XRP's Technical Setup Suggests Impending Explosive Move

XRP is currently consolidating within a year-long wedge formation, a rare technical pattern that analysts suggest often precedes significant price breakouts. Breakout targets derived from this pattern imply the potential for a parabolic phase, with projections indicating a sharp rally lasting several months once the wedge resistance is overcome. Macroeconomic models also suggest that XRP is approaching a historical expansion zone, indicating that the current consolidation is a structural preparation for future growth rather than a sign of weakness.

These analyses highlight that patience, precise timing, and an understanding of large-scale market structure may be more crucial for XRP holders than focusing on short-term price fluctuations.

Year-Long Wedge Formation Suggests Stored Energy

Analyst CryptoWzrd has observed that XRP has been trading within a tightening wedge formation for nearly a full year. This classic technical structure is known for often preceding powerful trend expansions. According to CryptoWzrd, this wedge has been compressing price action while simultaneously reducing volatility, signaling that the market is accumulating energy rather than losing momentum.

The wedge is characterized by a descending resistance line and an ascending support line, which together confine XRP's price movement into a progressively narrower range. CryptoWzrd believes that any breakout from this wedge will likely occur in conjunction with a shift in market dynamics, specifically a decline in Bitcoin's dominance. Historically, such a shift often leads to capital flowing from Bitcoin into large-cap altcoins like XRP.

"A breakout would send XRP parabolic," CryptoWzrd stated, emphasizing that patience has been a key lesson for XRP holders throughout this market cycle.

Projected Breakout Targets Indicate Vertical Expansion

CryptoWzrd's analysis indicates that XRP has formed a prolonged consolidation channel following an earlier impulsive upward move. The apex of the wedge formation is nearing, suggesting that the price has limited room to continue moving sideways. Projected breakout targets on the chart suggest that once XRP surpasses the wedge resistance, its price could accelerate rapidly toward a significantly higher zone, initiating what the analyst describes as a parabolic phase.

This structure also incorporates an earlier "pole" move, a common tool used by technical analysts to estimate potential upside targets after a breakout. Applying this method suggests that the projected move could result in a multi-month rally, rather than a brief price spike.

