On August 21, 2025, the Federal Reserve highlighted concerns about inflation pressures in meeting minutes, emphasizing the inadequacy of waiting for tariffs' effects on monetary policy adjustments.

The Fed's stance suggests potential volatility for cryptocurrency markets, which traditionally react to monetary policies affecting high-risk assets like Bitcoin and Ethereum.

Federal Reserve officials released minutes indicating their belief that the current policy position is beneficial, despite the ambiguity surrounding tariffs' inflationary effects. Most participants agreed that waiting for tariff impacts to become unmistakable was impractical. The central focus was on maintaining economic balance without immediate adjustments to the existing policy rate of 4.25%–4.50%. Statements suggest inflation concerns remain, with tariffs potentially amplifying price levels across markets.

Immediate changes due to the Fed's stance include anticipated continued pressure on high-risk assets. Cryptocurrencies like Bitcoin and Ethereum often react to Federal Reserve policies, reflecting broader market risk sentiments. Participants maintained that the buffer against inflation should not rely solely on post-tariff clarity due to ongoing uncertainties and persistent inflation rises due to external factors.

Market reactions saw stability in stock prices following the Fed's reaffirmation of its monetary approach. Cryptocurrency markets exhibited muted reactions, awaiting further guidance from Jerome Powell's expected address at the Jackson Hole conference. No direct comments from key financial leaders, including Powell, have emerged since the minutes, maintaining an air of hesitation among stakeholders.

"Most Committee Members Believe Inflation Risk is Greater Than Employment Risk," — Jerome Powell, Chair, Federal Reserve.

Did you know? The Federal Reserve's sustained high rate stance amid tariff-induced inflation echoes past trade tensions of 2018, impacting market risk appetite similarly now in the cryptocurrency domain.

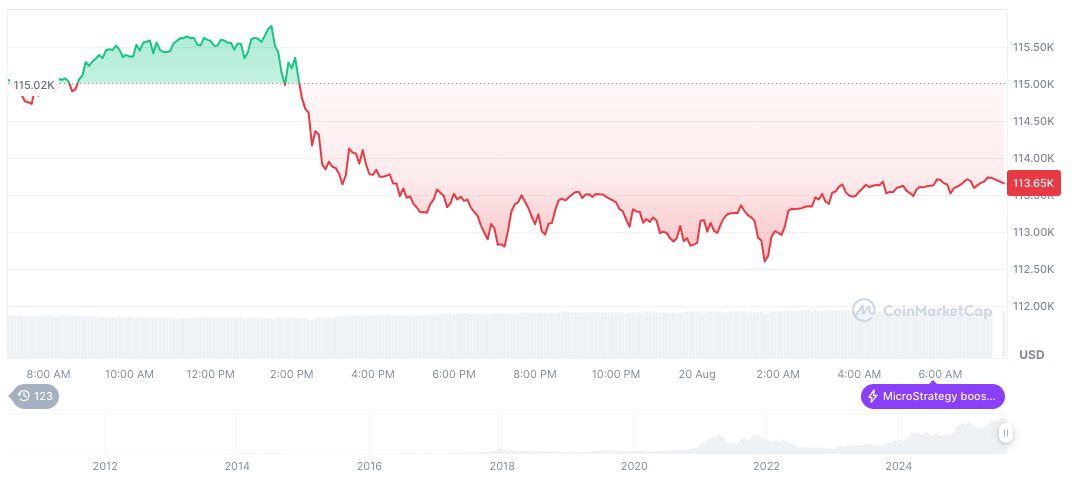

According to CoinMarketCap, Bitcoin (BTC) trades at $114,407.90, with a market cap surpassing $2.28 trillion and a dominance near 58.54%. Over the past 24 hours, trade volume hit $69.79 billion, decreasing by 2.04%. Bitcoin’s price fluctuated, recording a 1.00% rise in the last day, a notable 7.02% drop in the past week, and a mixed 12.23% increase over 60 days. Data reflects ongoing market volatility.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 22:34 UTC on August 20, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 22:34 UTC on August 20, 2025. Source: CoinMarketCap

Coincu research notes potential regulatory pressures could lead to increased volatility for DeFi tokens like UNI and AAVE if Fed policies tighten further. Historical trends indicate significant crypto drawdowns during past rate hikes, reinforcing the importance of tracking monetary policy shifts closely as they ripple across financial sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

By Coincu

about 5 hours ago