Key Points

- •Stablecoins are predicted to partially replace bank deposits, according to the Bank of Japan.

- •They are expected to play a key role in payment systems, emphasizing their global financial potential.

- •Japanese banks are actively developing yen-backed stablecoins for integration into existing financial structures.

Bank of Japan Deputy Governor Masayoshi Amamiya has stated that stablecoins could transform global payment systems, potentially replacing a portion of bank deposits. This development was reported by ChainCatcher.

The integration of stablecoins may redefine financial systems, impacting traditional banks and influencing global digital currency strategies. This signals a pivotal shift in Japan’s financial infrastructure.

Stablecoins and Blockchain Integration: A Global Shift

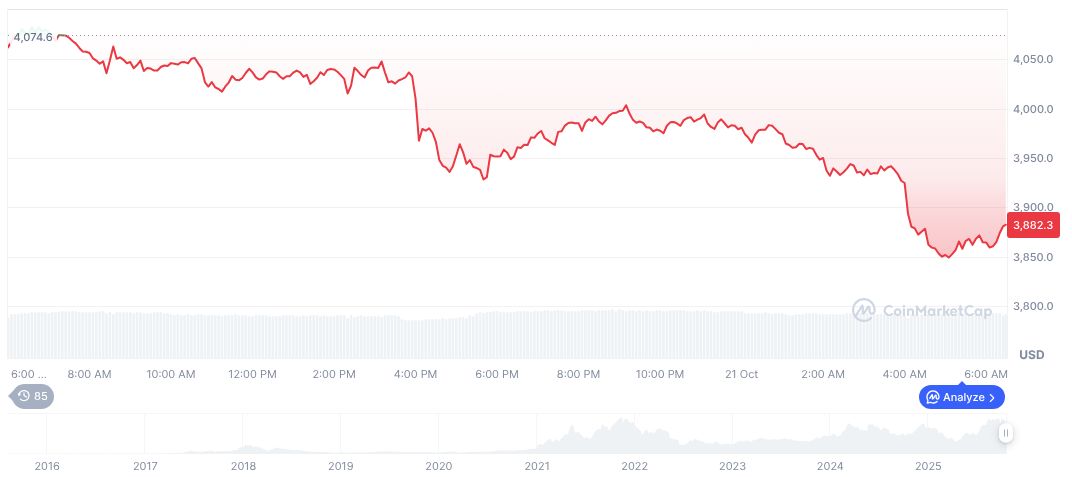

Ethereum, currently trading at $3,867.61 with a market capitalization of $466.81 billion, may see its potential significantly impacted by stablecoin adoption, especially as Japanese banks begin to utilize its underlying blockchain technology. Data from CoinMarketCap indicates a 4.26% decrease in Ethereum's value over the past 24 hours, with notable fluctuations across various timeframes. The substantial trading volume underscores Ethereum's relevance in supporting the development of stablecoins as Japan advances this technology. Experts from Coincu highlight Japan's movements in the stablecoin space as pivotal, suggesting that the establishment of clear regulatory frameworks could foster secure and compliant digital finance environments, thereby benefiting institutions worldwide.

The Bank of Japan's commitment to exploring and integrating stablecoins signifies a major shift in the financial landscape. This indicates a potential transformation in how digital currencies are incorporated into traditional banking systems.

"Stablecoins have the potential to become a key component of modern payment infrastructure," stated Ryozo Himino, Deputy Governor at the Bank of Japan.

Market Insights and Future Outlook

Did you know? Japan's initiative to utilize bank-issued stablecoins aligns with Europe's recent launch of a euro-backed stablecoin, reflecting a broader global trend toward integrating stablecoins into traditional finance.

Ethereum, trading at $3,867.61 with a market cap of $466.81 billion, shows potential impacts from stablecoin adoption as Japanese banks utilize its blockchain.

Experts from Coincu emphasize that Japan's stablecoin initiatives are pivotal. They suggest that regulatory frameworks are likely to be developed to ensure secure and compliant digital finance environments, which will benefit institutions globally.