Key Insights

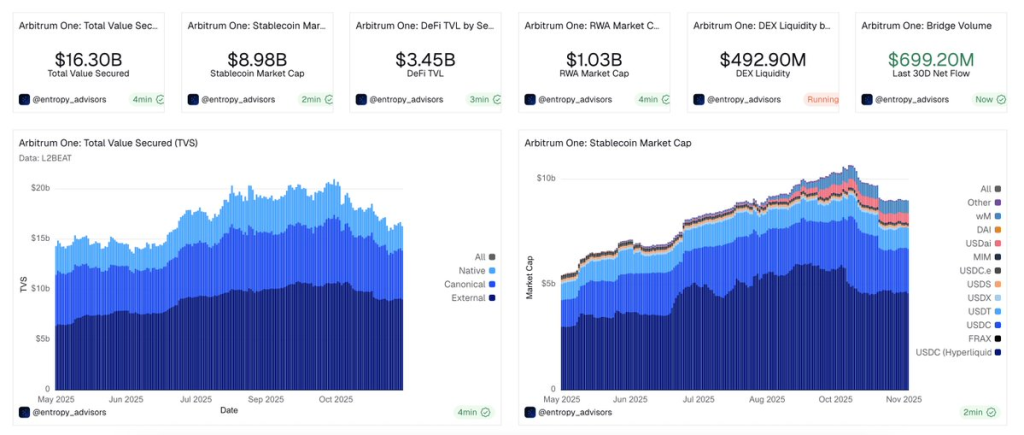

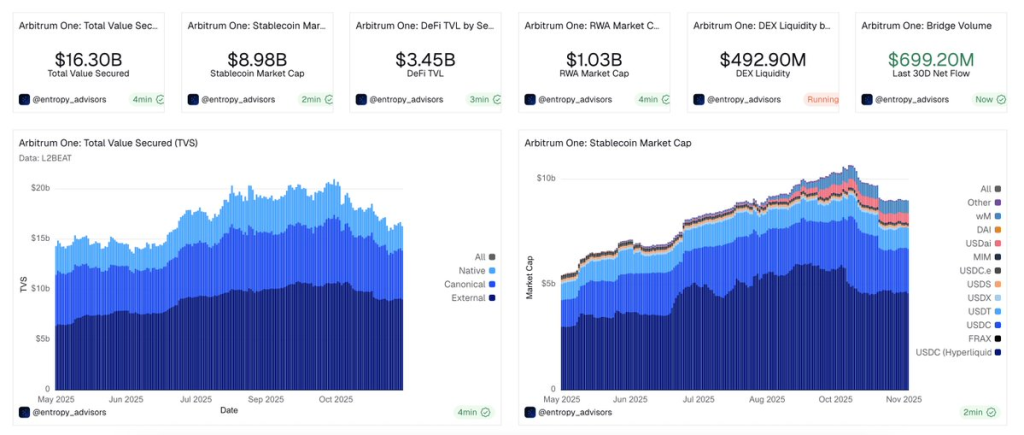

- •Arbitrum holds $16.3 billion in Total Value Locked (TVL), with ARB testing long-term accumulation support near historic levels.

- •ARB is currently trading around $0.27, while $699 million in bridge inflows indicate sustained capital confidence in the network.

- •Technical analysis suggests a potential Wyckoff accumulation pattern, with traders closely watching for a breakout above key resistance.

Arbitrum's native token, ARB, is currently trading around the $0.27 mark, a price point that has historically served as a zone for accumulation before significant recoveries. Despite recent market fluctuations, data indicates a continuous rise in activity across the Arbitrum ecosystem.

Price Holds Critical Support Channel

On the 3-day chart, ARB is currently situated within a long-term descending channel. The price recently touched the lower band of this structure and is trading between $0.27 and $0.25. This price range has historically acted as a support level during previous downturns and has often preceded rallies once demand returned to the market.

A Wyckoff model has been overlaid on the chart, suggesting a potential accumulation phase at current price levels. Should ARB successfully break above the channel's upper boundary and reclaim $0.55 or $0.64, it could signal a significant trend change. Until such a breakout occurs, the price action remains within a downward range, with both buyers and sellers actively testing its boundaries.

Arbitrum Network Shows Steady Growth

The total value secured on Arbitrum stands at $16.3 billion, showing a recovery from earlier dips this year. Network activity has seen a resurgence, bringing Arbitrum closer to its previous high set in mid-2025.

The stablecoin market capitalization on the chain has reached $8.98 billion, with USDC and USDT remaining the most utilized tokens. This stable liquidity environment supports deeper on-chain usage, particularly across decentralized finance (DeFi) protocols. Furthermore, real-world asset (RWA) integrations have now surpassed $1 billion, highlighting Arbitrum's expanding role in tokenized finance.

The total value locked in DeFi protocols currently sits at $3.45 billion, with ongoing participation in lending, trading, and liquidity provision protocols. This sustained level of development continues to attract capital even during periods of market consolidation.

Bridge Inflows Remain Strong

In the past 30 days, Arbitrum has experienced bridge inflows totaling $699.2 million. This indicates a consistent flow of capital entering the network from other blockchains and remaining within the Arbitrum ecosystem. Such sustained inflows are a strong indicator of user confidence in the chain's infrastructure and utility.

Despite broader market volatility, network activity has remained stable, helping to preserve overall fundamentals as ARB holds near its key price levels.

Market Watches for Breakout or Breakdown

ARB was priced at $0.268, reflecting a 6.2% decrease in the past 24 hours, while maintaining 1.72% weekly gains. Daily trading volume has exceeded $182 million. Traders are closely observing the current price range for a potential move either above resistance levels or a breakdown below the long-term demand zone.

According to a market analyst,

“This is where previous cycles have started their move, but we need a clean breakout.”

However, the price remains at a critical decision point, and the direction of the next move is likely to be determined by trading volume.