Arthur Hayes, co-founder of BitMEX and CIO of Maelstrom, has garnered significant attention from the crypto community with his recent pronouncements. He has issued strong criticism of Japan’s fiscal stimulus measures and reiterated his prediction of Bitcoin reaching $1 million.

Hayes is forecasting a potential collapse of the Japanese yen, with the exchange rate possibly reaching ¥200 per USD. Concurrently, he maintains his projection that Bitcoin could surge to $1 million, framing these views as part of a broader narrative contrasting the instability of fiat currencies with the principles of decentralized money.

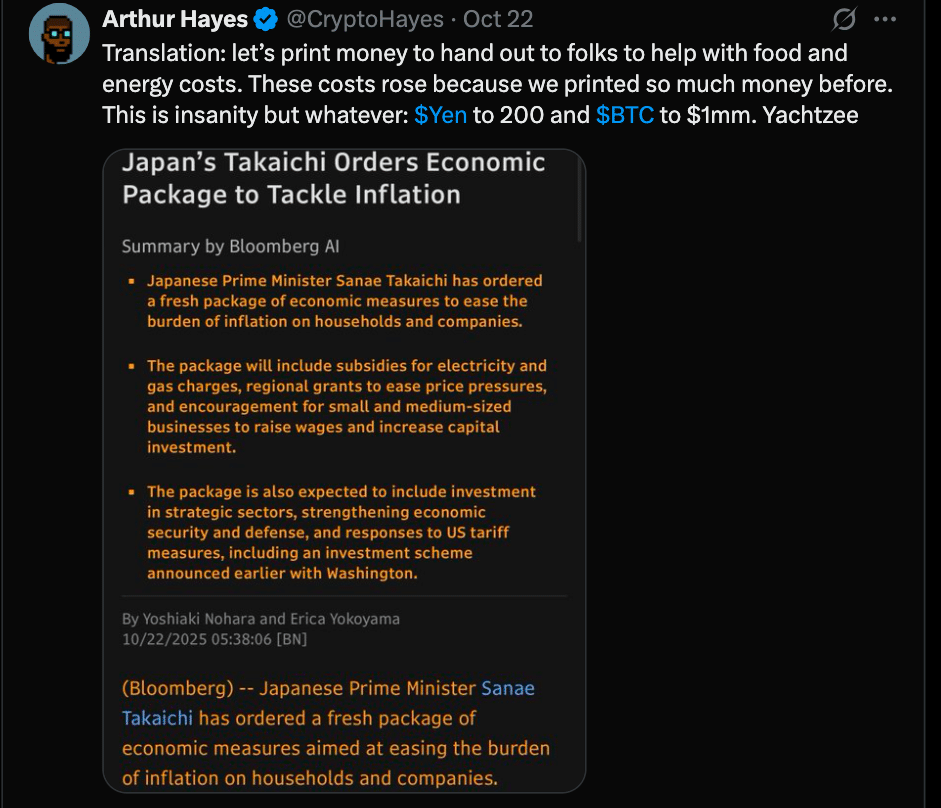

These comments from Hayes emerge shortly after Japan announced new stimulus measures, spearheaded by Prime Minister Sanae Takaichi, aimed at combating inflation.

Hayes’s Critique of Japan’s Stimulus and Fiat Monetary Policy

Hayes’s commentary specifically targets Japan’s latest stimulus package, which encompasses subsidies for energy costs, incentives for wage increases, and funding for local development projects. He describes these measures as politically expedient but economically unsound. In a post on X, he stated:

“Translation: let’s print money and hand it out to folks to help with food and energy costs. These costs rose because we printed so much money before. This is insanity but whatever: $Yen to 200 and $BTC to $1mm.”

According to Hayes’s perspective, the repeated act of printing money diminishes the credibility of fiat currencies and creates the conditions for a significant depreciation of the yen. He views the stimulus as a manifestation of chronic monetary overreach rather than a sustainable short-term solution. Consequently, his projected collapse of the Japanese yen serves as both a forecast and a warning.

The Yen at Crossroads: Economic and Policy Pressures

The Japanese yen has been experiencing sustained downward pressure. Market analysts attribute the yen’s weakness to a combination of structural and cyclical economic factors. Firstly, persistent inflation in essential imports such as food and energy exacerbates Japan’s exposure to external price fluctuations.

