The sharp sell-off that sent Bitcoin tumbling this week has reignited a familiar debate: Is the four-year Bitcoin cycle breaking down, or is this just another brutal reset within the same historical pattern?

According to a new analysis shared by Cointelegraph, top market analysts are divided after Bitcoin’s correction dragged the price to levels that challenge long-held cyclical models. The discussion centers on whether the halving-driven rhythm that has historically guided Bitcoin’s booms and busts remains intact in 2025.

Bubble Signals Trigger Mixed Interpretations

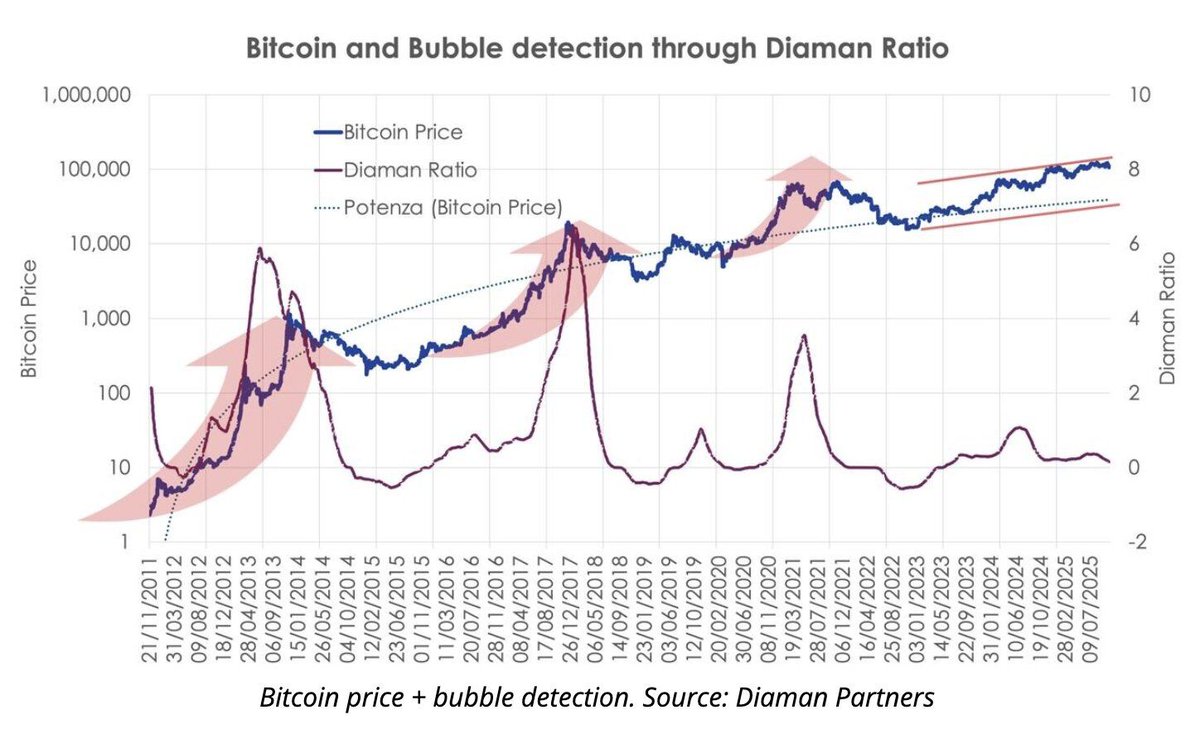

The chart from Diaman Partners, combining Bitcoin price, the Diaman Ratio, and Potenza trendlines, highlights several past blow-off tops and market bottoms stretching back to 2011. Historically, spikes in the Diaman Ratio have aligned with cycle peaks such as 2013, 2017, and late 2021.

However, this year’s behavior looks less clean.

While Bitcoin surged earlier in 2025, the recent drop has pushed the bubble-detection metrics into an ambiguous zone. Some analysts interpret this as the cycle running ahead of schedule, while others argue the metrics reflect a mid-cycle correction, not a structural break.

The Debate: Cycle Dead or Cycle Delayed?

Analysts cited by Cointelegraph fall into two broad camps:

- The Cycle Is Breaking

Those skeptical of the four-year model say Bitcoin’s increasing institutional integration, ETFs, derivatives depth, and portfolio allocation, is diluting the halving effect. As a result, macro flows and liquidity conditions, not supply shocks, now dictate price action.

They point to the steepness of the latest drop as evidence that Bitcoin no longer follows predictable historical timelines.

- The Cycle Is Still Alive

Traditionalists argue that despite the volatility, the long-term trend still maps closely to previous halvings. The Diaman Ratio’s latest spike resembles earlier pre-accumulation phases, and the broader Potenza trendline continues to slope upward, indicating structural growth similar to past cycles.

What’s Next

As Bitcoin consolidates at lower levels, analysts stress that the next few weeks could reveal whether this correction mirrors prior mid-cycle shakeouts, or whether the 2025 crash marks a definitive departure from Bitcoin’s famous four-year rhythm.