Bitcoin recently plunged below 113,000 dollars, causing a shockwave in the markets. This drop of over 8% from its peak at 124,000 dollars triggered a wave of pessimism among retail investors. But behind this apparent panic, some analysts see a contrary signal that could announce a reversal.

After falling below 115,000 dollars, Bitcoin dropped to 112,000 dollars on August 19, 2025, marking one of its strongest corrections in several months. Social networks reacted sharply: crypto forums filled with alarming messages, and small investors began liquidating their positions in a climate of widespread fear.

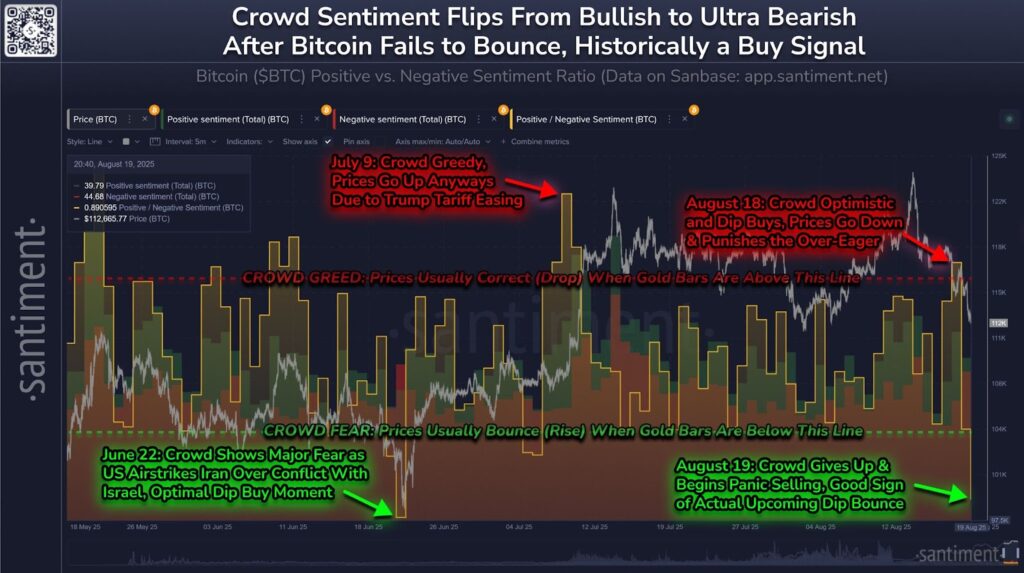

According to Santiment data, retail investor sentiment has become “ultra bearish“, reaching its most negative level since June. This type of extreme pessimism is often interpreted as a potential reversal indicator, especially when fundamentals remain solid.

The ultra bearish sentiment of investors.

The ultra bearish sentiment of investors.

