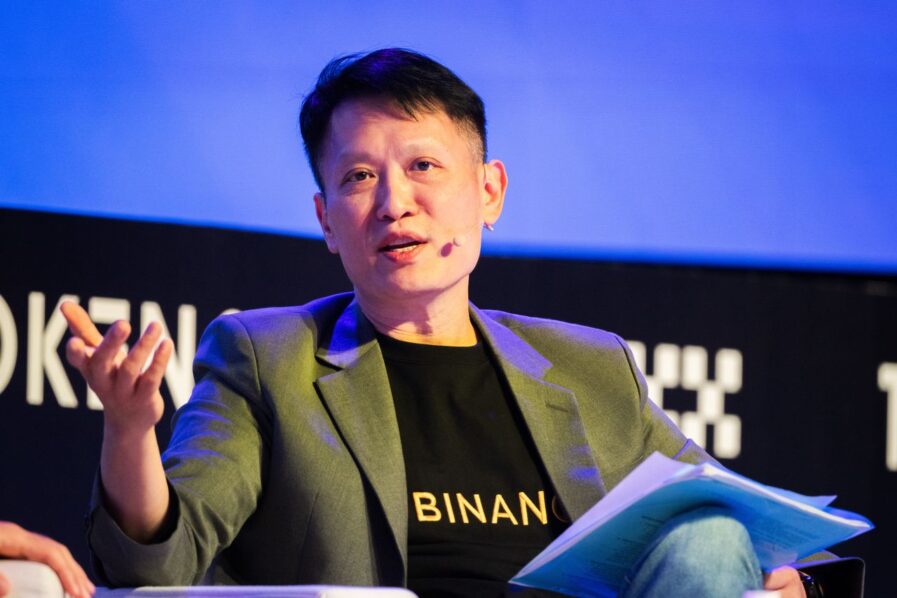

Richard Teng, chief executive of Binance, has denied claims that the exchange played any part in choosing USD1 — a stablecoin launched by the Trump family’s World Liberty Financial — for a $2 billion transaction with Abu Dhabi-based firm MGX. These comments were made in an interview reported by CNBC on Tuesday.

“The usage of USD1 for the transaction between MGX as a strategic investor into Binance, that was decided by MGX. We didn’t partake in that decision,” Teng stated, according to CNBC. The executive further clarified that Binance had no involvement in determining the settlement currency for the investment.

The MGX investment was announced in March and quickly drew political attention in Washington. This occurred after U.S. President Donald Trump granted a presidential pardon to Binance founder Changpeng “CZ” Zhao on October 23. Critics in Congress have accused the administration of favoring allies in the crypto industry through selective enforcement and political deals.

Political Fallout After CZ’s Pardon

The pardon for Zhao followed his guilty plea to U.S. charges tied to Binance’s Anti-Money Laundering violations and a $4.3 billion settlement reached last year. Trump later told CBS’s 60 Minutes that he “didn’t know who [Zhao] was,” while suggesting that the Justice Department under his predecessor had unfairly targeted him.

That explanation did little to ease concerns among lawmakers. In October, Senator Chris Murphy stated that Binance.US was “promoting Trump crypto” in the wake of the pardon, while Senator Elizabeth Warren alleged improper ties between Zhao and the Trump administration. Binance has threatened to pursue legal action over those accusations.

Questions Over Binance’s Ties to USD1

Despite Teng’s denial, a Bloomberg report in July cited three unnamed sources claiming Binance had a hand in developing parts of USD1’s codebase. At the time, Zhao indicated he was considering legal action against the outlet, describing the report as defamatory. Bloomberg maintained its reporting.

The Trump-linked stablecoin was created through World Liberty Financial, a business co-founded by Eric Trump that markets itself as “America’s financial freedom network.” Eric Trump stated earlier this year that the MGX investment in Binance would be settled using USD1, allowing the family business to benefit from transaction fees tied to the coin’s circulation.

The announcement triggered debate over conflicts of interest, with critics arguing that the use of a Trump-branded token in a multibillion-dollar investment involving a recently pardoned executive raised ethical and legal questions.

Regulatory and Market Implications

The Binance–MGX deal emerges as global regulators continue to monitor the exchange’s restructuring under Teng, who replaced Zhao last year following his resignation as part of the U.S. settlement. The exchange remains under supervision from several jurisdictions, including the United States, the United Arab Emirates, and Singapore.

While Binance’s operations have stabilized since Zhao’s exit, any perception of political entanglement could complicate efforts to regain full regulatory trust. For now, Teng’s distancing comments represent another attempt to separate Binance’s commercial activities from Trump’s growing crypto interests, though the issue shows little sign of fading from the spotlight.