Secondly, the Bank of Japan (BOJ) maintains a dovish monetary policy stance, characterized by ultra-loose measures. This approach results in less favorable yield differentials for holding yen compared to other currencies.

Furthermore, global capital flows tend to favor economies offering higher yields or exhibiting more dynamic growth, particularly during periods of market optimism (risk-on). Japan’s profile of slow economic growth renders it vulnerable in such environments.

In essence, Hayes’s forecast of a Japanese yen collapse is predicated on these underlying economic stresses, which he believes are amplified by what he perceives as the reckless nature of the current fiscal stimulus package.

Linking Yen Collapse to Bitcoin’s Long Term Rise

Hayes’s projection of Bitcoin reaching $1 million is intrinsically linked to his outlook on the yen. He posits that as fiat currencies lose their credibility and value erodes, decentralized digital currencies like Bitcoin emerge as a safe haven asset. In his analysis, continuous monetary expansion inevitably leads to inflation, prompting capital to flow into assets outside the traditional financial system.

Hayes argues that Bitcoin’s potential rise is a direct consequence of the risk associated with fiat currency collapse. While his forecast may appear extreme, it is not unprecedented within cryptocurrency circles. Large-scale bullish scenarios for Bitcoin often rely on assumptions of monetary system failure or currency debasement.

Hayes appears to be using Japan as a practical case study to test this theory. The underlying assumption is that a breakdown in fiat currencies will lead to a corresponding surge in the value of digital alternatives.

Market Reception, Risks and Counterpoints

Hayes’s bold prediction has generated both considerable attention and significant skepticism. While market participants may find his rhetoric compelling, many consider a yen valuation of ¥200 per USD or a Bitcoin price of $1 million to be exceedingly ambitious. It is possible that central banks could adjust their policies before a complete collapse occurs, and any depreciation of the yen beyond certain thresholds would likely prompt sharp intervention.

Moreover, Bitcoin’s trajectory is influenced not solely by macroeconomic narratives but also by factors such as widespread adoption, regulatory developments, and the overall health of its ecosystem.

Critics contend that forecasting an inevitable collapse overlooks the potential for policy adjustments, the interconnectedness of the global economy, and the dynamics of capital flows. The narrative of a Japanese yen collapse is persuasive, but the practical realization of macroeconomic scenarios is seldom a linear progression.

Conclusion

Arthur Hayes’s recent commentary places Japan’s monetary policy and the future of the yen at the core of a significant thesis: that current stimulus measures will precipitate a yen collapse and propel Bitcoin to $1 million. While his narrative connects these events within a framework of fiat currency decay, the path from critique to outcome is fraught with countervailing economic forces.

Nevertheless, Hayes’s voice amplifies a prevailing sentiment within the cryptocurrency space that traditional monetary systems lack inherent stability. As market dynamics and policy decisions intersect, the forecast of a Japanese yen collapse will undoubtedly be tested by evolving currency dynamics and Bitcoin’s inherent resilience.

Glossary

Stimulus package: Government spending or subsidies intended to stimulate consumption or economic growth.

Fiat currency: A government-issued currency that is not backed by a physical commodity but relies on the backing of the issuing state and its monetary policy.

Dovish monetary policy: A stance by a central bank favoring lower interest rates and increased liquidity to encourage economic growth.

Capital outflow: The movement of financial assets or money out of a particular economy or currency into other financial systems or assets.

Bitcoin as a hedge: The concept of Bitcoin serving as a store of value or a safe haven asset against the devaluation of fiat currencies.

Frequently Asked Questions About Arthur Hayes Japan Yen Collapse Forecast

Did Hayes literally mean the yen will go to 200?

Yes, Hayes explicitly stated "$Yen to 200" in his post, indicating it as a potential outcome resulting from continuous monetary expansion.

Is $1 million BTC possible under some scenarios?

While $1 million per Bitcoin is an extreme valuation by current standards, it becomes a plausible target within certain theoretical models that assume significant fiat currency debasement.

Will Japan intervene before such collapse?

This represents a counterargument to Hayes’s thesis. Central banks typically react to significant exchange rate volatility; therefore, intervention by the Bank of Japan is a possible factor that could moderate any extreme depreciation.

Does this mean Bitcoin will automatically go up?

Not necessarily. Bitcoin’s price appreciation is influenced by a multitude of factors, including demand, adoption rates, regulatory frameworks, and infrastructure development, in addition to macroeconomic narratives.