Aptos (APT) Price Action and Analyst Sentiment

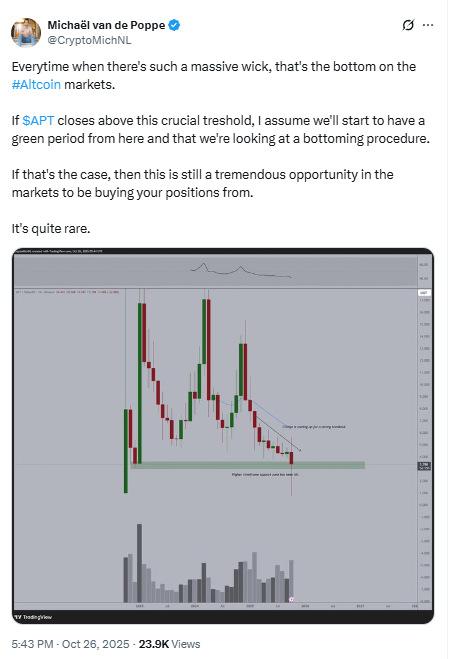

Aptos (APT) has seen a notable rebound, rising 7.84% to trade at $3.56. This price movement, characterized by a significant lower wick, is being interpreted by analyst Michaël van de Poppe as a strong indicator of a potential bottom for altcoins. The cryptocurrency's ability to recover from an intraday low of $3.28 suggests underlying buying pressure. Van de Poppe highlighted on X, "Everytime when there’s such a massive wick, that’s the bottom on the #Altcoin markets."

A critical price level to watch is the $3.60 threshold. A sustained close above this resistance point could signal the beginning of a bullish period for APT, with potential targets extending to $4.00 and beyond. This upward trajectory is further emphasized by the token's recovery of approximately 60% from its October low, demonstrating resilience amidst market volatility.

Technical Analysis and Market Context

The recent price action on Aptos charts, particularly the substantial lower wick observed on hourly bars, indicates a strong rejection of lower prices. This wick, which dipped below $3.30, has been identified as a key support level. The $3.60 mark, derived from recent price highs, serves as a crucial resistance level. A decisive break above this level is anticipated to unlock further upside potential, aligning with Fibonacci extension targets and historical breakout patterns.

Looking at the broader market context, October has presented challenges for altcoins, with APT experiencing a decline of over 20% in the month-to-date period. This downturn has been attributed to macroeconomic uncertainties and the sideways movement of Bitcoin. Despite these headwinds, APT has managed a significant 60% recovery from its all-time low of $2.22 on October 10, underscoring consistent demand from investors.

Fundamental Strengths and Investment Potential

Beyond technical indicators, Aptos' fundamental strengths provide a solid foundation for its growth. The blockchain's Move-based virtual machine continues to attract developers due to its high performance, offering sub-second finality and peak transaction speeds of up to 160,000 transactions per second. This robust infrastructure supports decentralized finance (DeFi) platforms such as Thala and Liquidswap.

While the total value locked (TVL) on Aptos has stabilized around $450 million following a summer surge, there are ongoing discussions about potential institutional inflows. The integration of stablecoins, such as the anticipated WLFI stablecoin associated with Donald Trump, could further catalyze demand for APT's network. Analyst Michaël van de Poppe has emphasized the current market conditions, stating, "The markets are providing tremendous opportunities… $APT is one of them, it’s the lowest valuation in years."

With a current market capitalization of $2.56 billion, Aptos is trading at a significantly lower valuation multiple compared to Solana, despite offering comparable transaction throughput. While risks such as Ethereum's Dencun upgrades, the competitive landscape of Layer 2 solutions, and potential delays in global interest rate cuts could impact risk assets, the current market setup is described as "quite rare" by van de Poppe. For experienced investors, the current price action represents a strategic accumulation opportunity, with the potential for a significant altcoin season encore in the fourth quarter.