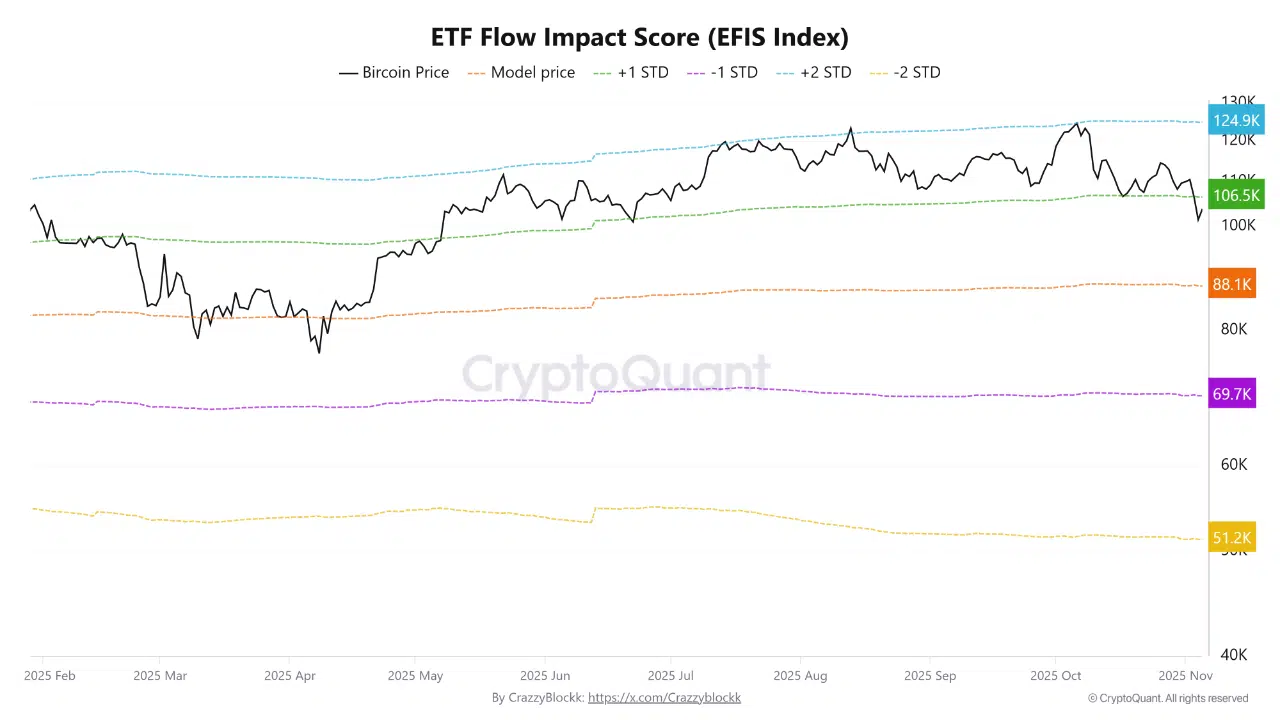

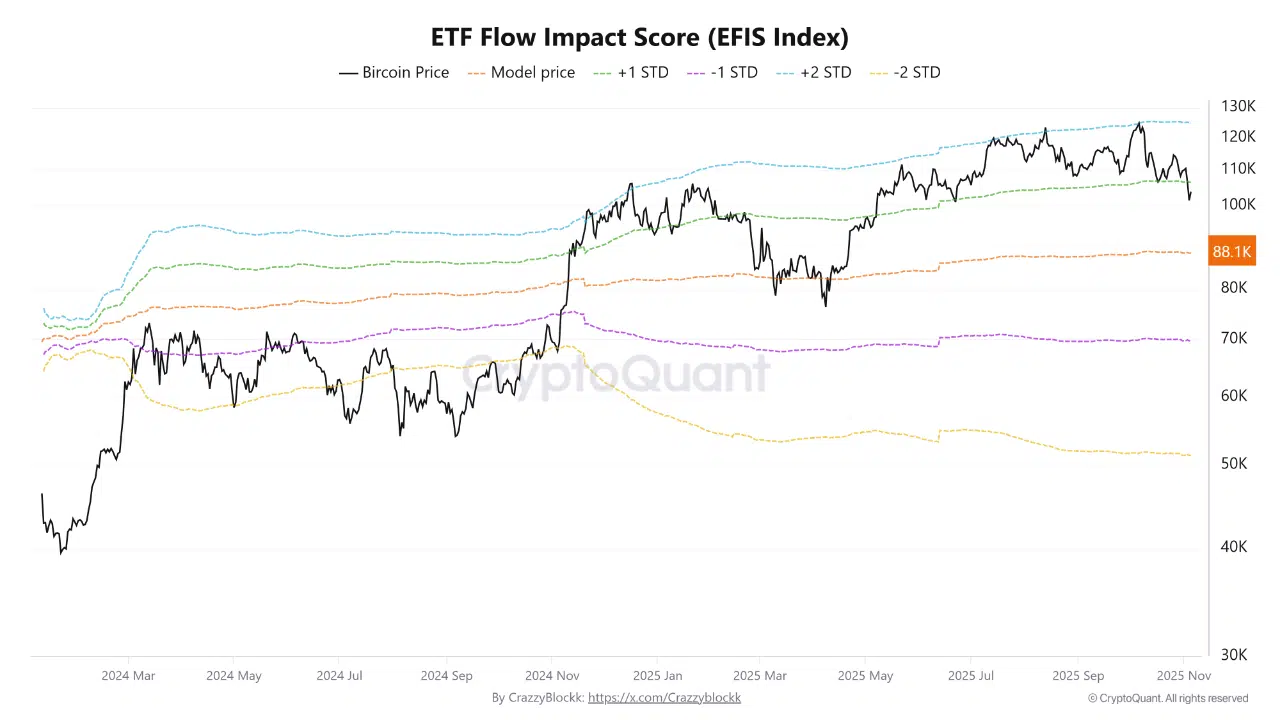

A new CryptoQuant report suggests that $88,000 has emerged as Bitcoin’s structural floor for the current market cycle, not through technical patterns, but through institutional positioning derived from more than 663 days of ETF flow data.

Key Takeaways

- •$88,000 identified as Bitcoin’s institutional floor: Flow-based modeling shows that ETF-driven capital has created a structural support zone around $88K, reflecting sustained institutional accumulation.

- •Institutional buying accelerates near this level: When Bitcoin trades 15% below model projections, data shows renewed inflows and rapid mean reversion within two to three weeks.

- •Support depends on ETF inflows: As long as normalized ETF flows remain positive, deeper corrections below $88K are statistically unlikely, only sustained outflows above 0.5% daily could invalidate this support.

How the EFIS Model Works

The analysis is powered by the ETF Flow Impact Score (EFIS), a quantitative model that tracks how inflows and outflows from Bitcoin exchange-traded funds (ETFs) translate into price impact.

The model normalizes ETF flows relative to total assets under management (AUM), which now exceed $100 billion, creating what CryptoQuant calls a “time-consistent institutional demand measurement.”

