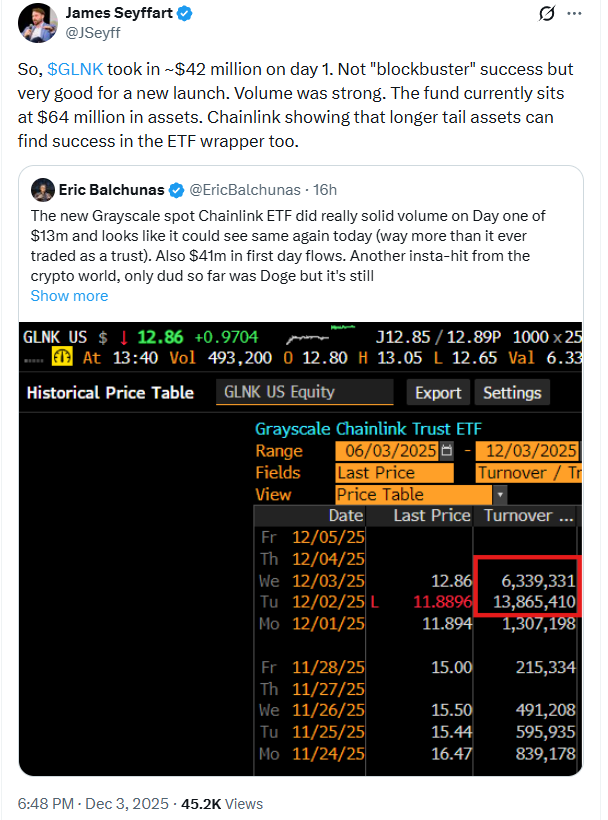

The debut of Grayscale’s $41 million Chainlink ETF signifies a notable shift in institutional investment, moving beyond speculative altcoins towards foundational crypto infrastructure. This trend highlights a growing demand for assets that secure data, liquidity, and cross-chain activity, positioning them as key players for the next market cycle.

The current market sentiment favors assets that are integral to transaction pathways, including oracles, execution layers, and robust networks for moving assets like Bitcoin and stablecoins at scale. These infrastructure components are increasingly seen as vital for bridging traditional finance with the digital asset space.

Emerging technologies are also addressing the limitations of established blockchains. Bitcoin Hyper is introducing a Layer-2 architecture that enhances Bitcoin’s speed and programmability, while PEPE NODE is innovating within the meme coin sector by integrating a mine-to-earn virtual node system and gamified elements to boost user engagement.

Chainlink, with its established role in decentralized oracles and cross-chain communication, continues to be a critical infrastructure provider. Its Decentralized Oracle Networks (DONs), Cross-Chain Interoperability Protocol (CCIP), and new Runtime Environment solidify its position for tokenization and institutional deployments across various blockchains.

Key Altcoins Aligning With the Infrastructure Thesis

Considering this infrastructure-heavy investment thesis, several altcoins stand out for their potential. These include Bitcoin Hyper ($HYPER), a high-throughput Bitcoin Layer-2 solution; PEPE NODE ($PEPENODE), a gamified mine-to-earn meme coin with node mechanics; and Chainlink ($LINK), the established oracle and interoperability layer now accessible through regulated ETF products.

