Key Regulatory Adjustments for Digital Assets

The Australian Securities and Investments Commission (ASIC) has introduced exemptions allowing intermediaries to distribute stablecoins and wrapped tokens without requiring additional licenses. This regulatory change is designed to foster growth in the digital asset sector by reducing operational barriers.

These measures aim to boost innovation in Australia's digital finance space while ensuring investor protections are maintained through stringent record-keeping and reserve standards.

ASIC's Policy Eases Financial Burdens for Crypto Intermediaries

ASIC's class order exemptions permit intermediaries to distribute stablecoins and wrapped tokens without the need for separate licenses. Licensed entities can now engage more freely in these activities under specified record-keeping conditions. These measures are part of a broader initiative to enhance innovation and competition within the digital asset market. The changes eliminate the requirement for a separate Australian Financial Services license, thereby reducing financial burdens for companies operating in this space.

Intermediaries are now able to utilize omnibus or aggregated trust accounts, which eases both the financial and administrative load. Previously, intermediaries faced significant costs associated with licensing requirements. By removing these barriers, ASIC is encouraging more active participation in the digital marketplace and supporting the seamless integration of stablecoins into Australia’s financial ecosystem.

"We are providing interim regulatory relief to support innovation while maintaining investor protections. This decision allows licensed intermediaries to facilitate access to digital assets while ensuring appropriate oversight." - Joe Longo, Chair, Australian Securities and Investments Commission (ASIC)

While ASIC has not made direct social media announcements regarding this policy, industry insiders and platforms have acknowledged the positive implications of these changes. Local cryptocurrency exchanges have pointed to enhanced operational capacity and a renewed focus on regulatory compliance.

Market Context and Potential Ripple Effects

ASIC's current exemption strategies bear similarities to policies implemented by the EU's MiCA, both of which target stability and compliance in digital markets.

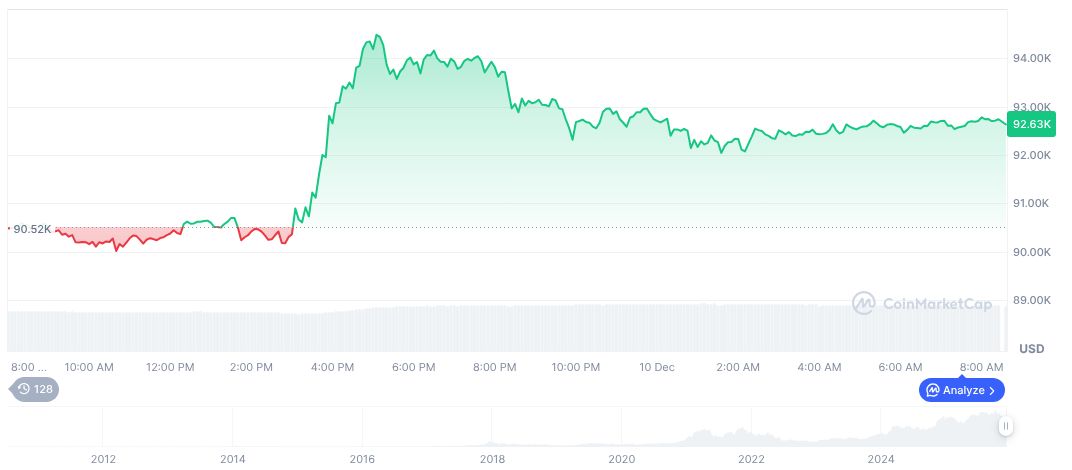

According to CoinMarketCap data, Bitcoin (BTC) is currently priced at $90,231.81, with a market capitalization of $1.80 trillion. This reflects a decline of 2.57% in the last 24 hours and 21.79% over the past 90 days. The trading volume has reached approximately $70.43 billion, indicating substantial market activity. The circulation stands at 19.96 million out of a maximum supply of 21 million.

Coincu research analysts suggest that ASIC's decisions could lead to greater collaborative efforts and innovations within the tech sector. These policy changes may also signal increased institutional involvement due to enhanced regulatory clarity, potentially boosting the sector's growth trajectory.