Binance Alpha Facilitates Vision Token Airdrop

Binance Alpha, an initiative operated by Binance, has commenced the claims process for the Vision (VSN) airdrop on November 28. Eligible users can claim their tokens using Alpha points on a first-come, first-served basis.

This event is designed to influence the distribution of Vision (VSN) and its market liquidity. It aims to incentivize early participation through a system of decreasing Alpha point thresholds and to enhance user engagement across Binance's platform.

The urgency inherent in this event is expected to elevate user engagement and interest in Vision tokens, potentially impacting the token's initial market movements. If tokens remain unclaimed, the required points threshold will gradually decrease, which could broaden access and encourage wider participation.

Market participants are closely observing the outcome of this distribution and its effects on the availability and trading dynamics of Vision tokens.

Market participants are closely observing the outcome of this distribution and its effects on the availability and trading dynamics of Vision tokens.

Vision Token Airdrop's Market Influence

Binance Alpha's point-based airdrop strategy, a method previously employed in earlier releases, has historically resulted in brief surges in user engagement and liquidity.

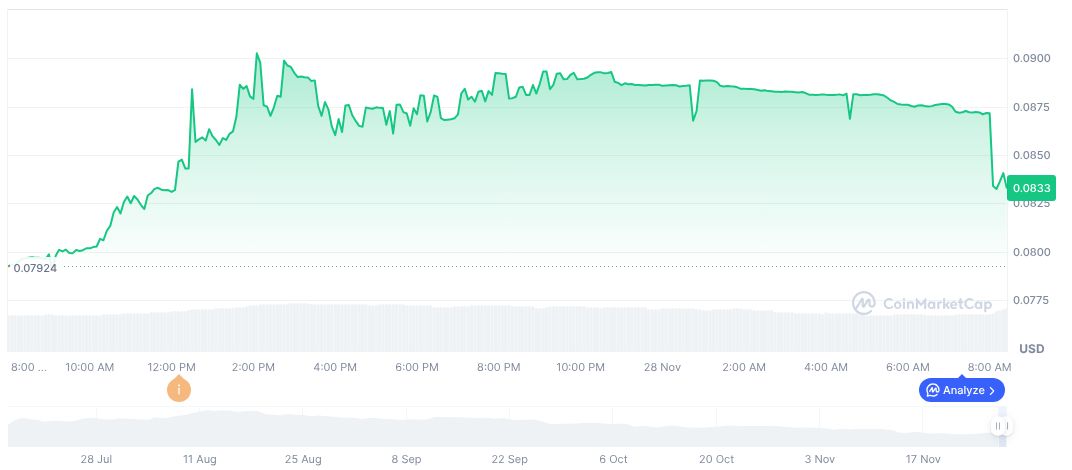

Vision (VSN) tokens are currently priced at $0.08, with a market capitalization of $286,112,925. The fully diluted market cap stands at $351,295,037. Recent data indicates a 24-hour trading volume of $22,744,555, representing a 15.39% increase. Vision's price performance shows a 5.07% rise in the last 24 hours, a 20.96% gain over the past 7 days, but a 26.03% decrease over the last 30 days, according to CoinMarketCap.

Research suggests that this airdrop may enhance market liquidity, particularly for newer tokens like Vision, by actively encouraging user interaction and generating temporary spikes in trading activities. The long-term effects on the market remain uncertain and will likely depend on market stabilization and future regulatory clarifications.