Altcoin Market Weakness and Current Standing

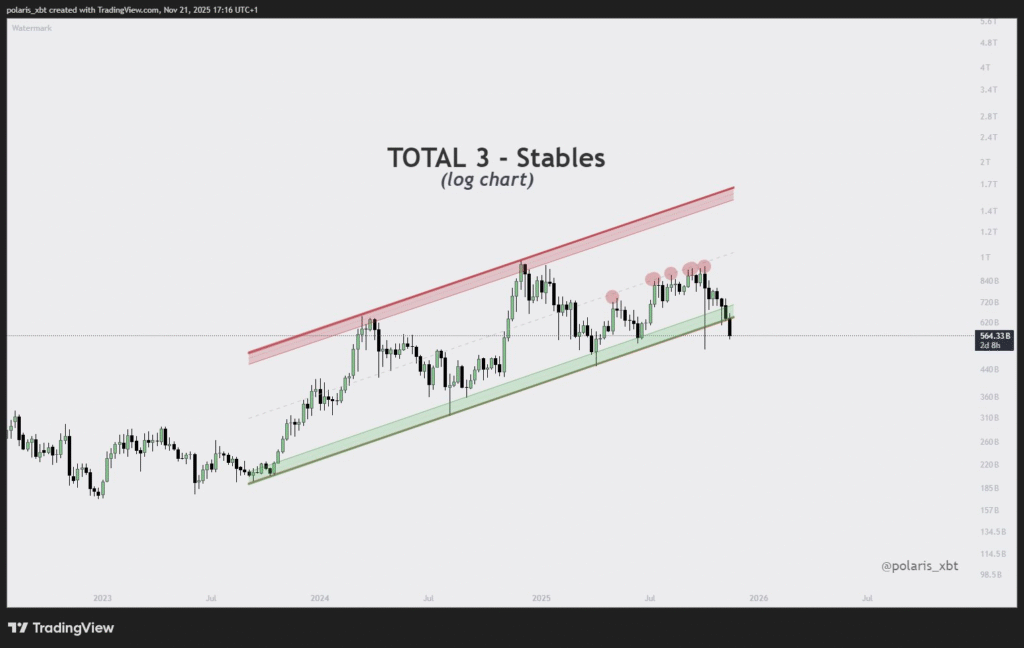

The altcoin market has dropped below a two-year log channel for the first time since mid-2023. This move follows a period of fading momentum and comes just as new altcoin ETFs begin trading in traditional markets. The altcoin market has fallen below a two-year log channel for the first time since mid-2023, with a current capitalization of $564.33 billion. This decline follows a period of diminishing momentum and coincides with the commencement of trading for new altcoin-focused Exchange Traded Funds (ETFs) in conventional financial markets.

Two-Year Log Channel Break Signals Weakness

According to polaris_xbt, the total altcoin market has fallen below a key log trend channel that supported price action for two years. This structure, shown in the “TOTAL 3 – Stables” chart, started in mid-2023 and remained intact until November 2025. The recent break signals that momentum has shifted. The total altcoin market has broken below a significant two-year log trend channel that had previously supported price movements. This channel, as illustrated in the “TOTAL 3 – Stables” chart, was established in mid-2023 and persisted until November 2025. The current breach of this trend line indicates a notable shift in market momentum.

The market peaked in December 2024 and has since declined. The current value of the altcoin market is $564.33 billion. This level is close to previous bear market lows, and it reflects a slowdown in investor demand despite structural market developments. The channel break also follows repeated failures to move past the upper resistance zone throughout 2025. The altcoin market reached its apex in December 2024 and has been on a downward trajectory since then. The total market capitalization currently stands at $564.33 billion, a figure that approaches historical bear market lows. This valuation reflects a decrease in investor interest, even amidst significant structural changes in the market. The break below the established channel is also preceded by multiple unsuccessful attempts to surpass the upper resistance levels observed throughout 2025.

ETFs Arrive But Response Remains Mixed

New altcoin-focused ETFs were launched recently, beginning with Ethereum. These products allow traditional investors to gain exposure to crypto without holding tokens. While this move was expected to bring new capital, the results so far are uneven. New Exchange Traded Funds (ETFs) focused on altcoins have recently been introduced, with Ethereum being among the first. These financial instruments enable traditional investors to access cryptocurrency markets without the direct ownership of digital assets. Although the introduction of these ETFs was anticipated to attract fresh capital, the market's reaction has been inconsistent.

Ethereum gained ETF approval first, and other major altcoins followed. The response in market prices has varied, with no clear upward momentum yet. This shows that ETF launches do not always lead to immediate inflows. One observer noted, “Altcoin ETFs have arrived, and one wonders whether Wall Street just started an altseason without meaning to.” Following the initial ETF approval for Ethereum, other prominent altcoins have also seen similar products launched. However, the impact on market prices has been diverse, with no discernible upward trend emerging thus far. This indicates that the launch of ETFs does not invariably result in immediate capital inflows. As one commentator observed, “Altcoin ETFs have arrived, and one wonders whether Wall Street just started an altseason without meaning to.”

Sentiment Resembles Previous Cycle Lows

Sentiment across altcoin markets is currently similar to levels seen during prior market bottoms. Traders note that resistance near the $1 trillion mark was tested several times, but failed. These repeated rejections caused selling pressure to increase, eventually pushing prices below the lower boundary of the channel. The current sentiment within altcoin markets mirrors the conditions observed at previous market cycle bottoms. Market participants have noted multiple instances where resistance around the $1 trillion mark was tested but ultimately could not be overcome. These repeated failures to break through resistance have amplified selling pressure, leading to prices falling below the established lower boundary of the trend channel.

Technical analysts see this as a key break. However, some suggest a recovery could still happen if Ethereum gains strength again. Ethereum often leads price moves in altcoins, and its performance may influence market direction in the short term. From a technical analysis perspective, this break is considered significant. Nevertheless, some analysts propose that a market recovery remains possible if Ethereum demonstrates renewed strength. Given Ethereum's historical role in leading price movements within the altcoin sector, its future performance could significantly influence the short-term direction of the broader altcoin market.