The price of ASTER experienced a significant decline, dropping by over 20%. This downturn has resulted in substantial unrealized profits for a prominent trader who has taken a short position on the token. This trader, identified as an "anti-CZ whale," has reportedly accumulated approximately $19 million in unrealized profits from their ASTER shorts alone, with their overall unrealized gains across multiple short positions approaching $100 million.

This contrarian bet was initiated shortly after Binance co-founder Changpeng Zhao, widely known as CZ, announced his purchase of over 2 million ASTER tokens on November 2. The whale's decision to short the token against CZ's bullish move has proven to be highly profitable.

Full disclosure. I just bought some Aster today, using my own money, on @Binance.

I am not a trader. I buy and hold. pic.twitter.com/wvmBwaXbKD

— CZ 🔶 BNB (@cz_binance) November 2, 2025

The broader cryptocurrency market has also seen a downturn, with a general decrease of about 3% in the past 24 hours. This market-wide sell-off has exacerbated losses across major altcoins. Dogecoin (DOGE) has dropped 6%, Pepe (PEPE) has fallen 10%, Ethereum (ETH) is down 6%, and XRP has declined by 6.5%, indicating rising selling pressure.

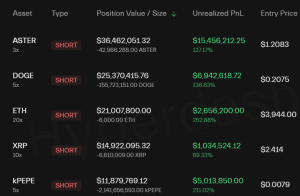

Data from Hyperdash indicates that the whale is currently holding unrealized profits exceeding $19 million across two wallets specifically from their ASTER short positions. This figure is a slight decrease from the over $21 million reported earlier by Lookonchain on the social media platform X.

Whale Expands Short Positions to DOGE, ETH, XRP, and PEPE

With technical indicators flashing bearish signals for ASTER, the anti-CZ whale has strategically expanded their shorting strategy to include other prominent cryptocurrencies. The trader has now initiated short positions on Dogecoin (DOGE), Ethereum (ETH), XRP, and Pepe (PEPE).

The whale is currently sitting on substantial unrealized profits from these new positions. Their DOGE short is yielding over $6.9 million in unrealized gains, while their ETH short has generated more than $2.65 million. Additionally, the XRP short has brought in over $1 million, and the PEPE short has accumulated more than $5 million in unrealized profits.

Furthermore, the whale is also holding an unrealized profit of over $4.2 million on a DOGE short position executed through another of their wallets. These combined trades, influenced by recent market movements, have pushed the trader’s total collective profit close to the $100 million mark.

ASTER Faces Continued Downside Risk

The recent 24-hour correction in ASTER's price has reversed its performance over the past week, pushing it back into negative territory. What appeared to be a temporary pause in the bearish trend that ASTER had been experiencing over the last month now seems to have been a failed bullish attempt, likely due to the broader cryptocurrency market correction.

Consequently, ASTER has seen a decline of more than 59% over the past month. Technical indicators on the altcoin's daily chart suggest that ASTER's price remains at risk of further declines.

From a momentum perspective, bears appear to have a stronger influence than bulls. This is indicated by the 9 Exponential Moving Average (EMA) being positioned below the longer 20 EMA. As the gap between these two EMAs widens, a significant bearish technical flag is on the verge of being triggered by the Moving Average Convergence Divergence (MACD) indicator.

In the last 24 hours, the MACD line has trended downwards towards the MACD Signal line. A potential crossover below the signal line could signal a continuation of the bearish trend.

Meanwhile, the Relative Strength Index (RSI) is currently around 40, which suggests that sellers are currently exerting more pressure than buyers. The negative slope of the RSI line indicates that sellers are unlikely to ease their pressure on ASTER's price in the near future. They may continue to drive the price lower until the RSI approaches the 30 level.