Key Developments in AI Infrastructure Trading

Binance Futures is set to introduce the AIAUSDT perpetual contract for DeAgentAI (AIA) on January 20, 2026, offering users up to 20x leverage on their investments.

The upcoming contract launch positions AIA prominently within crypto trading, potentially affecting market dynamics for AI-related digital assets as anticipation builds among traders and investors.

Binance Launches AIAUSDT Futures with 20x Leverage

Binance notes that futures listings do not correlate with spot listings and warns of high volatility risks.

Immediate implications include expanded market participation and potential volatility. Trading may resume swiftly, luring diverse participants to this unique AI infrastructure project by facilitating futures and copy trading.

Market reactions remain to be fully observed due to the recent announcement. Key participants await further details from industry leaders and potential secondary effects on similar crypto projects.

DeAgentAI Sees Significant Market Surge Amidst Crypto Landscape Shifts

The AIAUSDT contract was originally planned for January 16, 2026, but was delayed, showcasing the dynamic nature of crypto futures launch strategies.

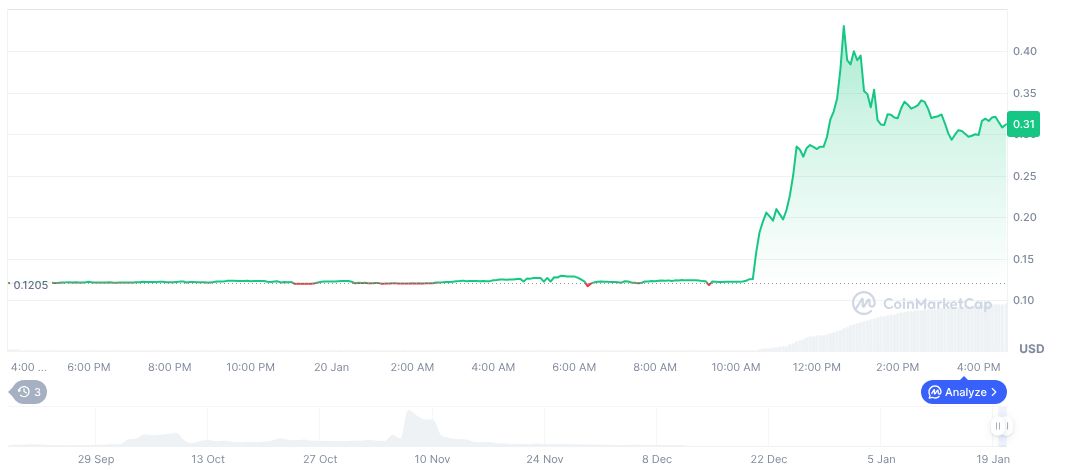

Data from CoinMarketCap highlights DeAgentAI (AIA) trading at $0.31, with a market cap totaling $45.50 million. The recent trading surge shows a 153.11% increase within 24 hours. Price fluctuations over 60 days depict contrasting trends.

Enhanced market liquidity for AI-centric projects is suggested by insights from the Coincu research team. However, future regulatory and technological shifts require careful monitoring, as the crypto landscape evolves amidst innovative contract offerings.