Aster (ASTER) has distinguished itself as one of the few altcoins demonstrating resilience during a broad market pullback. As of the latest reporting, Aster is trading at $1.24, marking a 3% increase over the past day and an 11.94% rise over the past week. This performance stands in stark contrast to the losses experienced across major cryptocurrencies.

A recent listing on SWFT Blockchain’s Bridgers further enhanced the token's appeal. This integration with the BNB Chain has led to faster ASTER transfers on the network, with reduced fees and increased speed benefiting traders engaged in cross-chain transactions.

Aster Captures Attention with Major Trading Event

The introduction of an intensive trading competition by Aster has further amplified interest in the token. The event offers $10 million in prizes, representing the project's largest competition of its kind to date. Such high-value competitions typically elicit a rapid response from trading enthusiasts and have generated significant discussion within crypto communities.

The current price action supports a bullish outlook. Following its breakout above a key resistance level, ASTER has successfully maintained its position above this threshold, with buyers actively supporting the token during intraday pullbacks. This stability is crucial in mitigating the risk of sharp reversals, even amidst broader market weakness.

Technical Indicators Signal a Strengthening Trend

Prior to a recent shift in momentum, the cryptocurrency was consolidating on the 4-hour timeframe. Characterized by small candlestick bodies and low volatility, this indicated a fragile equilibrium between sellers and buyers. The token's proximity to short-term Exponential Moving Averages (EMAs) suggested a neutral setup.

Subsequently, the EMAs have shown an upward trend, signaling an improvement in short-term sentiment. The 200 EMA, positioned at $1.190, continues to serve as strong support, indicating ongoing market backing for higher prices.

Technical indicators further corroborate this positive shift. The MACD line has risen to 0.039, with the signal line at 0.030, forming a bullish crossover pattern. The histogram, near 0.009, indicates sustained buying interest.

If the support range between $1.19 and $1.20 holds, a bullish bias is likely to persist for ASTER. Further establishment of a higher low would reinforce this structure and confirm the prevailing trend. Conversely, a move below the EMA cluster, particularly below $1.19, would suggest weakening momentum.

The coming days will be critical for ASTER's medium-term outlook. For a new bull attempt to materialize, the market must achieve a daily close above $1.28. Breaking this level would provide additional momentum to overcome strong resistance in the $1.50-$1.59 area.

Trading Activity and Market Data

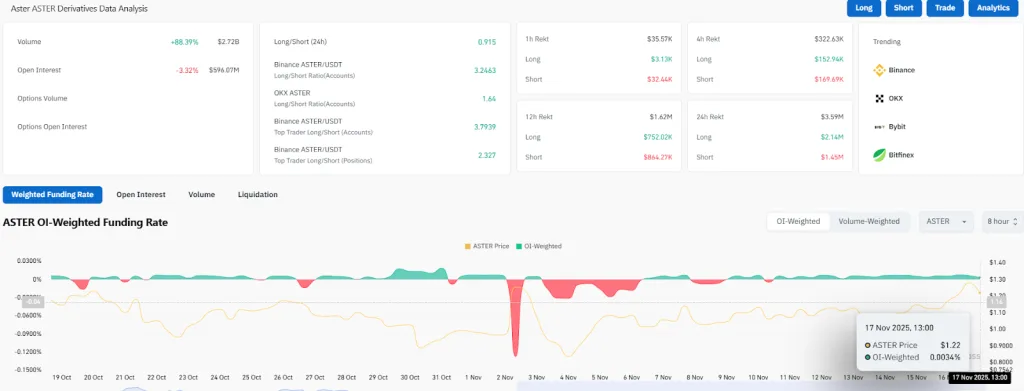

Data from CoinGlass reveals significant shifts in trading participation. Trading volume has surged by 88.39% to $2.72 billion, indicating robust engagement. Open interest has decreased by 3.32% to $596.07 million, suggesting a reduction in leveraged positions. The OI-weighted funding rate stands at 0.0034. Total liquidations over the past 24 hours reached $3.59 million, comprising $2.14 million in long positions and $1.45 million in short positions.

Addressing Token Unlock Concerns

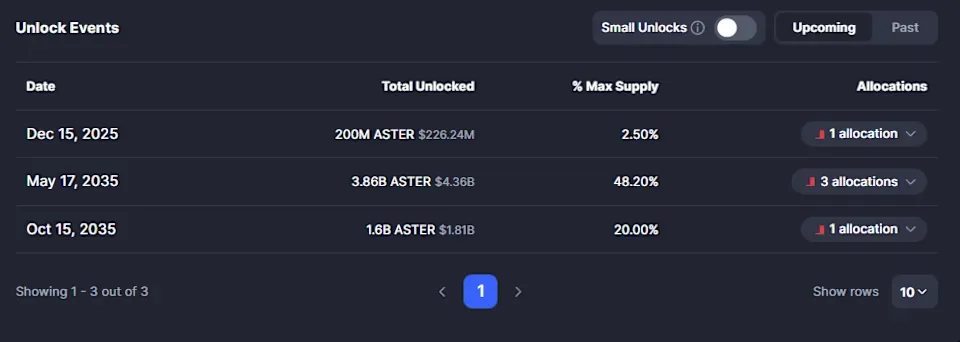

Amidst these market fluctuations, Aster has also addressed community concerns regarding discrepancies in token unlock data displayed on CoinMarketCap compared to earlier presentations. The listing indicated a 200 million ASTER unlock scheduled for December 15, 2025, and a further 5.46 billion release planned for 2035. These figures prompted inquiries regarding supply conditions.

Aster's recent performance has coincided with news concerning its unlocking schedules and supply transparency. The clarification of planned unlocks provided a temporary reprieve from potential supply pressure. This information was considered vital for traders who closely monitor vesting schedules, especially during turbulent market periods.

Increased activity across the Aster DEX ecosystem has also contributed to the token's performance. This surge in user engagement with existing features has helped sustain liquidity.

Aster remains under close market scrutiny during the current economic climate. Traders are observing whether the token can maintain its upward momentum as market stress persists.