Strategic Investment in AerodromeFi

Animoca Brands has significantly enhanced its AERO holdings by establishing veAERO, a strategic move to support AerodromeFi, a leading decentralized exchange on the Base Chain. AerodromeFi currently commands over 50% of the total value locked within the DEX.

This initiative highlights Animoca Brands' commitment to fostering sustainable token economics. By optimizing liquidity management, incentivizing rewards, and enabling robust governance through voter-driven liquidity allocations, the company aims to strengthen its position within the DeFi ecosystem.

Boosting DeFi Infrastructure on Base Chain

Animoca Brands has made a substantial strategic move within the cryptocurrency market by establishing and maximizing its AERO holdings as veAERO. This action is specifically designed to bolster AerodromeFi on the Base Chain, as reported by PANews on October 28, 2025.

This investment is a clear demonstration of Animoca Brands' strategic efforts to improve liquidity and governance mechanisms within the decentralized finance (DeFi) landscape, with a particular focus on the Base Chain.

"The investment represents Animoca’s unwavering commitment to expanding DeFi infrastructure through tactical innovations," said Yat Siu, Executive Chairman of Animoca Brands.

Market Dynamics and veAERO Governance

Venture-led liquidity injections utilizing ve-token mechanisms, such as Animoca Brands' strategy with AerodromeFi, have historically been observed to enhance protocol resilience. This approach mirrors patterns seen in previous significant governance events within other DeFi protocols.

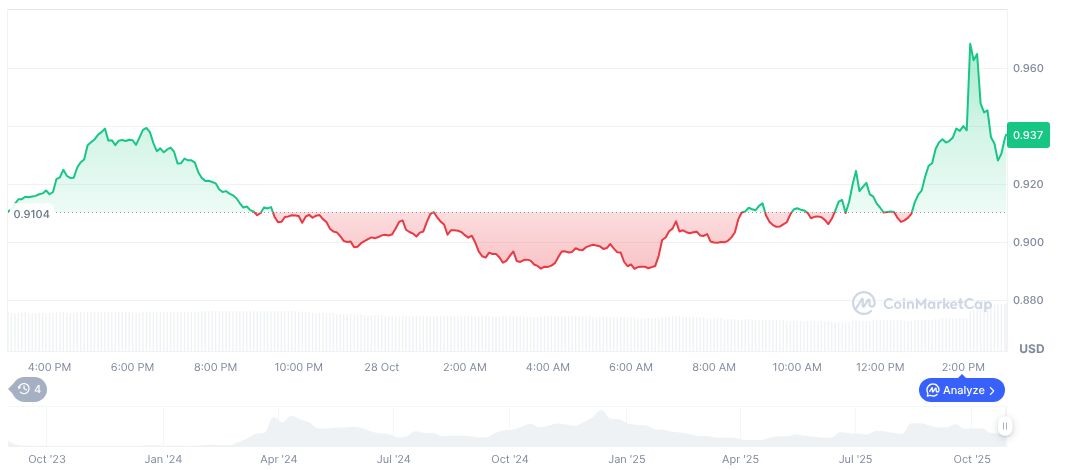

As of October 28, 2025, Aerodrome Finance (AERO) is trading at $0.93, with a market capitalization of $841.25 million. Trading volume has seen a 20.80% increase in the last 24 hours. While AERO has experienced a 14.46% increase over the past 90 days, it has seen a 18.68% decrease over the last 60 days. Despite these fluctuations, AerodromeFi continues to maintain its market presence and viability.

Industry experts suggest that Animoca Brands' strategic approach could influence how regulatory bodies perceive the cryptocurrency market. This may contribute to the development of a more favorable regulatory environment for ve-token models. Historical market analysis indicates that such strategic investments often lead to improved liquidity resilience and enhanced on-chain stability, trends that have been previously observed in other prominent DeFi ecosystems.