Key Concerns Regarding Stablecoins and Bank Deposits

Bank of America CEO Brian Moynihan issued a significant warning on January 15th, indicating that up to $6 trillion in deposits could shift from traditional banks to stablecoins if the U.S. Congress does not implement restrictions. This potential outflow highlights the profound impact that stablecoin models could have on the deposit base of traditional banking institutions.

Moynihan's concerns have ignited a vigorous debate surrounding the regulation of stablecoins, particularly focusing on measures needed to protect the stability of commercial banks' deposit bases. The comparison of stablecoins to money market funds underscores the perceived risk to traditional banking models.

Moynihan Details the $6 Trillion Stablecoin Risk

Bank of America's CEO, Brian Moynihan, has articulated the potential consequences of interest-bearing stablecoins on the U.S. commercial banking sector. Moynihan estimated that without regulatory intervention, as much as $6 trillion in deposits could migrate to stablecoins. This significant shift could profoundly impact the existing deposit structures of traditional banks. He drew a parallel between stablecoins and money market mutual funds, noting that funds held in money market instruments are not typically used to finance bank loans, unlike traditional deposits.

The legislative environment is evolving, with proposals such as the CLARITY Act aiming to address these concerns. This proposed legislation seeks to prevent the offering of rewards on idle stablecoin holdings, while permitting rewards for activities like staking. The overarching goal of such measures is to protect the traditional banking sector from potential disruptions. Stablecoins exert pressure on established banking models and their deposit bases, prompting Moynihan's call for robust regulatory frameworks designed to maintain financial stability.

The discussion surrounding stablecoins has elicited diverse reactions from industry participants and policymakers. While some experts advocate for the responsible development and integration of stablecoins into the financial ecosystem, others have expressed significant apprehension. Policymakers are actively considering the need for further legislative actions to address these evolving financial instruments. Brian Moynihan's statement, "if it becomes a problem, it’s hard to put the genie back in the bottle," effectively conveys the sense of urgency felt by many banking leaders regarding this issue.

Historical Parallels: Stablecoins and Money Market Funds

The comparison between stablecoins and money market mutual funds is informed by historical banking events. Past instances of significant outflows from money market funds have historically led to contractions in the banking system, illustrating the potential systemic impact of such fund movements on today's financial landscape.

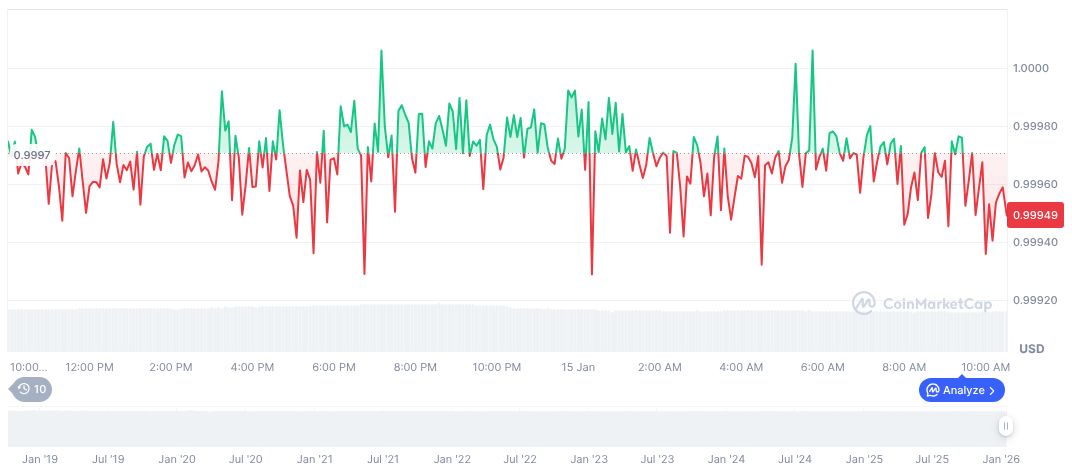

As of January 15, 2026, USDC was trading at $1.00. Its market capitalization stood at $75.66 billion, representing 2.31% of the total crypto market dominance. Over the preceding 24 hours, trading volume reached $19.18 billion, marking a decrease of 6.17%. In the sixty days leading up to this date, USDC experienced a gradual price decline of 3.59%, according to CoinMarketCap data.

Analysts at Coincu project that the banking sector may face considerable challenges stemming from stablecoins drawing liquidity away from traditional banks. The legislative actions proposed by the CLARITY Act could lay the foundation for future financial technology models, potentially influencing how liquidity is managed and banking stability is preserved.