Altcoin Season Index Touches 32: Signs of Increased Market Activity

The Altcoin Season Index’s movement—from 31 to 32 recorded on November 16—reflects a subtle enhancement in altcoin performance against Bitcoin. This index, compiled by CoinMarketCap under the leadership of Binance’s Richard Teng and Rush Luton, tracks the relative strength of top altcoins versus Bitcoin over a 90-day period. Approximately 32 cryptocurrencies have managed to outpace Bitcoin, despite it remaining below the 75-point mark, a threshold marking an official altcoin season.

The upward shift in this index points to growing interest in larger-cap altcoins such as Ethereum, Solana, and Avalanche. Market participants are cautiously reallocating investments, though the lack of further capital influx suggests a moderate adjustment rather than a sweeping market change. No official statements have been issued by CoinMarketCap executives on this update, nor have any major crypto influencers commented on social media platforms.

Market discussions are gradually picking up, observable through increased discussions on platforms like Twitter and Discord. Despite such activity, no significant statements have emerged from regulatory bodies or industry leaders in response to the latest index indication, with the community response remaining tempered.

Ethereum Leads Altcoin Leaders Despite Market Volatility

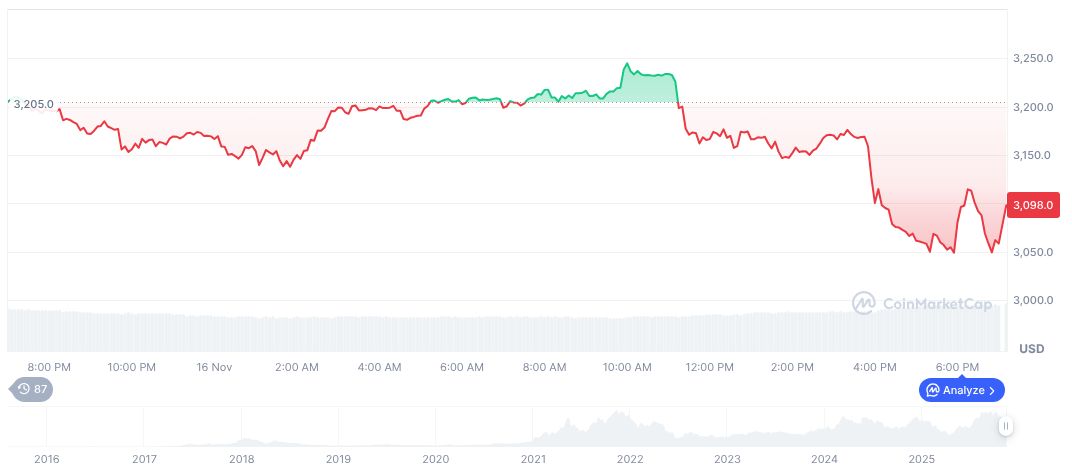

Ethereum (ETH), as part of the altcoin contingent beating Bitcoin’s performance, is currently valued at $3,077.63, with a market cap of $371.46 billion and a market dominance of 11.70%, per CoinMarketCap. Ethereum’s trading volume reached $28.93 billion over the past 24 hours, despite a 2.51% day-on-day decline. Over the past 90 days, Ethereum has seen a price decrease of 29.60%.

Experts from Coincu suggest that the modest rise in the Altcoin Season Index signals cautious optimism regarding altcoin investment strategies. Past market data illustrates that such incremental improvements can precede brief upticks in high-liquidity tokens, although risks remain given the volatile market conditions.