1. Bitcoin Hyper ($HYPER): Enhancing Bitcoin’s Capabilities with SVM Execution

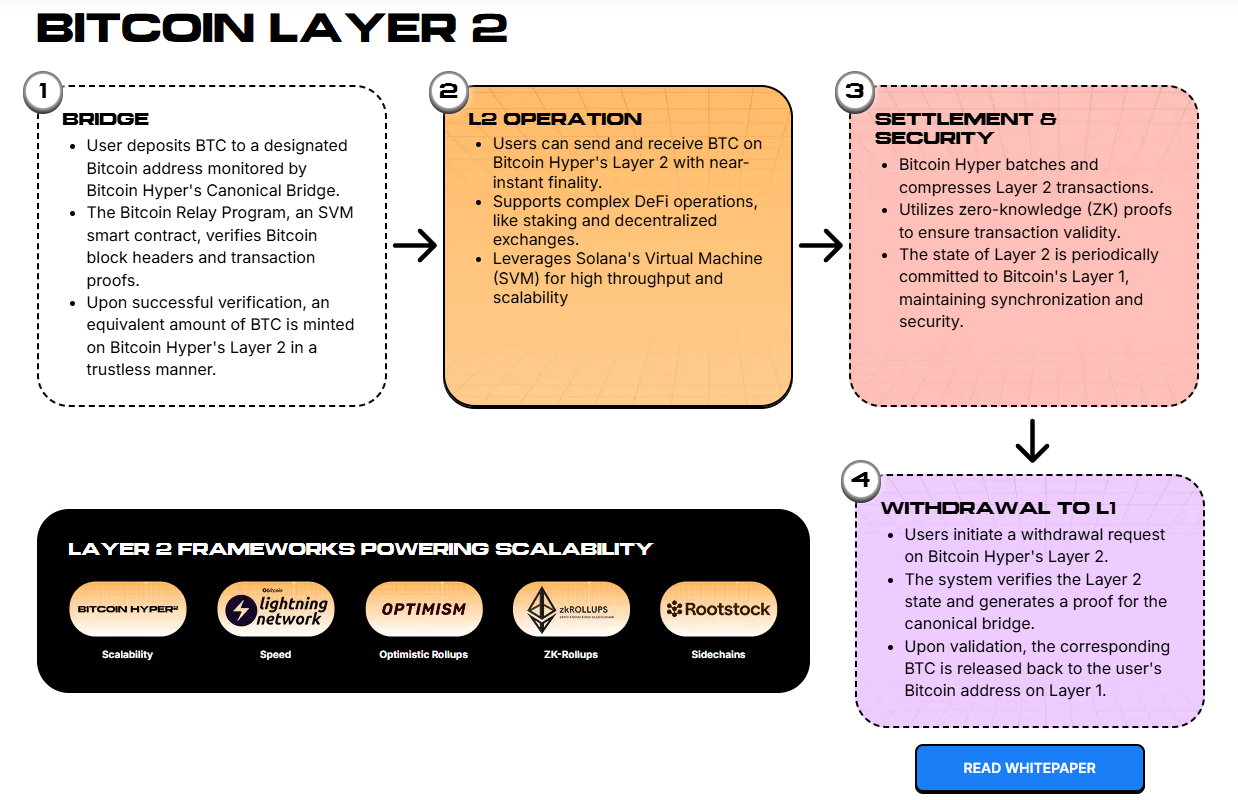

Bitcoin Hyper ($HYPER) aims to address Bitcoin’s inherent limitations in settlement speed, transaction fees during congestion, and programmability by integrating the Solana Virtual Machine (SVM). This Layer-2 solution separates responsibilities, with the Bitcoin Layer-1 handling settlement and a real-time SVM Layer-2 managing transaction execution and smart contracts.

The SVM-based execution environment is designed to offer performance comparable to Solana, featuring low-latency block production and sub-second transaction confirmations. Developers can deploy Rust-based, SPL-style contracts while maintaining security and finality anchored to Bitcoin through periodic state commitments and a decentralized canonical bridge for $BTC transfers.

For users, $HYPER promises high-speed, $BTC-denominated payments, low-fee decentralized finance (DeFi) applications such as swaps, lending, and staking, as well as non-fungible token (NFT) and gaming decentralized applications (dApps) that require rapid block times. Wrapped $BTC will be transferable on the Layer-2 with significantly reduced fees compared to native Bitcoin, facilitating micro-transactions and more capital-efficient DeFi positions for $BTC holders who wish to remain within the Bitcoin security framework.

$HYPER is currently trading at $0.013375, with staking yields at 40% APY. The project's presale has already attracted substantial interest, raising $28.9 million, indicating its appeal to early-stage infrastructure investors. Notable whale investments, including a $502.6K purchase and a $379K purchase, have been recorded.

