Key Takeaways

- •Arthur Hayes has cautioned about valuation compression risks for HYPE in the competitive Perp DEX market.

- •HYPE's valuation is under pressure despite its revenue approaching historical peaks.

- •Other DEX tokens are also facing similar market challenges and competitive pressures.

Market Concerns Highlighted

On October 21st, BitMEX co-founder Arthur Hayes took to social media to voice concerns about the potential for valuation compression affecting HYPE. This situation arises from the increasing competition within the decentralized perpetual contract exchanges sector, a development that has captured industry-wide attention.

This scenario emphasizes the growing challenges for HYPE and comparable tokens to sustain competitive valuations. Speculators are increasingly demanding clearer indicators of future revenue growth before committing capital.

Revenue Trends vs. Valuation Decrease

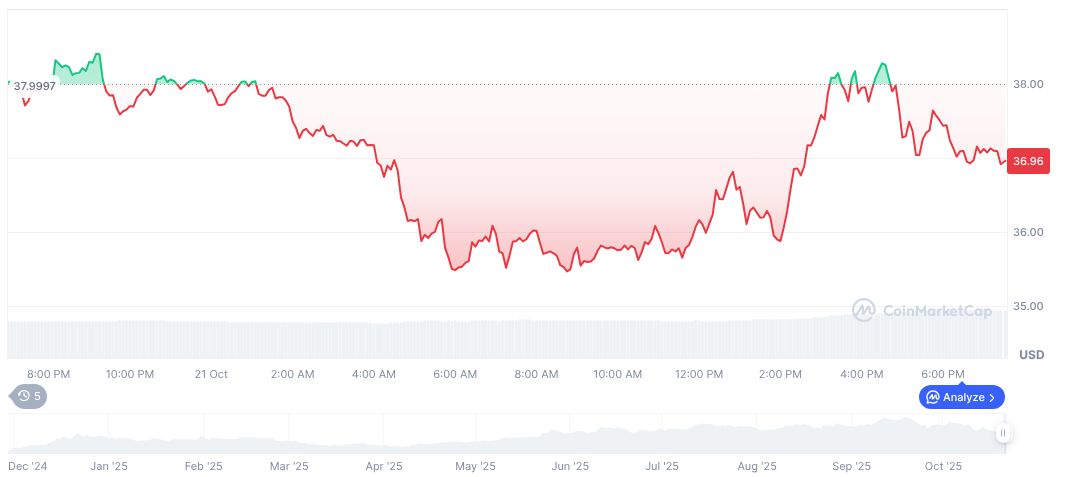

Arthur Hayes specifically addressed what he perceives as a significant valuation risk for HYPE. He pointed out the token's declining price trajectory, even as its annual revenues are nearing their historical highs. This divergence is occurring within a market characterized by a notable rise in competition among decentralized perpetual exchanges.

As HYPE's valuation faces increasing pressure, investors appear hesitant to assign a high premium for revenue streams with uncertain future prospects. This trend could potentially extend to other similar tokens in the market, influencing their own valuation models.

Arthur Hayes, Co-founder of BitMEX and CIO of Maelstrom, observed that HYPE is experiencing "valuation multiple compression due to increased competition," indicating potential future challenges for HYPE and similar tokens.

Numerous market participants, including seasoned industry experts, share Hayes's concerns. Market analysts are observing that the environment for tokens like HYPE has become intensely competitive, necessitating careful consideration from speculators when making investment decisions in such a volatile market.

Competitive Pressures Impact HYPE's Market Standing

The native token of Hyperliquid, HYPE, is currently trading at $36.97 with a market capitalization of $12.45 billion. Over the past 30 days, the token has experienced a decline of 28.51%, signaling a cautious sentiment among investors.

Market analysis suggests that the escalating competition within the Perpetual Decentralized Exchange (Perp DEX) sector could serve as a catalyst for innovation. Anticipated regulatory developments and technological advancements are expected to play a significant role in shaping the future landscape. Investors remain vigilant about potential market shifts that could affect the trajectories of HYPE and comparable tokens.

DISCLAIMER: The information provided on this website serves as general market commentary and does not constitute investment advice. Investors are encouraged to conduct their own thorough research before making any investment decisions.