According to recent on-chain data from CryptoQuant, the Bitcoin market is undergoing a rare structural transition defined by two simultaneous forces: heavy whale capitulation and a surge in exchange stablecoin reserves.

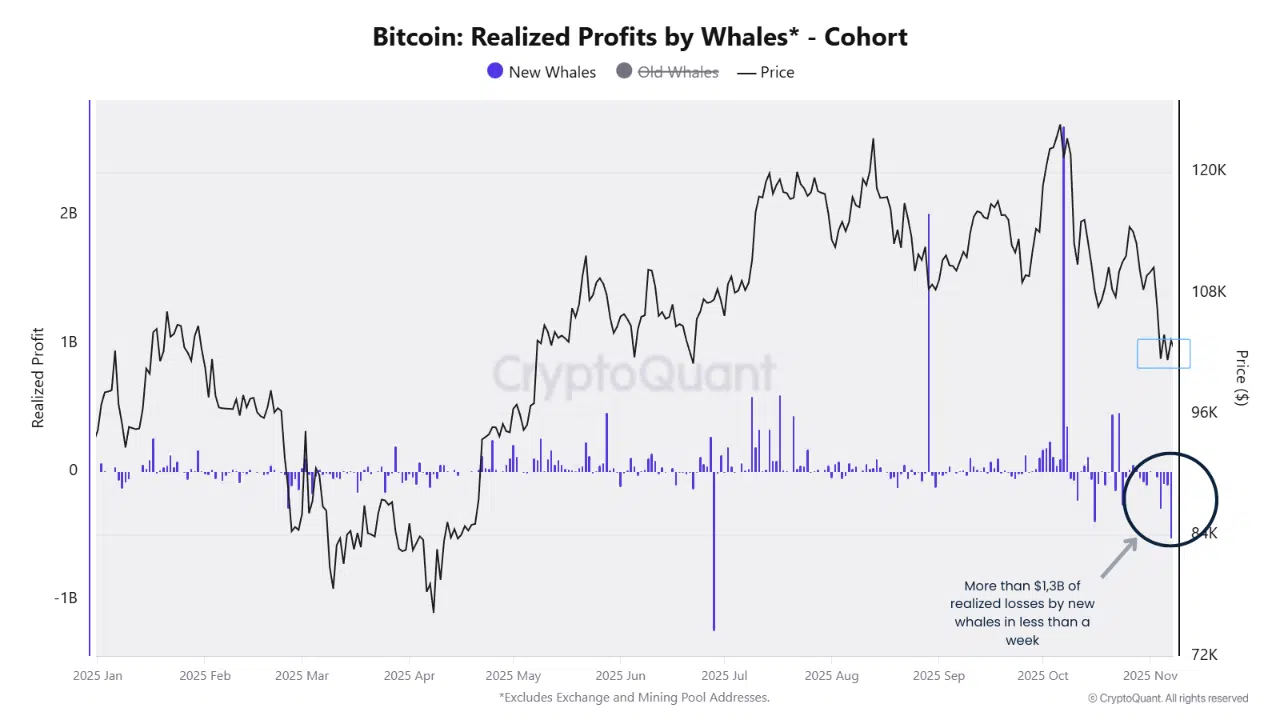

Analyst MorenoDV reports that over the past six days, new Bitcoin whales have realized over $1.3 billion in losses, marking one of the most aggressive capitulation streaks of 2025. This wave of selling typically reflects forced liquidations or loss aversion from newer, leveraged entrants.

Yet, despite this pressure, Bitcoin’s price has held firm above the $100K–$105K support range, suggesting resilience and significant absorption capacity from stronger hands.