"Bent Fork" and "Macro Compass" Models Align with Bullish Outlook

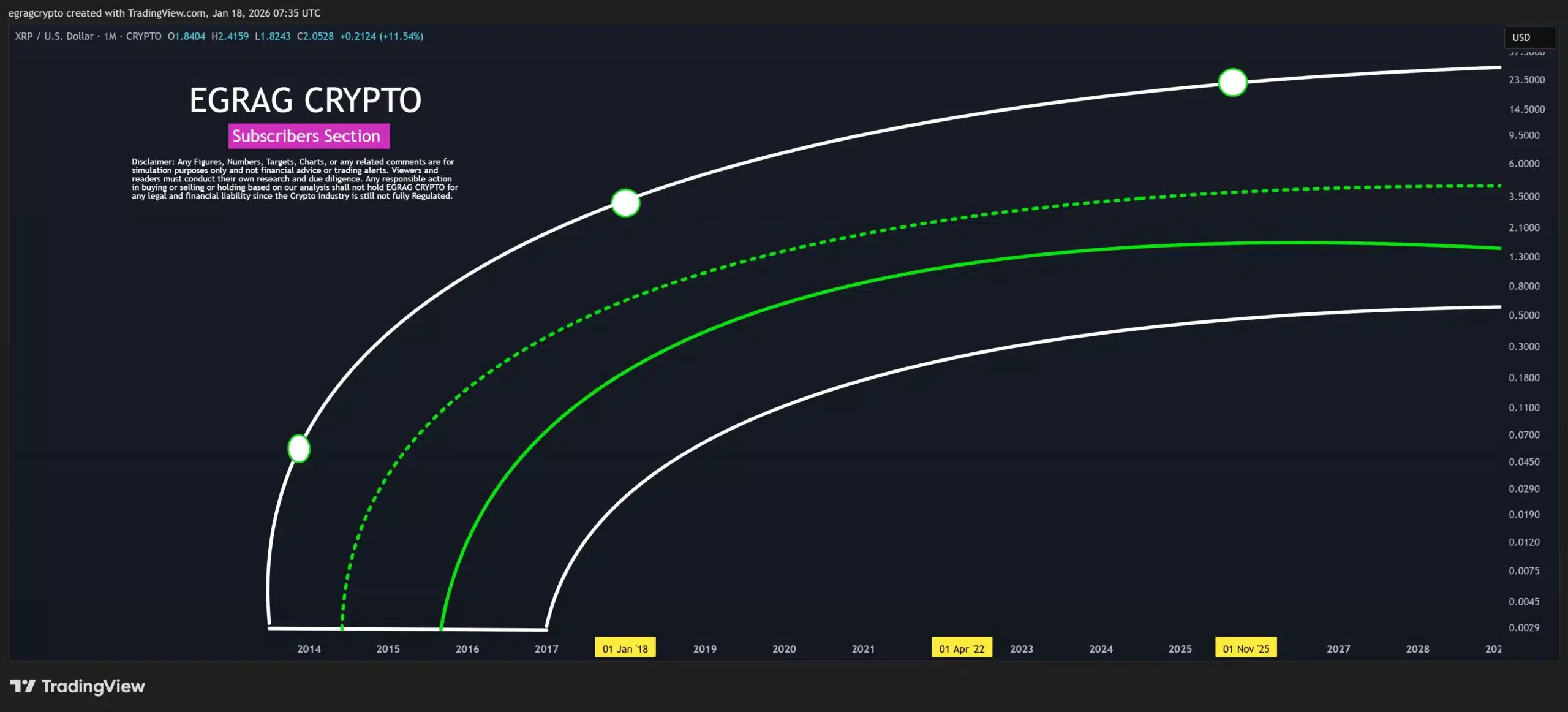

Analyst Egrag Crypto has supported the bullish outlook by introducing his "Bent Fork" and "Macro Compass" models. These represent large-scale geometric structures that are discernible on long-term charts. Egrag Crypto posits that XRP adheres to a repeating macro pattern that aligns its price movements with curved growth trajectories, as opposed to linear trendlines.

Historically, each time XRP has followed this pattern across previous cycles, the market has responded with a predictable sequence: extended accumulation followed by an exponential rally phase. "This isn’t about hype. It’s about geometry, structure, and timing," Egrag stated, emphasizing that his model focuses on XRP's position within the broader market cycle rather than short-term indicators.

Long-Term Curves Suggest Entry into Cycle Expansion Phase

Egrag Crypto's macro chart illustrates XRP moving within rising curved bands that resemble long-term growth arcs. Green and white guide curves on the chart show XRP consistently oscillating between lower and upper macro channels.

According to this model, XRP is currently approaching a zone where past cycles have transitioned from consolidation into a full trend expansion. The upper macro arc indicates potential long-term price objectives that extend far beyond current levels, assuming historical patterns repeat. Marked time indicators on the chart suggest that XRP is entering a period where previous cycles experienced sharp upward acceleration.

Analysts Emphasize Structure Over Short-Term Volatility

Both analysts concur on a fundamental point: XRP's current market behavior is indicative of preparation rather than weakness. CryptoWzrd views the situation as a coiled spring within a wedge, poised for a significant resolution upon breakout. Egrag Crypto perceives XRP as following an underlying macro roadmap that is only evident on multi-year charts.

Collectively, their analyses suggest that XRP may be considerably closer to a major inflection point than many traders currently realize. While both analysts maintain a bullish stance, they acknowledge the necessity for XRP to confirm any breakout.

A failure to breach wedge resistance or a resurgence in Bitcoin's dominance could potentially delay or invalidate the projected parabolic scenario. In such an event, XRP might remain within its current range for an extended period, contrary to expectations. Nevertheless, from both a structural and macro perspective, CryptoWzrd and Egrag Crypto argue that XRP is entering a historically significant zone where patience is likely to be rewarded.