While Bitcoin and Ethereum continue to consolidate near key technical levels, activity across the altcoin market tells a different story.

Capital is rotating aggressively into select mid-cap tokens where exchange listings, protocol upgrades, and real usage catalysts are converging at the same time. Over the past 24 hours, several projects posted sharp gains, supported by rising volume and identifiable drivers rather than isolated price spikes.

Here’s how three standout names are positioning themselves as momentum builds.

RollX Gains Steam on Exchange Listings and Airdrop Activity

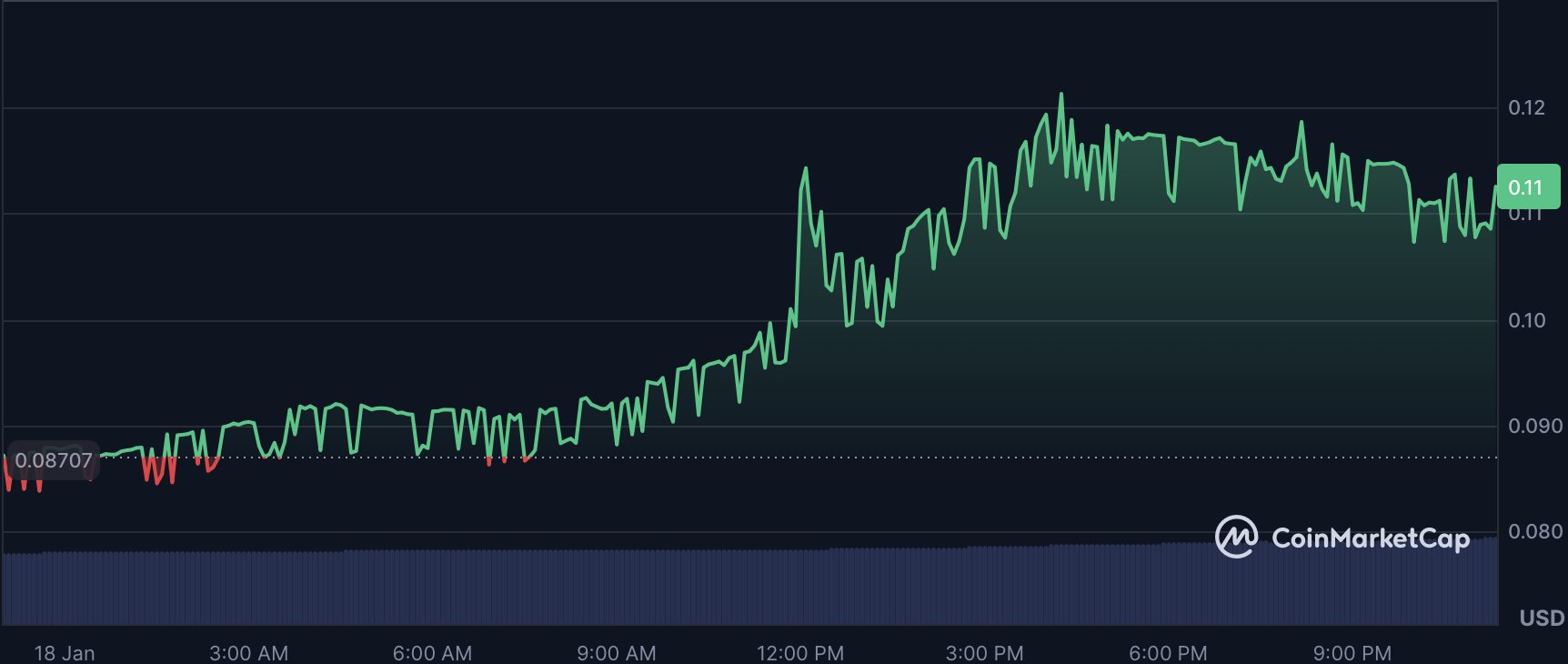

RollX recorded a strong upside move, climbing more than 35% over the past 24 hours and extending its seven-day advance to nearly 14%, pushing its market capitalization to around $17.6 million. The rally followed its January 16 listing on Bitget, which significantly expanded access for spot and derivatives traders. Momentum was further supported by an active WEEX airdrop campaign running through January 23, helping drive engagement across trading venues.

Trading activity surged alongside price, with daily volume reaching $1.78 billion and more than 339,000 trades recorded. Beyond the short-term listing effect, RollX has already processed roughly $28 billion in cumulative volume and operates a revenue-sharing model, suggesting that the protocol is seeing repeat usage rather than purely speculative interest. As the airdrop window approaches its end, market participants are watching closely to see whether demand holds or if short-term profit-taking introduces volatility.

Vanar Chain Rallies as AI Infrastructure Shifts to Subscription Model

Vanar Chain extended its breakout, rising nearly 26% in the past day and more than 28% over the last week, lifting its market cap to approximately $23.9 million. The move followed a key transition within its AI infrastructure stack, as Neutron and Kayon adopted subscription-based pricing with on-chain token burns tied directly to usage.

That shift triggered a sharp reaction in market activity, with trading volume jumping more than 2,100% to $48.8 million. The introduction of recurring payments and supply reduction through burns has reframed VANRY’s narrative toward sustainable demand, particularly as Web3 infrastructure increasingly intersects with AI services such as data storage and processing. Recent price performance reflects growing confidence that usage-driven mechanics could support longer-term value accrual if adoption metrics continue to improve.

Frax Breaks Higher After Mainnet Migration and New Listings

Frax delivered one of the strongest performances in the market, surging more than 44% over the past 24 hours and gaining nearly 36% on the week, with its valuation climbing above $106 million. The rally followed its January 15 mainnet migration, a milestone that consolidated liquidity and simplified access across the ecosystem.

The upgrade was quickly reflected in market structure. Binance, KuCoin, and WEEX launched new spot and perpetual markets, driving a sharp expansion in derivatives activity as 24-hour volume climbed to $54.5 million, up almost 300%. Institutional positioning also drew attention after DWF Labs withdrew roughly $5.4 million, a move often associated with longer-term strategic exposure rather than short-term trading. As broader DeFi activity remains closely linked to Ethereum’s staking dynamics, Frax is increasingly viewed as a beneficiary of renewed interest in yield-focused infrastructure.

Market Takeaway

The current altcoin strength highlights a clear pattern: price follows structure. Whether through exchange expansion, usage-based token mechanics, or protocol-level upgrades, these projects are attracting capital because their narratives are being reinforced by measurable activity. As long as volume and participation continue to confirm price action, rotations into names like RollX, Vanar Chain, and Frax suggest that risk appetite within the altcoin market remains very much alive.