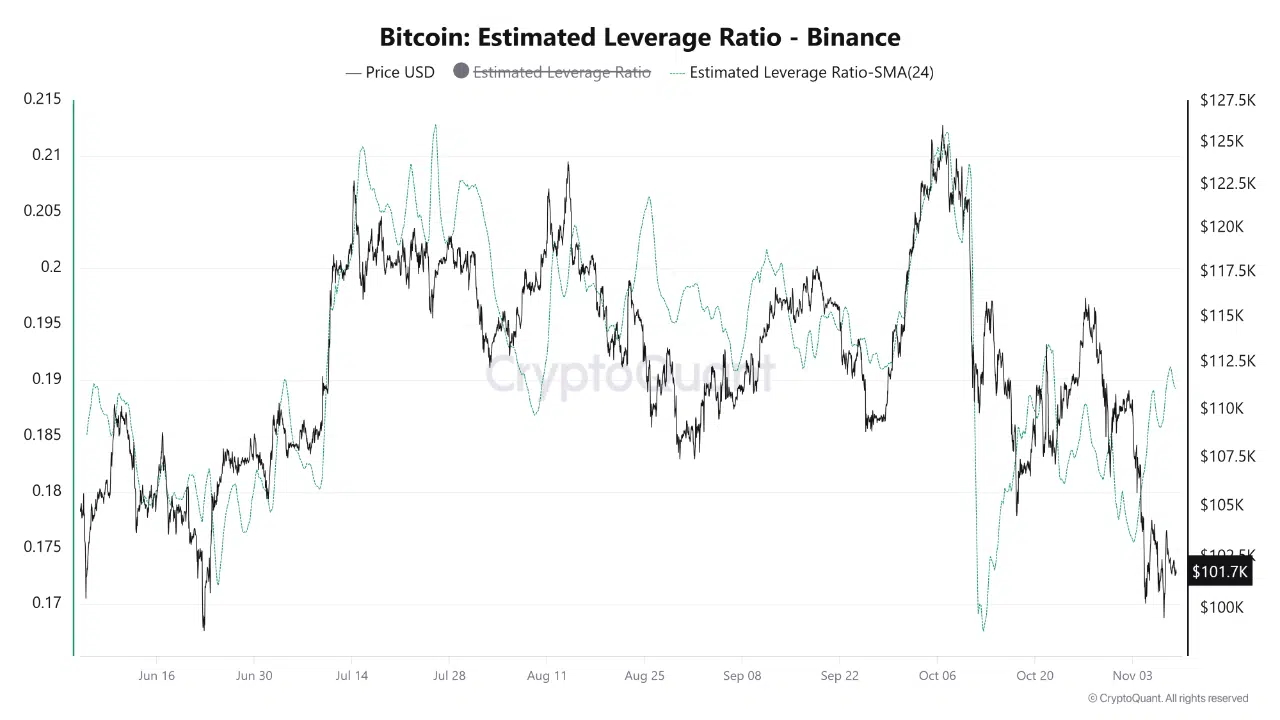

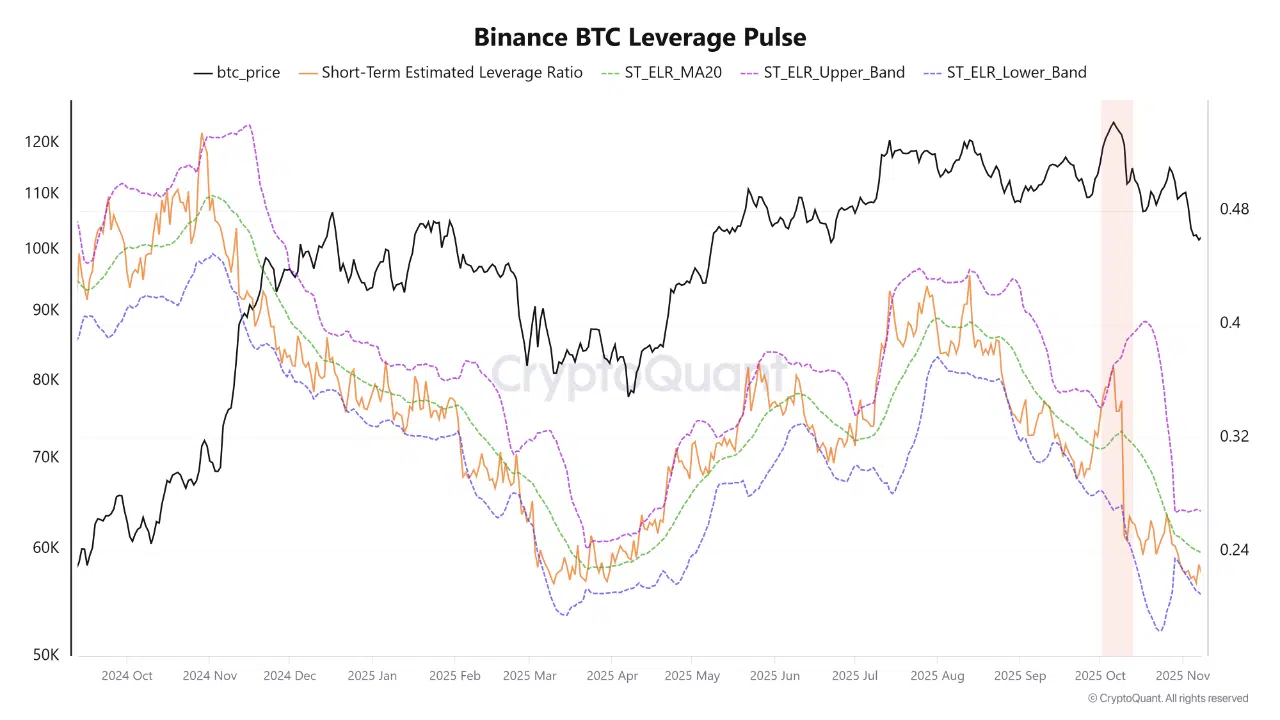

According to a new CryptoQuant report shared by analyst Crazzyblockk, leverage in the Binance Bitcoin futures market has cooled significantly following the latest market pullback. The exchange’s Short-Term Estimated Leverage Ratio (ST_ELR), which measures open interest relative to stablecoin reserves, dropped sharply to 0.2247 as of November 8, 2025.

This marks a notable decline below its 20-day moving average of 0.2391, and positions the ratio close to its lower volatility boundary near 0.2069, signaling a period of reduced risk and renewed stability. The move coincides with Bitcoin’s correction from above $110,000 to roughly $102,000, as traders rapidly unwound leveraged positions to avoid further losses.

Deleveraging Signals Market Reset

CryptoQuant notes that the negative Z-score of the ST_ELR now places leverage below historical norms, a condition that has often preceded short-term stabilization or rebounds in Bitcoin’s price. Historically, when the ST_ELR approaches its lower band, the market is exiting a liquidation phase and transitioning toward balance.

“The current decline in leveraged exposure suggests that overextended short-term traders have exited,” the report stated, adding that this cleansing effect often serves as a foundation for healthier price action in the following weeks.

Binance’s Risk Systems and Liquidity Strength

The ST_ELR metric, calculated as Open Interest ÷ Stablecoin Reserves, provides a snapshot of market leverage against available liquidity. A high ratio reflects excessive risk, while a decline indicates a more resilient trading environment.

Binance’s drop in leverage during a downtrend highlights the exchange’s robust risk management systems, which automatically curtail excessive exposure in turbulent conditions. The platform’s deep stablecoin reserves and liquidity buffers enable it to act as a stabilizing force during volatile market phases, absorbing shocks more effectively than many competitors.

Market Outlook: Stability Before the Next Move

The CryptoQuant analysis concludes that the leverage reset on Binance likely marks the end of the forced liquidation phase that drove Bitcoin’s recent volatility. With traders deleveraging and liquidity conditions improving, the environment is increasingly favorable for gradual price recovery or sideways consolidation in the short term.

As leverage resets and risk exposure normalizes, Binance continues to function as the structural core of the global crypto market, reinforcing investor confidence through transparency and liquidity depth.