XRP Ledger has emerged as a significant player in the cryptocurrency space, demonstrating remarkable growth in its Real World Asset (RWA) market cap and attracting institutional interest. This success highlights a broader trend towards projects focused on building robust financial infrastructure and utility.

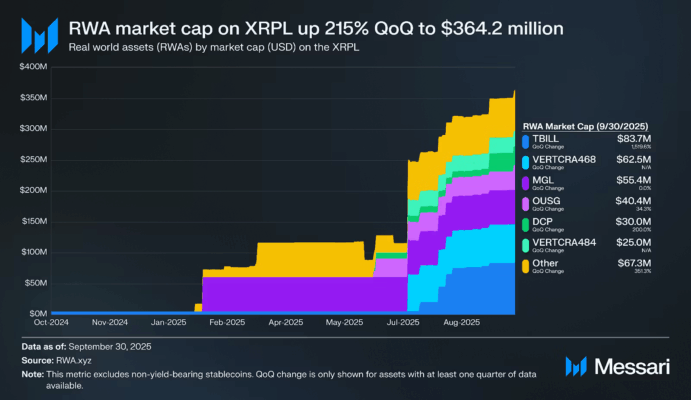

According to Messari's Q3 report, XRP Ledger experienced a substantial surge in its RWA market cap, growing by 215.3%. The platform also saw an increase in XRP's price by 27.2% and a 8.9% rise in average daily transactions. This performance positions XRP Ledger as a key protagonist in the evolving crypto landscape, moving beyond speculative assets to focus on tangible financial applications.

The growing appetite for institutional-grade infrastructure is further evidenced by partnerships like the one between Ripple and Franklin Templeton. This collaboration allows clients to exchange tokenized money market funds for Ripple's $RLUSD stablecoin, signaling a significant step for traditional asset managers engaging with blockchain technology.

The cryptocurrency market is shifting from speculative "trust me bro" tokenomics towards projects that offer practical solutions and address real-world financial problems. XRP Ledger's success serves as a testament to the maturation of the crypto industry, emphasizing the development of functional financial plumbing.

In light of this trend, several altcoins are emerging that target different facets of institutional financial infrastructure, including wallet solutions, Bitcoin Layer 2 DeFi, and cross-border remittance services. These projects offer opportunities for investors looking to capitalize on the growing demand for utility-driven crypto assets.

Best Wallet Token ($BEST) – Secure Wallet Solutions and DeFi Access

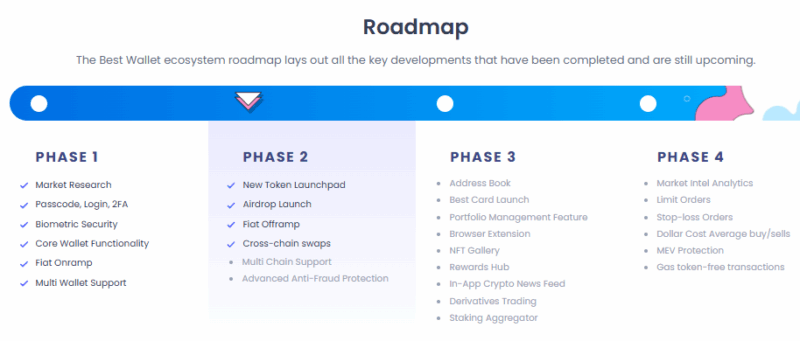

Best Wallet offers a non-custodial, multi-chain wallet solution that is already available on iOS and Android. This functional infrastructure is built using Fireblocks' MPC technology, which eliminates the need for traditional seed phrases and enhances security for institutional adoption.

The project's roadmap includes the integration of Best Card, expanding its utility beyond wallet functions to include spending solutions. This development aims to bridge the gap between cryptocurrency and everyday financial transactions.

With its token currently priced at $0.025895, $BEST has raised over $16.8 million in its presale, indicating strong investor confidence in its institutional infrastructure focus.

Bitcoin Hyper ($HYPER) – Enhancing Bitcoin with Layer 2 DeFi Capabilities

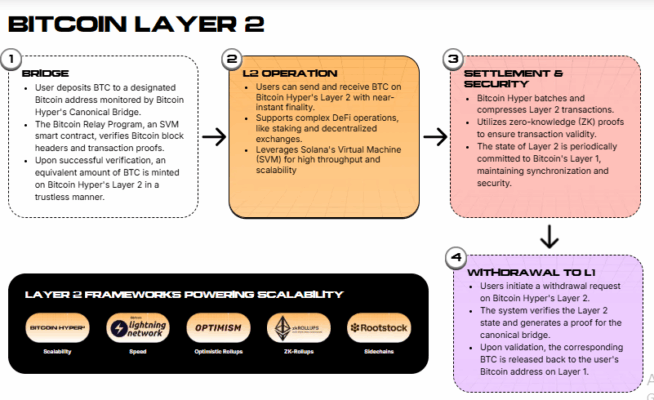

Bitcoin Hyper ($HYPER) is developing a Layer 2 solution aimed at bringing Decentralized Finance (DeFi) capabilities to the Bitcoin network. This initiative is particularly timely given the significant institutional attention on Bitcoin.

The $HYPER Layer 2 solution utilizes a Canonical Bridge and a Solana Virtual Machine to introduce smart contract compatibility and support for decentralized applications (dApps) on the Bitcoin chain. The system will operate using wrapped Bitcoin, with the ability for users to withdraw to the Layer 2 at any time for enhanced security.

The $HYPER token is central to this ecosystem, intended for use in paying fees, creating dApps, and various other functions within the network. The project has successfully raised over $25.7 million in its presale, with tokens currently priced at $0.013215.

Bitcoin Hyper targets the growing interest in Bitcoin Layer 2 solutions as institutional capital seeks yield-bearing products beyond spot ETFs. As more institutional investors explore the potential of Bitcoin beyond cold storage, projects that bridge Bitcoin with DeFi are poised for significant growth.

Large investments, including buys of $379.9K and $274K, suggest that informed investors are backing the project's potential to execute this vision for Bitcoin.

Remittix ($RTX) – Streamlining Cross-Border Payments

Remittix ($RTX) is addressing the substantial cross-border remittance market, estimated at $19 trillion, which currently incurs over $50 billion annually in fees. The project aims to provide a more efficient and cost-effective alternative to existing remittance services.

Remittix is positioning itself as a practical competitor to established players like Ripple and Stellar, focusing on the cross-border payment infrastructure that has driven the relevance of assets like $XRP. Early investors recognize the significant potential of the "PayFi" sector.

In line with regulatory considerations, Remittix has undergone a CertiK audit and features transparent tokenomics. The project also incorporates a deflationary model where transaction fees are burned, reducing the token supply over time.

With stablecoins like $RLUSD demonstrating success in institutional settlement, projects like Remittix that connect cryptocurrency with traditional banking rails are well-positioned for substantial growth.

The success story of XRP Ledger's institutional adoption provides a clear blueprint for the future of cryptocurrency. Projects like Best Wallet Token ($BEST), Bitcoin Hyper ($HYPER), and Remittix ($RTX) are focusing on building essential infrastructure, delivering tangible utility, and solving real financial problems. This approach contrasts with the speculative nature of many meme coins, suggesting a shift towards more sustainable and value-driven projects in the crypto market.

The ultimate success of these ventures will depend on their execution, but the underlying narrative of building practical, institutional-grade financial solutions is undeniably strong.