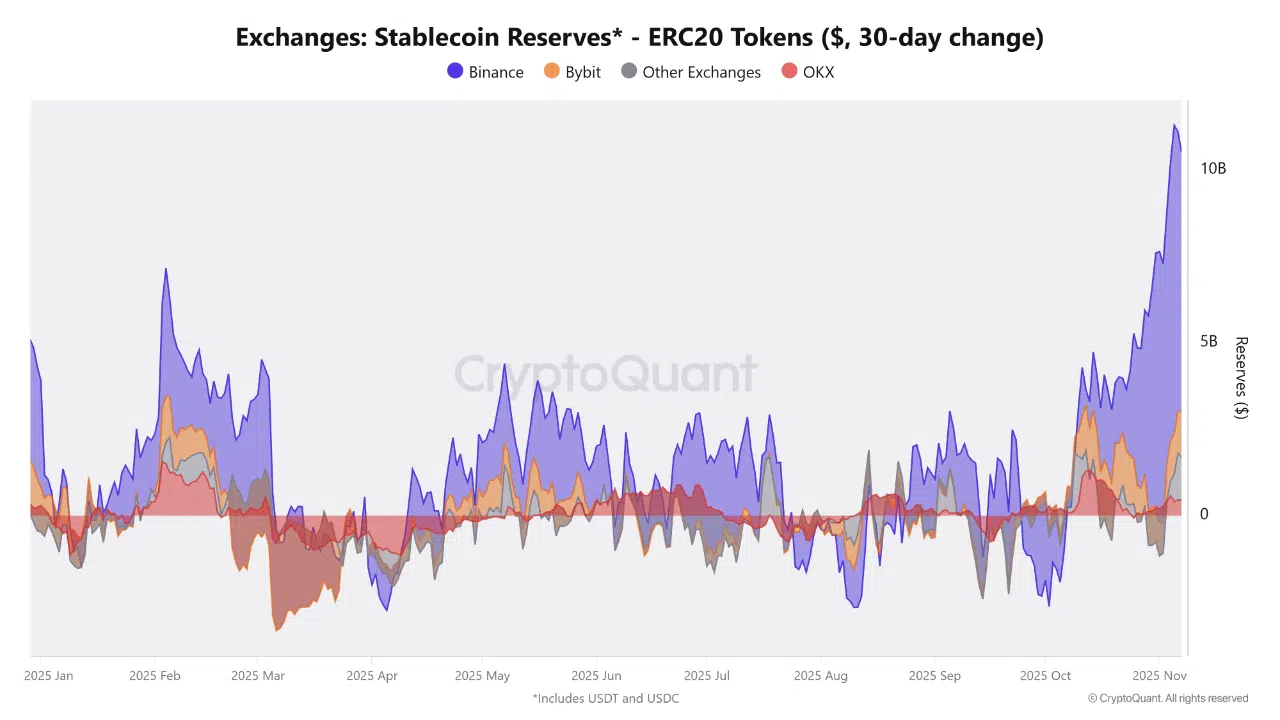

Significant Stablecoin Inflows Signal Massive Liquidity Build-Up

Complementing this capitulation data, a separate report from CryptoOnchain shows that exchange stablecoin reserves have surged by nearly $9 billion in the past month, the largest increase in 2025. The majority of this inflow is concentrated on Binance, which accounts for more than two-thirds of the total growth.

Such inflows typically indicate rising “buying power” or sidelined capital preparing to re-enter the market. Historically, sharp expansions in stablecoin balances have preceded major rallies, as traders and institutions position liquidity ahead of accumulation phases.

While Bybit and OKX also registered moderate growth, Binance’s dominance highlights its continuing role as the center of capital rotation within the crypto market.

Market Dynamics: Capitulation Meets Liquidity Rebuild

The convergence of whale capitulation and liquidity expansion paints a nuanced but promising picture. CryptoQuant analysts note that markets often form local bottoms following such dual signals, one group exiting in losses while another replenishes liquidity to buy the dip.

If Bitcoin maintains stability above $100K through mid-November, this period could represent a final shakeout before a renewed accumulation wave. With nearly $9 billion in fresh capital ready to deploy, on-chain indicators suggest a potential rebound phase led by institutional buyers and stablecoin-backed inflows.