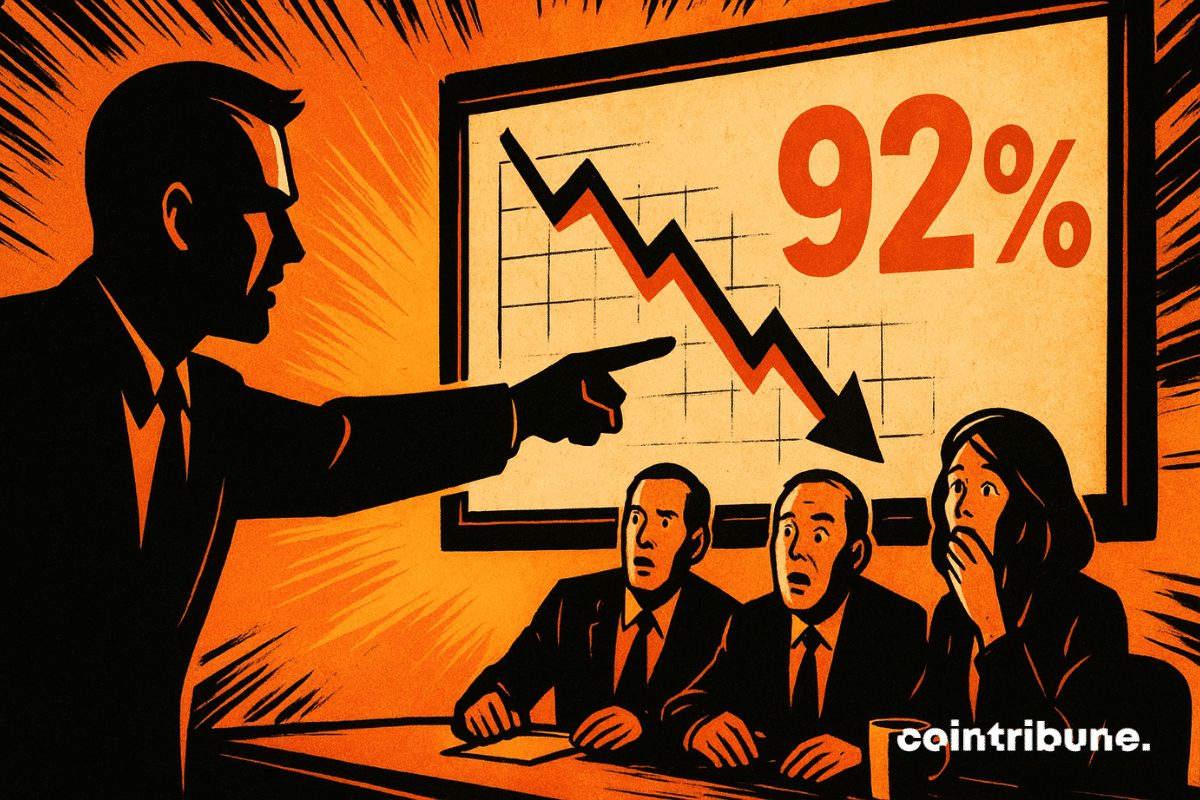

Changpeng Zhao and his investment company YZi Labs are taking a strong stance against the management of CEA Industries, accusing them of allowing the BNC stock price to plummet by more than 90%. This aggressive move signifies a critical juncture for the future of this treasury company focused on BNB. The question remains whether shareholders will align with CZ in the effort to regain control of the company.

In brief

- •YZi Labs has submitted a consent declaration to the SEC proposing a restructuring of CEA Industries' management.

- •The BNC stock has experienced a significant decline of 92% from its July peak of $82.88, currently trading at $6.47.

- •YZi Labs holds approximately 5% of the company's shares, equating to 2.1 million shares valued at $14 million.

- •The company alleges that CEO David Namdar has been negligent and has engaged in conflicts of interest with other cryptocurrency projects.

A Spectacular Drop Prompts CZ's Action

Changpeng Zhao, the founder of Binance, and YZi Labs have initiated an offensive against CEA Industries (BNC), a publicly traded treasury company specializing in BNB. This action was formally announced on Monday with the filing of a consent declaration with the U.S. Securities and Exchange Commission (SEC), demanding substantial alterations to the company's board of directors and management structure.

The current situation is described as alarming. Since reaching a peak of $82.88 in July 2024, shortly after the announcement of its BNB treasury initiative, the BNC stock has plummeted by 92% to close at $6.47. The stock saw a further 10% decrease the following Monday. This dramatic decline starkly contrasts with the performance of BNB itself, which achieved a historic high of $1,369 in October before settling back to $829.

The official document states, "We believe the current board is in critical need of additional directors with the knowledge and experience to effectively oversee management." YZi Labs, which possesses roughly 2.1 million shares constituting 5% of the company's capital and valued at $14 million, had previously participated in a $500 million PIPE financing during the summer, acknowledging the project's "institutional potential."

However, this initial support proved short-lived. Within a month, YZi Labs representatives began expressing their concerns to Hans Thomas, a company director. Grievances accumulated over a dozen documented contact attempts, citing insufficient communication, a lack of media presence, and general mismanagement.

Serious Accusations of Conflicts of Interest

The criticisms leveled against CEA Industries' management extend beyond mere communication failures. YZi Labs has directly accused CEO David Namdar and other executives of actively "promoting and seeking funding for other digital asset treasuries" while their primary responsibility is to focus exclusively on BNC. These revelations, which surfaced in November, raise significant ethical questions regarding the justification for such divided attention during a critical company crisis.

YZi Labs unequivocally states that the management is "directly responsible" for the company's poor performance. The consent declaration calls for shareholders to vote on four key proposals: expanding the board of directors, electing candidates nominated by YZi Labs, and rescinding any statutory provisions enacted after July. A consent ballot is included with the document to facilitate shareholder voting.

The investment company emphasizes, "The stockholders of BNC deserve a well-functioning board that understands its role as a steward of stockholder resources." The urgency of the situation is underscored by the statement, "We believe that time is of the essence. Stockholders cannot afford the leadership of the current board and management team."

A Battle for the Future of the BNB Treasury

This assertive action by CZ and YZi Labs highlights the inherent challenges faced by publicly traded crypto treasury companies. Despite possessing "solid fundamentals" and a "favorable market position," CEA Industries has failed to effectively leverage its assets. The paradox is particularly evident: while BNB has reached unprecedented highs, the stock designed to reflect its value has collapsed.

The names of the candidates YZi Labs intends to place on the board are currently confidential within the filed document. Neither YZi Labs nor CEA Industries has responded to requests for comment.

Ultimately, this confrontation could set new precedents for governance standards within the cryptocurrency ecosystem and determine the capacity of traditional investment vehicles to accurately capture the value of digital assets. For ordinary shareholders, this marks a critical moment for decision-making.