2. PEPE NODE ($PEPENODE): A Gamified Mine-to-Earn Meme Coin Economy

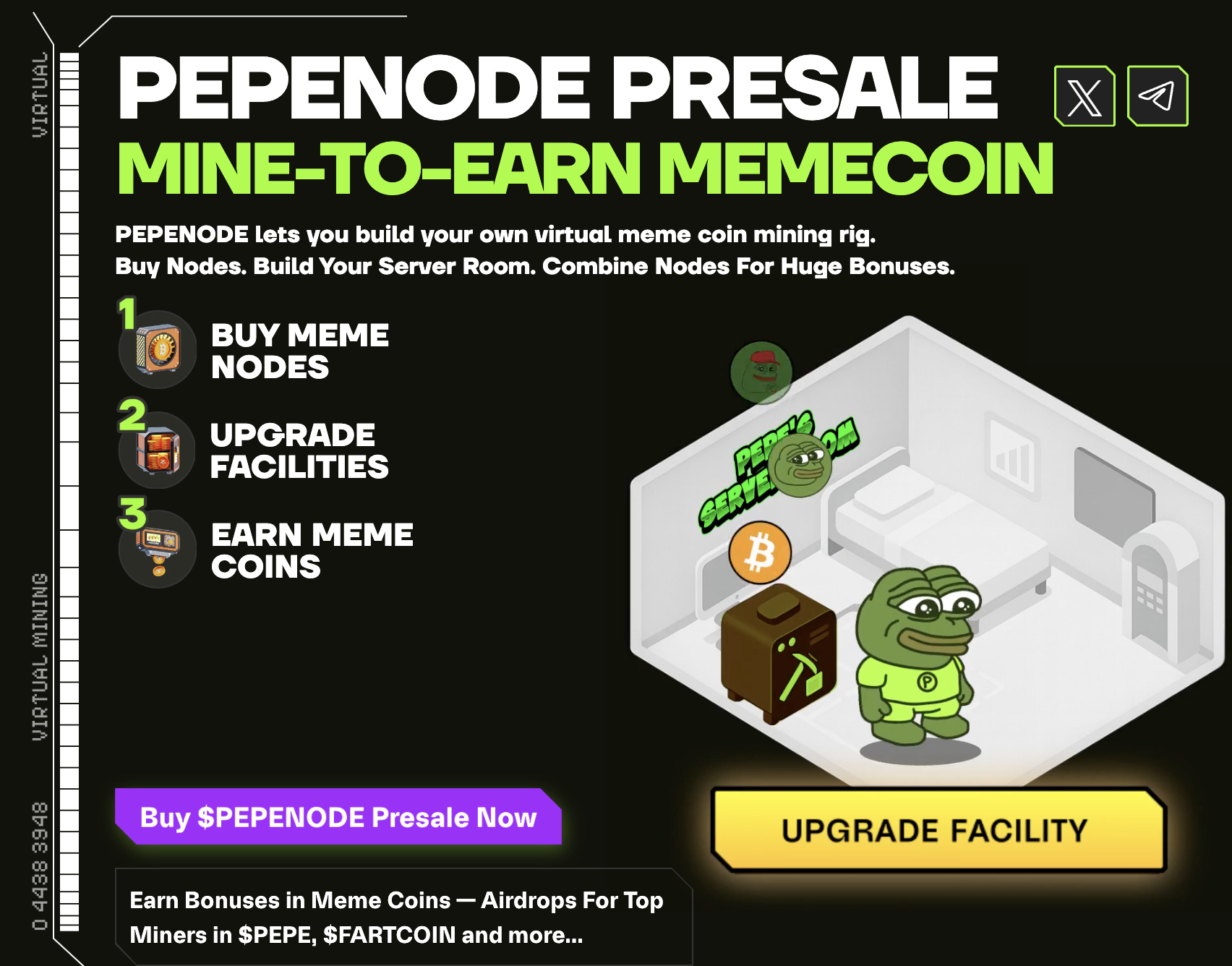

PEPE NODE ($PEPENODE) redefines the meme coin model by incorporating a crypto-mining economy, positioning itself as the first mine-to-earn meme coin. Instead of relying solely on speculative momentum, it introduces a virtual mining system where users can establish nodes that generate tiered rewards based on participation and in-ecosystem activity.

The project's gamified dashboard is central to user engagement. It provides a mining interface that simulates a node network, allowing users to unlock higher reward tiers and engage in competitive elements as they expand their virtual infrastructure. This approach fosters a more sustainable engagement loop compared to traditional meme coins that often depend on short-lived hype cycles. Additionally, PEPE NODE users can earn rewards in other popular meme coins, such as $FARTCOIN and $PEPE.

The presale for PEPE NODE has shown promising early traction, raising over $2.2 million. With tokens currently priced at $0.0011778 and staking offering a 573% APY, there is significant upside potential if the mine-to-earn mechanism gains widespread adoption among retail traders.

For investors interested in meme coin culture but seeking structural utility and gamification, PEPE NODE offers a more systematic approach to gaining exposure, moving beyond pure virality.

3. Chainlink ($LINK): The Oracle and Cross-Chain Backbone for Institutional Flows

Chainlink ($LINK) continues to be the leading decentralized oracle network, facilitating the connection of smart contracts to real-world data, foreign exchange rates, indices, and off-chain infrastructure. It plays a crucial role in securing pricing and data for on-chain derivatives, lending protocols, stablecoins, and tokenized assets, making it a key bridge between DeFi and traditional finance initiatives.

The network's Decentralized Oracle Networks (DONs) provide verified off-chain data on-chain, while its Cross-Chain Interoperability Protocol (CCIP) ensures secure messaging and value transfer between different blockchains. This cross-chain capability is increasingly vital as institutions explore multi-chain tokenization strategies and require unified, audited data and messaging layers, rather than relying on fragmented bridging solutions.

Chainlink reportedly secures over $103 billion in value across more than 2,500 projects, underscoring its position as the premier oracle provider for both DeFi protocols and traditional finance integrations. The significant demand for the first Chainlink ETF, which attracted $41 million on its first day, validates the "data backbone" narrative within regulated markets. This institutional interest is expected to positively influence spot $LINK demand on cryptocurrency exchanges.

Conclusion: Infrastructure-Centric Investment in Crypto

The strong performance of the Chainlink ETF and the subsequent focus on infrastructure highlight a maturing investment landscape in the cryptocurrency space. Bitcoin Hyper, PEPE NODE, and Chainlink each represent distinct yet complementary facets of this infrastructure-driven thesis, covering execution, user engagement, and data provision respectively.