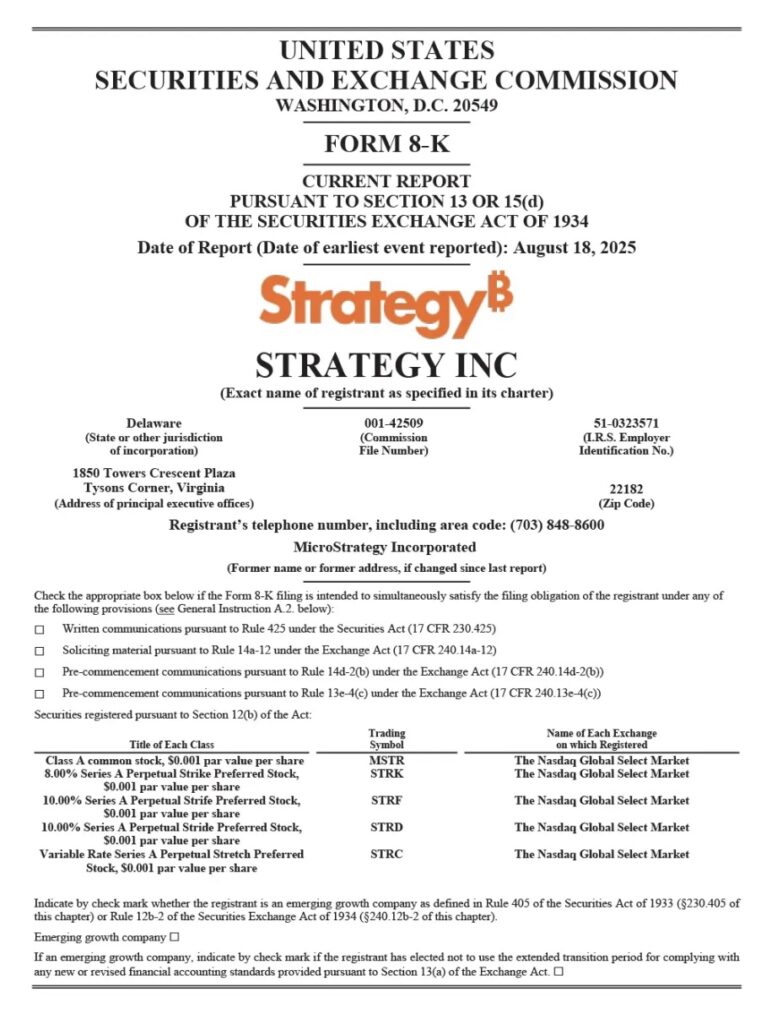

While retail traders react emotionally, institutionals adopt a strategic stance. Actors like Strategy took advantage of the decline to strengthen their positions by buying 430 additional BTC worth 51.4 million dollars. Betting on a medium-term recovery.

Strategy buys 430 additional bitcoins.

Strategy buys 430 additional bitcoins.

This contrast illustrates a well-known dynamic: When retail sells in fear, whales buy in silence. Historical precedents support this hypothesis. In 2017, a 36% bitcoin drop in September preceded a new peak three months later. In 2021, a similar fall was followed by a bullish rally.

Several technical indicators suggest an unstable bitcoin situation, but not desperate. Indeed:

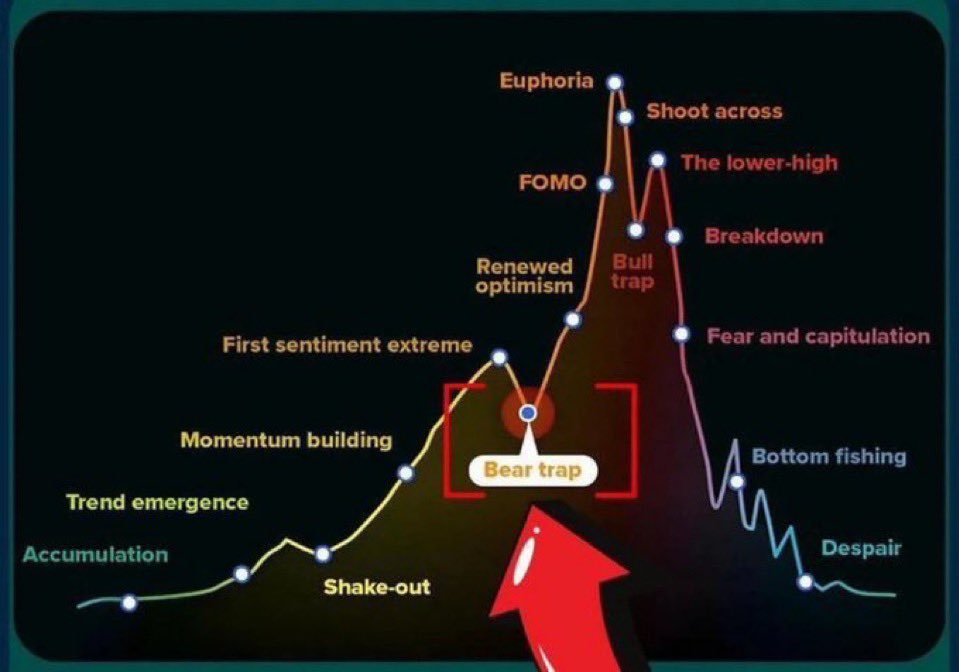

This setup could correspond to a “Bear Trap” for bitcoin, a bearish trap where the market simulates a negative trend to encourage selling… just before a rebound.

Bitcoin Bear Trap.

Bitcoin Bear Trap.

As noted by Ryan Lee, chief analyst at Bitget, this drop could be a false bearish signal:

If the 112,000-dollar level holds as support, this could indeed be the starting point of a new bullish leg, rather than a market reset.

Retail pessimism, institutional accumulation, and the holding of technical support reinforce this hypothesis. Therefore, bitcoin investors should not give in to panic. They should watch for weak signals and think long term.

The drop of bitcoin to 113,000 dollars is therefore not necessarily the start of a bear market. It could well be a strategic breather, signaling a new bullish cycle for those who know how to read between the lines. However, the shadow of Ghost Month looms and BTC could sink to 100,000 dollars.

By Cointribune

about 7 hours ago