At present, U.S. Bitcoin ETFs collectively hold 1.047 million BTC, with normalized inflows averaging 0.3%–0.5% daily over the past 90 days. Using optimized coefficients, EFIS calculates an $88K equilibrium price based solely on institutional capital activity, implying that institutional accumulation has become a measurable, stabilizing force for Bitcoin’s price structure.

Institutional Buying Triggers

The report highlights a critical behavioral pattern: when Bitcoin’s spot price trades more than 15% below EFIS projections for an extended period, it tends to trigger accelerated institutional accumulation.

CryptoQuant’s analysis shows this dynamic has occurred three times since ETF inception, with price recoveries following within 2–3 weeks each time. The only exceptions were during prolonged ETF outflows exceeding 1% of daily AUM, which have not been seen since March 2024.

Why $88K Matters

According to the report, the $88,000 level represents the institutional conviction floor, not a retail sentiment zone. As long as normalized ETF flows remain positive, the model implies that deeper corrections below $88K become statistically unlikely.

Only sustained negative flows exceeding 0.5% daily could invalidate this support thesis.

CryptoQuant notes that this flow-based support model differs from traditional technical analysis: it measures forward-looking institutional behavior, not price history. In essence, EFIS isolates capital flows from broader macro factors, allowing analysts to distinguish between healthy profit-taking and structural outflows.

If the trend persists through early 2026, $88K could stand as the defining floor of this institutional-driven Bitcoin cycle.