Bitcoin experienced a significant price drop yesterday, reaching its lowest point in nearly five months at just under $99,000. Many altcoins followed this downward trend, with Ethereum (ETH) turning negative for the year. However, some altcoins have since shown impressive gains, notably ASTER and HYPE.

BTC Bounces Above $100K

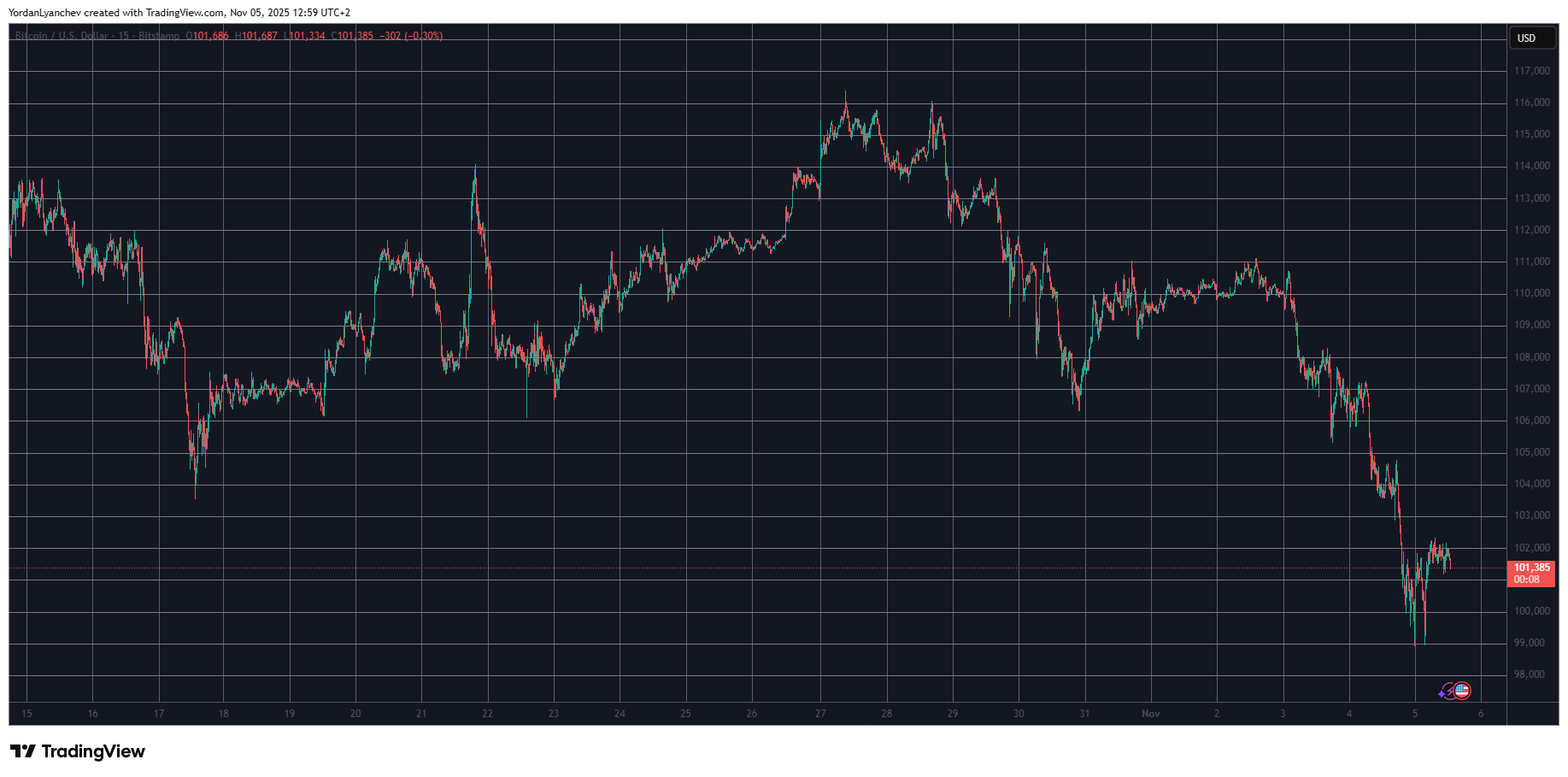

Just one week ago, Bitcoin was challenging the $116,000 resistance level. After failing to break through this resistance on multiple occasions, the asset began to decline, falling below $107,000 following the US Federal Reserve's interest rate cut. By the weekend, Bitcoin had recovered some ground, trading between $110,000 and $111,000. The situation worsened on Monday when BTC plummeted to $104,000. After a minor recovery later that day, another substantial drop occurred on Tuesday. The most significant decline took place yesterday evening, pushing Bitcoin below $100,000 and reaching a low of just under $99,000.

This price level marked the lowest point for Bitcoin since mid-June. The sharp decline led analysts to speculate about the potential start of a bear market. However, bulls intervened at this critical juncture, helping Bitcoin rebound slightly to just over $101,000 as of press time. Despite the rebound, Bitcoin's market capitalization has significantly decreased, now standing at $2.020 trillion according to CG. Its dominance over altcoins, however, has increased to 58.6%.

HYPE, ASTER on the Rebound

Altcoins also suffered significantly yesterday, including Ethereum, the leading altcoin. ETH dropped from $3,900 on Sunday to under $3,200 on Tuesday evening, effectively erasing all its gains for the year 2025. While ETH has approached $3,300 on a daily basis, it remains the worst-performing larger-cap altcoin.

Other cryptocurrencies such as XRP, BNB, SOL, DOGE, ADA, LINK, BCH, and XLM are also trading in negative territory. In contrast, HYPE, ASTER, and BGB have recorded gains of 6-7% overnight. The total market capitalization of all crypto assets experienced a substantial decline, dropping by over $400 billion from its peak to its trough within a two-day period. As of press time, it has rebounded to $3.450 trillion.