Key Cardano Insights

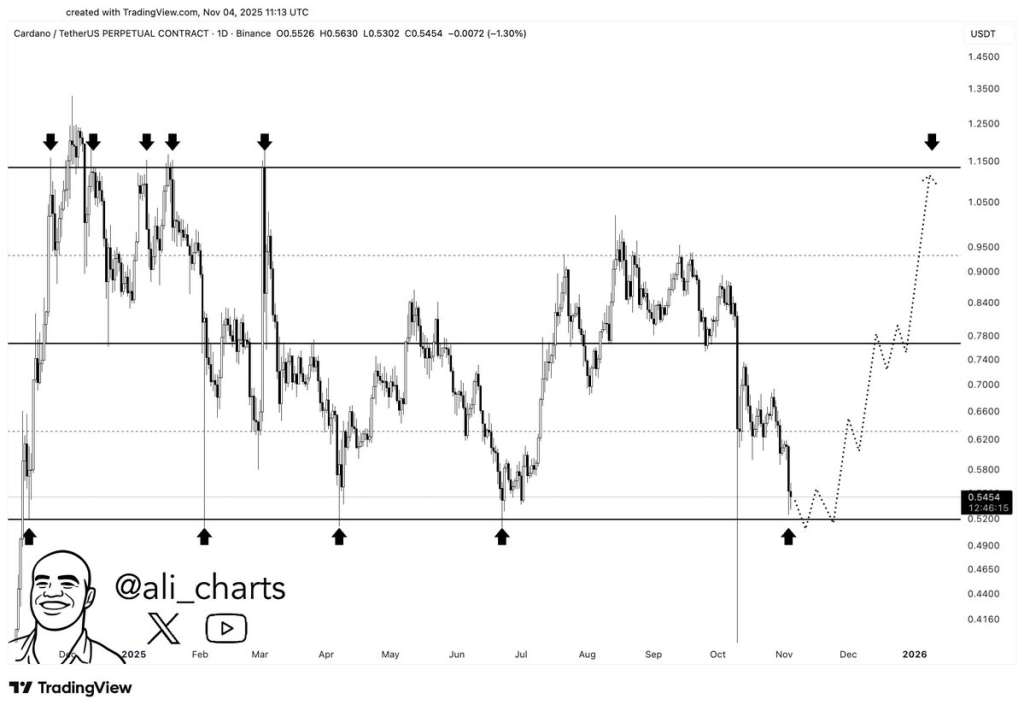

- •Cardano tested $0.52 support again, a level that triggered strong rallies throughout 2025.

- •RSI is near oversold territory, and the MACD shows signs of easing bearish momentum, suggesting a potential trend shift.

- •A long setup at $0.52 targets $0.67 and $0.85, with a stop-loss below $0.485 to manage downside risk.

ADA Tests Key $0.52 Level

Cardano (ADA) was once again trading near the $0.52 support area. This level has acted as a launch point for price rebounds several times since late 2024. As of November 5, ADA is priced around $0.543 after recovering slightly from recent losses.

The support zone was tested again this week, and the market responded with a bounce. This mirrors price behavior from earlier in the year, where $0.52 triggered upward moves. So far, the level has held.

Key Support Shows Reaction

Analyst Ali stated, "$0.52 is a support level that has triggered strong rebounds for Cardano since November 2024."

The level has served as a consistent area of demand throughout 2025. Previous reactions from this zone were followed by rallies toward $0.78 and beyond.

On November 5, a green daily candle formed at this level, marking a clear response from buyers. The current price action suggests that this support is still being respected. If it continues to hold, the next zones to watch are $0.60 and $0.74.

RSI and MACD Point to Potential Change

The Relative Strength Index (RSI) is sitting at 32.30. This reading places ADA just above the oversold line. While still weak, the RSI may suggest a possible shift if price strength continues to build.

The MACD remains below zero, and the MACD line is still under the signal line. However, the gap between them is narrowing, and the histogram bars are becoming shorter. This could indicate that the recent selling is easing.

The indicators don’t yet confirm a trend change, but they are showing early signs that momentum may be turning.

Trade Setup Builds Around $0.52 Level

Traders from The Sniper Club noted that ADA’s drop to the $0.52 zone opens the door for a long position. The plan shared includes an entry near $0.52, with a stop-loss just under $0.485. The first target area lies between $0.58 and $0.67. The second target is between $0.74 and $0.85.

This setup uses a tight stop and allows for upside potential if price follows previous rebound patterns. These resistance zones have seen multiple price reactions in recent months.

Market Watching for Break or Bounce

At present, Cardano was holding above its well-tested support. If buyers maintain control, a move toward the $0.60 level could follow. A daily close above this point would improve the short-term picture. On the other hand, a break below $0.485 would cancel the current setup and may suggest more downside.