Large cryptocurrency holders are showing increased interest in Bitcoin and Ethereum. On-chain and derivatives data indicate recent surges in high-value transactions, institutional engagement, and outflows of assets from exchanges. This heightened activity is drawing attention as both Bitcoin and Ethereum rebound from recent lows, despite ongoing market volatility and policy adjustments.

Bitcoin Network Sees Surge in Whale Transactions

Analysis of the Bitcoin network reveals a notable increase in transactions involving substantial sums. Crypto analyst Ali Martinez reported that the number of Bitcoin transactions exceeding $1 million has reached 6,311, representing the highest figure in the past two months. This peak in whale transaction activity occurred approximately between October 26 and October 28, according to available data.

Whale activity on the Bitcoin $BTC network is climbing, hitting a two-month high of 6,311 transactions exceeding $1 million each. pic.twitter.com/ydym8VjJ5H

— Ali (@ali_charts) October 29, 2025

Concurrently, Bitcoin experienced a rebound from approximately $106,000 to a local peak of $116,000 before a recent correction. The asset is currently trading at $110,700, showing a 2% decrease over the last 24 hours but a minor gain over the past week. This recovery followed a recent dip below $108,000, which occurred shortly after the US Federal Reserve announced a rate cut.

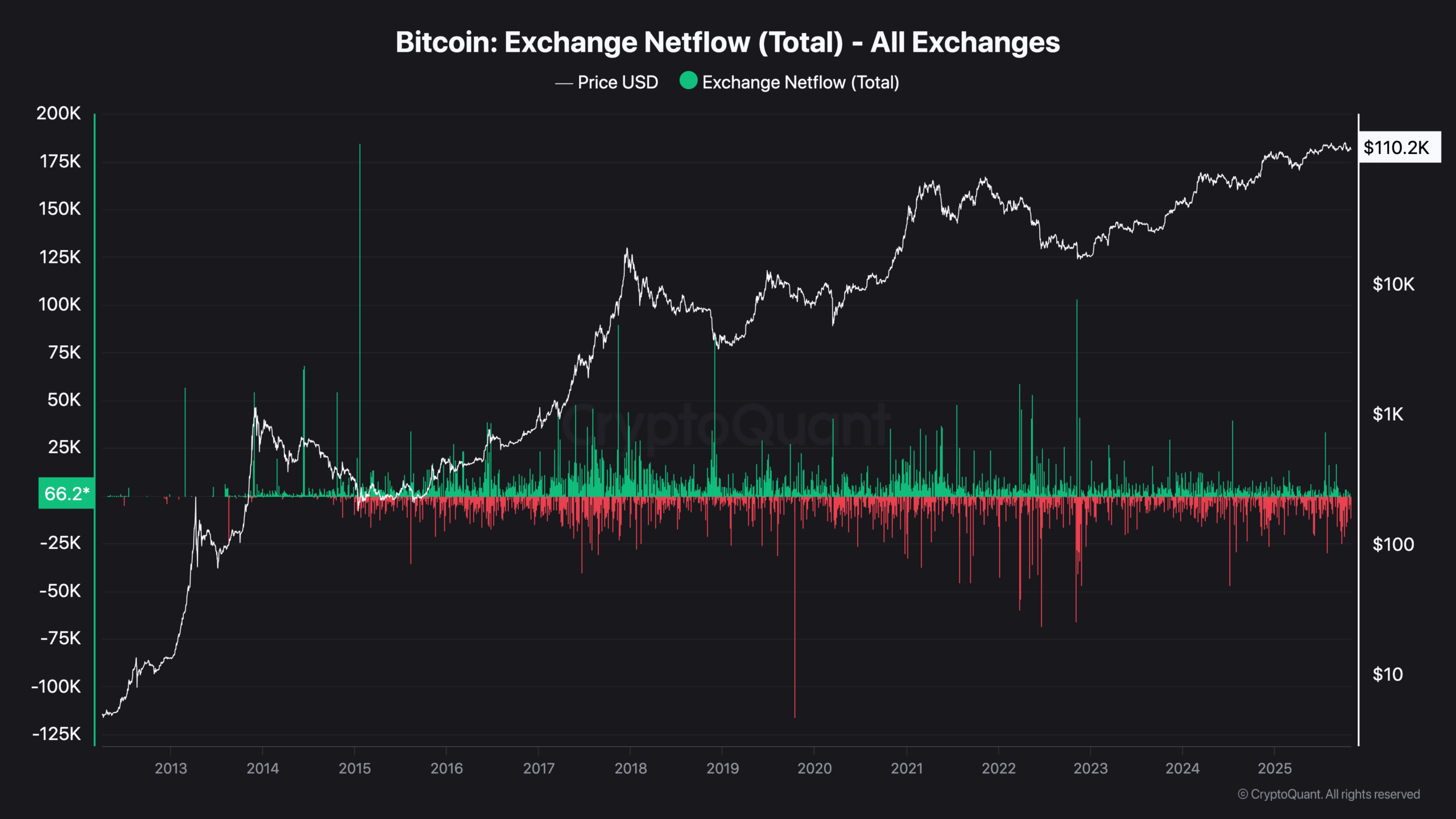

Furthermore, data from CryptoQuant confirms consistently negative Bitcoin exchange netflows throughout October. This trend indicates that more Bitcoin is being withdrawn from exchanges than deposited, suggesting a move towards holding rather than trading.

Such withdrawal patterns often signify that holders are transferring funds to cold storage, a common behavior during accumulation phases. When combined with the surge in large transactions, this data supports the notion that significant investors might be strategically repositioning their portfolios for the upcoming months.

Ethereum Sees Increased Whale Activity Amidst Growing Futures and Wallet Holdings

Ethereum is also experiencing growing institutional interest. According to data from CryptoQuant, as shared by Crypto Rover, the open interest in CME Ethereum futures has reached a record high, exceeding 2.25 million contracts. This growth is observed across various expiry periods, predominantly within the 1 to 6-month range.

BIG PLAYERS ARE COMING FOR $ETH! pic.twitter.com/RZ9RJtcEi5

— Crypto Rover (@cryptorover) October 29, 2025

This rise in open interest has coincided with a steady price recovery for Ethereum. ETH has moved from below $1,400 to a peak of $4,950 in 2025 before experiencing a pullback. At the time of this report, the asset is trading around $3,900, with a 3% decrease in the past 24 hours and a 2% increase over the last seven days.

Additional data from Alphractal indicates an increase in the number of Ethereum addresses holding more than 1,000 ETH. These substantial wallets have become more active in recent weeks. Concurrently, CryptoQuant reports that ETH reserves across all exchanges have decreased by approximately 1 million coins since the end of September.

Previous reports highlighted that institutional accumulation of Ethereum has expanded at a faster rate than Bitcoin over the past year. This trend suggests that institutional portfolios are increasing their exposure to Ethereum more rapidly than to Bitcoin.