Crypto analyst Michaël van de Poppe believes the market is misreading the current cycle. According to him, the bull market is not ending; instead, the altcoin bear market is. His comments follow a widely shared chart from analyst TechDev, which visually maps Bitcoin’s long-term business cycle against altcoin macro lows. Van de Poppe argues the data shows a rare setup forming, one that he calls a “once-in-a-lifetime opportunity.”

Chart Shows Altcoin Lows Form When the Business Cycle Bottoms

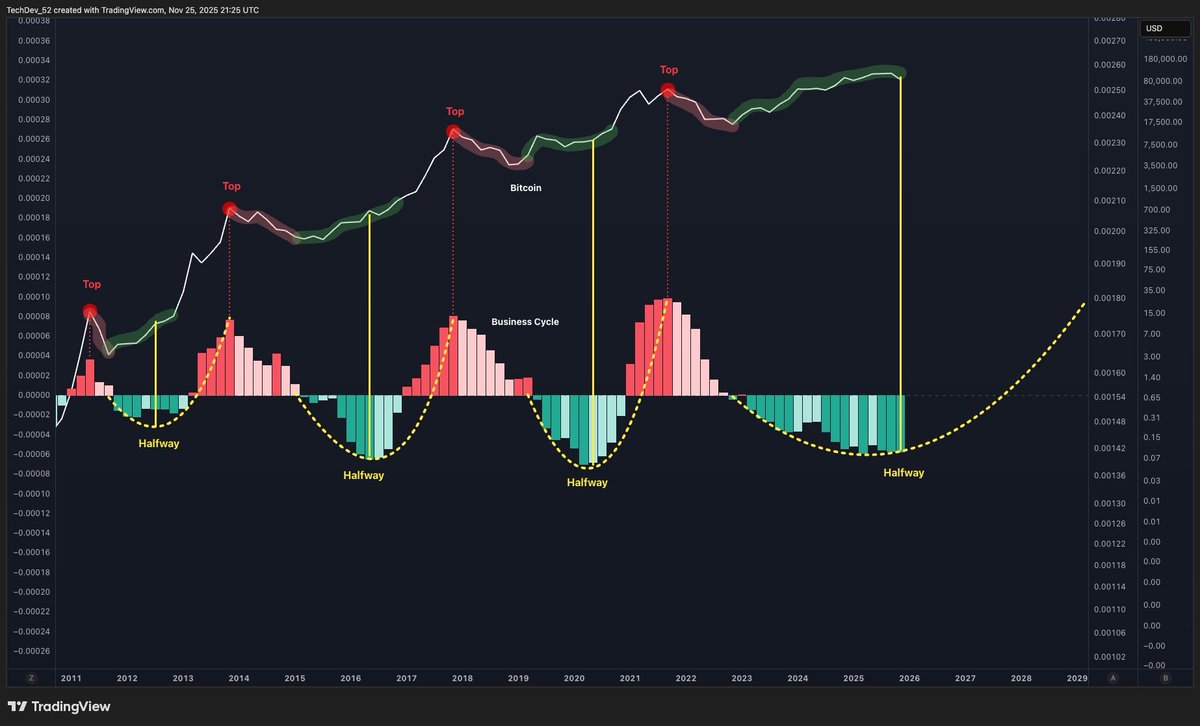

The TechDev chart plots Bitcoin’s historical tops and altcoin cycle lows across multiple business cycles. In every previous cycle, altcoins bottomed when macro conditions were least favorable:

- •Q2 2012

- •Q1–Q2 2016

- •Q1 2020

Each of those periods produced deep losses in the altcoin market, “bloodbaths,” as van de Poppe describes, while Bitcoin traded below its all-time high and broader risk markets remained defensive. But each time, those lows were followed by explosive recoveries as the business cycle shifted back into expansion.

Van de Poppe says the same dynamic is playing out again now, with the chart showing altcoins sitting at the “halfway” bottom of the macro cycle, just as they did in previous years.

ETF Era Has Shifted Market Structure

What makes this cycle different, van de Poppe argues, is the presence of Bitcoin ETFs, which have created a new structural floor under BTC. In prior cycles, Bitcoin traded well below its all-time highs during these altcoin bottoms. This time, Bitcoin is holding north of its previous ATH, often trading above the $100,000 region.

That new stability, he says, has “confused” the market, making traders think the bull market has peaked when, in reality, Bitcoin hasn’t even begun its true vertical phase.

A Longer, Non-Traditional Cycle Ahead

Van de Poppe also rejects the idea that crypto still operates on the classic four-year halving rhythm. According to him, the cycle has changed:

- •It’s longer.

- •It’s shaped more by global liquidity and the business cycle.

- •It requires more capital to move prices.

- •It demands more time for risk markets to rotate.

If the altcoin bear market has indeed been as severe as the chart shows, he argues that the next bull phase may be “significantly larger,” matching the broader scale of the current macro cycle.

“Opportunities Everywhere – People Just Don’t See It”

Van de Poppe believes today’s market offers one of the strongest asymmetric opportunities in crypto history.

The combination of depressed altcoin valuations, shifting macro conditions, and a Bitcoin cycle that hasn’t yet reached its true expansion phase creates what he says is an opportunity “most people will only get once.”

He credits TechDev for the visual, calling it the clearest representation yet of where crypto sits in the current cycle.

According to him, the message is simple:

The bull market isn’t ending, the altcoin bear market is. And the biggest moves are still ahead.